Is Now The Right Time To Invest In Nio Stock? Expert Opinion

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is Now the Right Time to Invest in Nio Stock? Expert Opinion

The electric vehicle (EV) market is booming, and Nio (NIO) is a key player vying for a significant slice of the pie. But with market volatility and economic uncertainty looming, many investors are asking: is now the right time to invest in Nio stock? The answer, as with most financial decisions, is nuanced and depends on several factors. Let's delve into the expert opinions and current market conditions to help you make an informed decision.

Nio's Recent Performance and Future Outlook:

Nio has experienced a rollercoaster ride in recent years. Early growth was impressive, fueled by strong demand for their stylish and technologically advanced EVs in the Chinese market. However, the company has also faced challenges, including supply chain disruptions, intense competition, and broader macroeconomic headwinds affecting the global auto industry. Recent financial reports show a mixed bag, with some quarters exhibiting strong growth while others reveal setbacks. Understanding these fluctuations is crucial before considering an investment.

Key Factors Influencing Nio Stock:

Several factors significantly influence Nio's stock price and future prospects:

- Competition: The EV market is incredibly competitive, with established players like Tesla and a growing number of Chinese competitors. Nio needs to maintain its innovative edge and competitive pricing to thrive.

- Chinese Market Dynamics: As a primarily China-focused company, Nio's performance is heavily reliant on the health of the Chinese economy and government policies related to EVs and subsidies.

- Technological Advancements: Nio's success hinges on its ability to continue innovating and developing cutting-edge battery technology, autonomous driving capabilities, and other features that appeal to consumers.

- Global Expansion: While currently focused on China, Nio's plans for international expansion will play a vital role in its long-term growth potential. Success in new markets could significantly boost the stock price.

- Financial Health: Analyzing Nio's debt levels, profitability, and cash flow is essential for any potential investor. A strong financial position is a key indicator of long-term sustainability.

Expert Opinions are Divided:

Financial analysts hold differing viewpoints on Nio's investment potential. Some experts remain bullish, highlighting the company's innovative technology, strong brand recognition in China, and potential for international growth. They see the current price as a buying opportunity, anticipating future price appreciation.

However, other analysts express caution, citing the competitive landscape, economic uncertainties, and the company's fluctuating financial performance. They advise investors to proceed with caution and diversify their portfolios. Many suggest conducting thorough due diligence before investing in any single stock, especially one as volatile as Nio.

Should You Invest? A Cautious Approach:

The decision to invest in Nio stock is ultimately personal and depends on your risk tolerance, investment goals, and overall portfolio strategy. Before investing, consider:

- Your Risk Tolerance: Nio is a growth stock with inherent volatility. Only invest an amount you can afford to lose.

- Long-Term Perspective: Investing in Nio requires a long-term perspective, as the EV market is dynamic and requires patience. Short-term fluctuations should be expected.

- Diversification: Never put all your eggs in one basket. Diversify your investments to mitigate risk.

Resources for Further Research:

- Check out Nio's official investor relations website for financial statements and company news.

- Consult reputable financial news sources and analyst reports for up-to-date information.

- Consider seeking advice from a qualified financial advisor to discuss your investment strategy.

Conclusion:

Investing in Nio stock presents both significant opportunities and considerable risks. While the future of electric vehicles is promising, the success of any individual company depends on numerous factors. Thorough research, careful consideration of your risk tolerance, and a long-term perspective are crucial before making any investment decisions. Remember, this information is for educational purposes only and is not financial advice. Always consult with a qualified financial advisor before making investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is Now The Right Time To Invest In Nio Stock? Expert Opinion. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

