What's Next For AVGO? Analyzing Broadcom's Stock After Earnings Report

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

What's Next for AVGO? Analyzing Broadcom's Stock After Earnings Report

Broadcom (AVGO) recently released its earnings report, sending ripples through the tech investment world. The results were largely positive, but investors are now grappling with the question: what's next for this tech giant? This analysis dives into the key takeaways from the report and explores the potential future trajectory of AVGO stock.

Strong Q3 Results, But What About the Future?

Broadcom exceeded analysts' expectations for its third-quarter earnings, reporting strong revenue growth driven by its robust semiconductor business. The company's performance in key sectors like networking and wireless communication was particularly impressive. This positive performance fueled a short-term stock price surge, but the longer-term outlook remains a subject of debate among analysts.

Key Highlights from the Earnings Report:

- Revenue Beat: Broadcom significantly exceeded its projected revenue, demonstrating strong demand for its products.

- Profitability: Margins remained healthy, showcasing the company's efficient operations and pricing power.

- Guidance: While the company provided positive guidance for the next quarter, some analysts believe it may be somewhat conservative, leaving room for potential upside surprises.

- Software Acquisition: Broadcom's ongoing acquisition strategy, particularly its focus on expanding its software portfolio, is a key factor shaping its future growth prospects. This strategic shift positions them to compete more effectively in the rapidly growing cloud computing market.

Challenges and Uncertainties:

Despite the positive earnings report, several challenges cloud the future outlook for AVGO:

- Global Economic Uncertainty: The global economic slowdown presents a significant headwind for the semiconductor industry, potentially impacting demand for Broadcom's products.

- Geopolitical Risks: Increased geopolitical tensions and trade disputes could further disrupt supply chains and impact the company's operations.

- Competition: Intense competition from other major semiconductor players remains a considerable factor.

Analyzing the Stock Price:

Following the earnings report, AVGO's stock price experienced a temporary surge. However, the longer-term outlook depends on various factors, including macroeconomic conditions, competitive pressures, and the successful integration of recent acquisitions. Investors should carefully consider these factors before making any investment decisions. [Link to reputable financial news source discussing AVGO stock price].

What to Expect Next:

Several key factors will shape Broadcom's performance in the coming quarters:

- Success of Acquisitions: The successful integration and performance of recently acquired companies will be crucial for future growth.

- Innovation and R&D: Broadcom's continued investment in research and development will be vital in maintaining its technological edge.

- Market Demand: The overall demand for semiconductors and related technologies will significantly influence AVGO's performance.

Conclusion: A Cautiously Optimistic Outlook

While Broadcom's recent earnings report paints a positive picture, investors should adopt a cautiously optimistic approach. The company's strong financial performance and strategic acquisitions provide a solid foundation for future growth. However, the challenging macroeconomic environment and intense competition necessitate careful consideration of the risks involved. Further analysis, including monitoring industry trends and geopolitical developments, is crucial before making any investment decisions regarding AVGO stock. Stay informed and conduct thorough research before investing.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on What's Next For AVGO? Analyzing Broadcom's Stock After Earnings Report. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

