Is SMCI Stock Overvalued? A P/E Ratio Analysis.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is SMCI Stock Overvalued? A P/E Ratio Analysis

Should you buy, sell, or hold? Let's dive into the valuation of SMCI stock using its Price-to-Earnings (P/E) ratio.

The question on many investors' minds is whether shares of SMCI (assuming this refers to a publicly traded company; please replace with the full company name if different) are currently overvalued. One of the most common tools used to assess this is the Price-to-Earnings ratio, or P/E ratio. This metric compares a company's stock price to its earnings per share (EPS), offering a snapshot of how much investors are willing to pay for each dollar of earnings. A high P/E ratio can suggest a stock is overvalued, but it's crucial to consider context.

Understanding the P/E Ratio:

The P/E ratio is calculated by dividing the current market price per share by the earnings per share (EPS). For example, if SMCI's stock price is $50 and its EPS is $5, the P/E ratio would be 10 (50/5). A higher P/E ratio generally implies investors expect higher future earnings growth. However, a very high P/E ratio compared to its industry peers or historical averages could indicate overvaluation.

SMCI's Current P/E Ratio:

(This section requires current market data. Please replace the bracketed information below with real-time data from a reputable financial source like Yahoo Finance, Google Finance, or Bloomberg.)

As of [Date], SMCI's stock price is [Stock Price]. Its trailing twelve-month (TTM) EPS is [TTM EPS]. Therefore, SMCI's current P/E ratio is [Calculated P/E Ratio]. This compares to the industry average P/E ratio of [Industry Average P/E Ratio] and SMCI's historical average P/E ratio of [SMCI Historical Average P/E Ratio].

Is this High or Low? Context is Key:

A P/E ratio in isolation doesn't tell the whole story. Several factors must be considered:

- Growth Prospects: Companies with high growth potential often command higher P/E ratios because investors anticipate significant future earnings. Is SMCI experiencing rapid growth, justifying a potentially higher P/E? Analyzing its recent financial reports and future projections is crucial.

- Industry Benchmarks: Comparing SMCI's P/E ratio to its competitors within the same industry provides valuable context. If SMCI's P/E is significantly higher than its peers, it could suggest overvaluation.

- Debt Levels: High levels of debt can negatively impact a company's profitability, potentially making its P/E ratio less reliable as an indicator of value. Check SMCI's debt-to-equity ratio for further analysis.

- Market Sentiment: Broad market trends can influence stock valuations. A generally bullish market might inflate P/E ratios across the board.

Other Valuation Metrics:

While the P/E ratio is a valuable tool, it's not the only metric to consider. A comprehensive analysis should also include:

- Price-to-Sales (P/S) Ratio: This compares the market capitalization to revenue, offering another perspective on valuation.

- Price-to-Book (P/B) Ratio: This compares the market value to the book value of assets, useful for valuing asset-heavy companies.

- PEG Ratio: This adjusts the P/E ratio for growth, providing a more nuanced view.

Conclusion:

Determining whether SMCI stock is overvalued requires a thorough analysis beyond just its P/E ratio. Consider the factors outlined above, including growth prospects, industry comparisons, debt levels, and market sentiment. Consulting with a qualified financial advisor is always recommended before making any investment decisions. Remember, past performance is not indicative of future results, and investing in the stock market carries inherent risk.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always conduct your own thorough research and consult with a financial professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is SMCI Stock Overvalued? A P/E Ratio Analysis.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tesla Investors Rejoice Ceos Update Signals Potential 1300 Stock Growth

May 27, 2025

Tesla Investors Rejoice Ceos Update Signals Potential 1300 Stock Growth

May 27, 2025 -

Post May 9th Xbh Juan Sotos Impact On The Mets Lineup

May 27, 2025

Post May 9th Xbh Juan Sotos Impact On The Mets Lineup

May 27, 2025 -

Haddad Maia Vs Baptiste French Open 2025 Prediction And Betting Odds

May 27, 2025

Haddad Maia Vs Baptiste French Open 2025 Prediction And Betting Odds

May 27, 2025 -

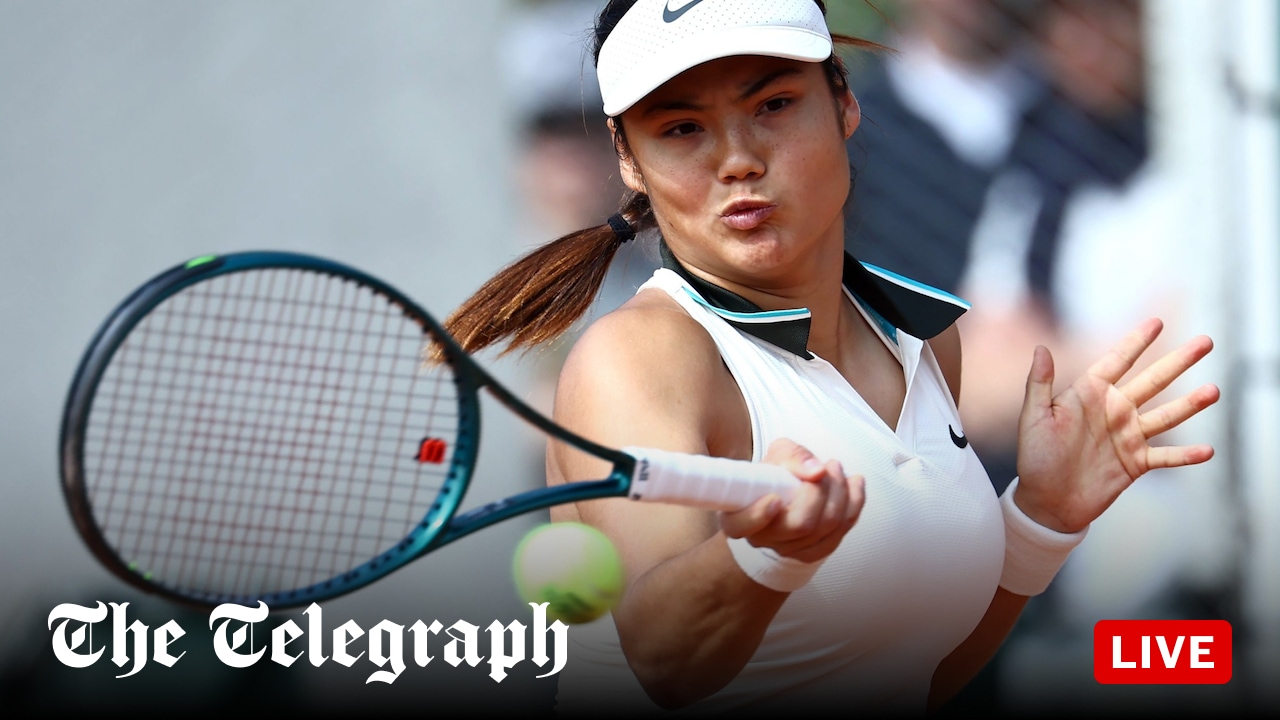

French Open Get The Latest Updates On Raducanu Vs Wang Xinyu

May 27, 2025

French Open Get The Latest Updates On Raducanu Vs Wang Xinyu

May 27, 2025 -

Teslas Robotaxi End Of A Dark Chapter Beginning Of Autonomous Drivings Golden Age

May 27, 2025

Teslas Robotaxi End Of A Dark Chapter Beginning Of Autonomous Drivings Golden Age

May 27, 2025