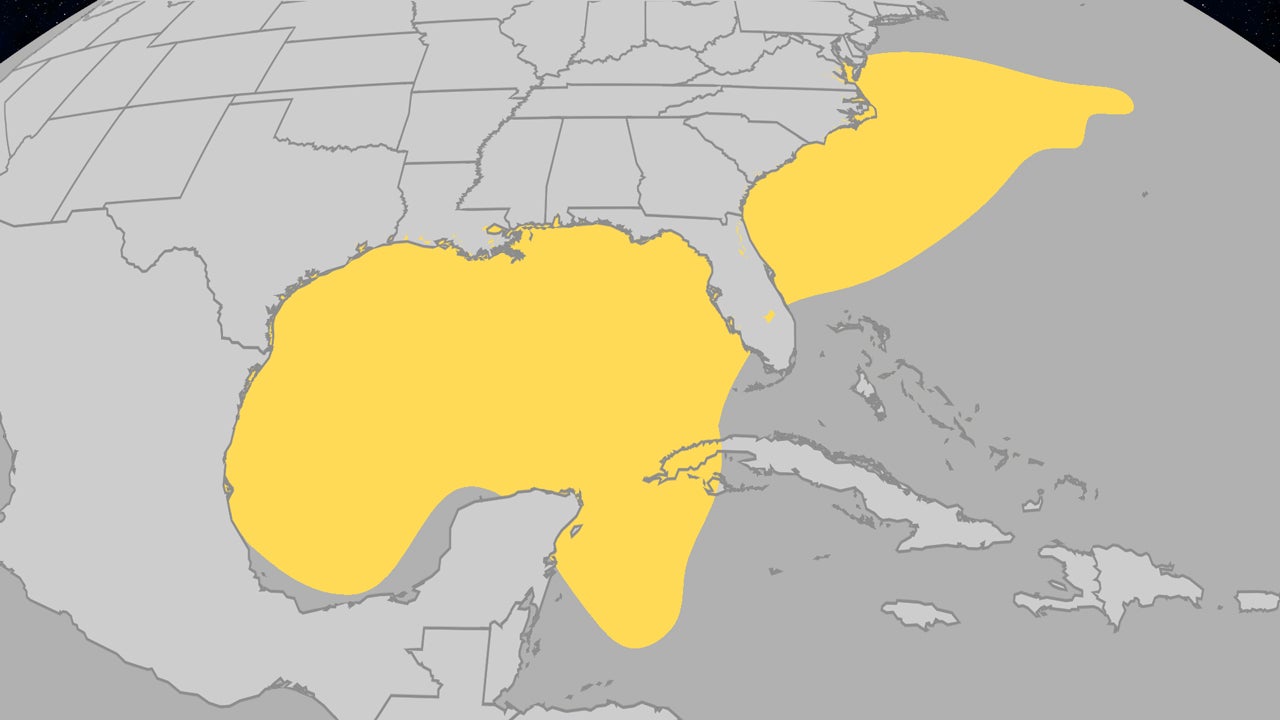

Where Do Atlantic Hurricanes Form In June Examining Recent Storm Trends

May 27, 2025

Where Do Atlantic Hurricanes Form In June Examining Recent Storm Trends

May 27, 2025 -

Eight Of Sixteen Ncaa Baseball Regional Sites Awarded To Sec Schools

May 27, 2025

Eight Of Sixteen Ncaa Baseball Regional Sites Awarded To Sec Schools

May 27, 2025 -

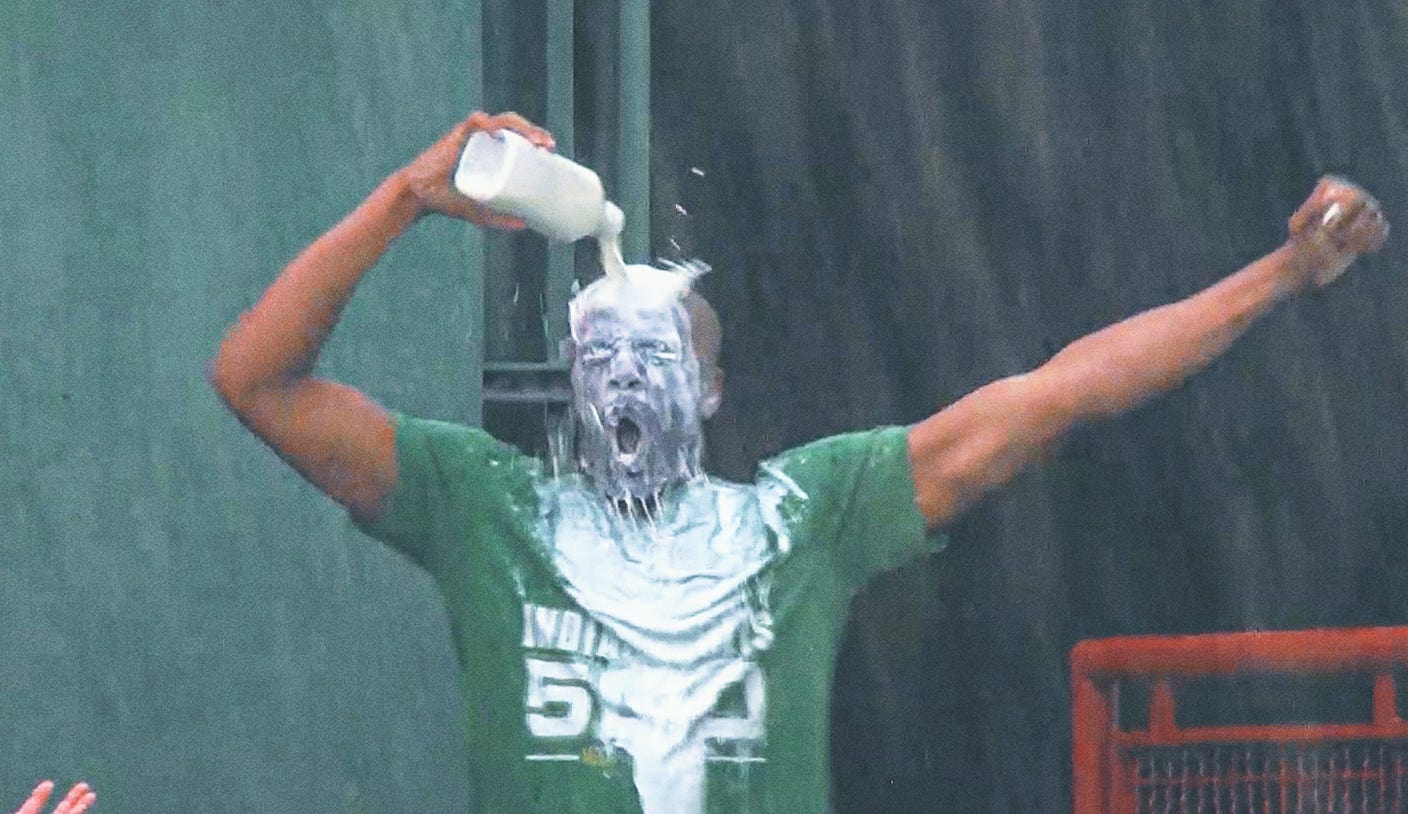

Home Run Hype Why Baseball Fans Are Pouring Milk On Themselves

May 27, 2025

Home Run Hype Why Baseball Fans Are Pouring Milk On Themselves

May 27, 2025 -

Is Smci Stock Overvalued A P E Ratio Analysis

May 27, 2025

Is Smci Stock Overvalued A P E Ratio Analysis

May 27, 2025 -

Is Now The Right Time To Invest In Nio Stock Expert Opinion

May 27, 2025

Is Now The Right Time To Invest In Nio Stock Expert Opinion

May 27, 2025