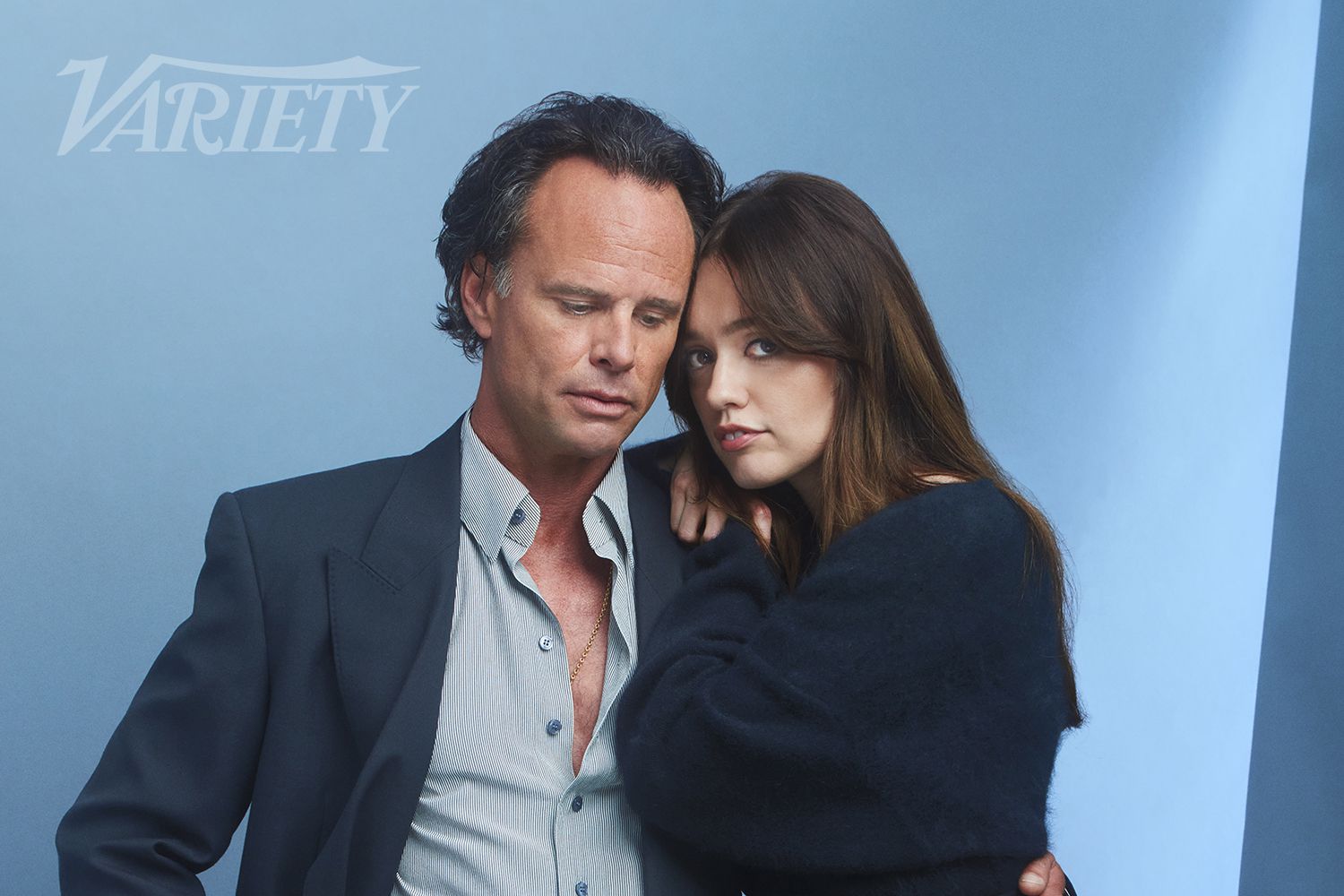

New Interview Walton Goggins And Aimee Lou Wood Clear The Air On Public Dispute

Jun 06, 2025

New Interview Walton Goggins And Aimee Lou Wood Clear The Air On Public Dispute

Jun 06, 2025 -

Robinhoods Recent Performance A Buy Or Sell Signal

Jun 06, 2025

Robinhoods Recent Performance A Buy Or Sell Signal

Jun 06, 2025 -

Ibm Lags Behind Understanding The Recent Stock Market Dip

Jun 06, 2025

Ibm Lags Behind Understanding The Recent Stock Market Dip

Jun 06, 2025 -

36 75 Million Deal Ravens Secure Rashod Batemans Future

Jun 06, 2025

36 75 Million Deal Ravens Secure Rashod Batemans Future

Jun 06, 2025 -

2025 Belmont Stakes Analyzing Chris The Bear Fallicas Horse Racing Picks

Jun 06, 2025

2025 Belmont Stakes Analyzing Chris The Bear Fallicas Horse Racing Picks

Jun 06, 2025