Robinhood's Recent Performance: A Buy Or Sell Signal?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood's Recent Performance: A Buy or Sell Signal?

Robinhood, the once-darling of the commission-free trading app revolution, has experienced a rollercoaster ride recently. Its stock price has fluctuated wildly, leaving many investors wondering: is now the time to buy, sell, or hold? This analysis delves into Robinhood's recent performance, examining key factors to help you make an informed decision.

A Look at the Numbers:

Robinhood's recent financial reports have presented a mixed bag. While the company has shown growth in certain areas, others remain a cause for concern. Key metrics to consider include:

-

Monthly Active Users (MAU): While MAU numbers have shown some growth, the rate of increase has slowed, raising questions about the platform's ability to attract and retain users in a competitive market. This is a crucial indicator of long-term viability and revenue potential.

-

Revenue Growth: Robinhood's revenue has experienced periods of growth followed by stagnation. Understanding the drivers behind this volatility – factors like trading volume, subscription services, and net interest income – is critical in assessing future performance. A deep dive into the quarterly earnings reports is necessary for a comprehensive understanding.

-

Profitability: The path to consistent profitability remains a challenge for Robinhood. Analyzing its operating expenses, including marketing costs and technology investments, provides insights into its ability to control costs and generate sustainable profits.

Factors Influencing Robinhood's Performance:

Several external factors play a significant role in shaping Robinhood's performance:

-

Market Volatility: The overall market climate heavily impacts trading activity, directly influencing Robinhood's revenue. Periods of high volatility can boost trading volumes, while calmer markets can lead to decreased activity.

-

Competition: Robinhood operates in a fiercely competitive landscape. Established players and new entrants continuously strive for market share, putting pressure on Robinhood to innovate and offer competitive pricing and services.

-

Regulatory Scrutiny: The regulatory environment for financial technology companies is constantly evolving. Changes in regulations can significantly impact Robinhood's operations and profitability.

Is it a Buy or Sell Signal?

Determining whether Robinhood is a buy or sell signal requires a nuanced approach. There's no simple yes or no answer. Consider these points:

-

Long-Term Potential: Robinhood's potential for long-term growth hinges on its ability to diversify its revenue streams, enhance its user experience, and navigate the competitive landscape successfully. A focus on innovation and expanding its product offerings will be crucial.

-

Risk Tolerance: Investing in Robinhood carries inherent risks. Its stock price is highly volatile, and its future performance is uncertain. Investors with a higher risk tolerance may be more inclined to consider a purchase.

-

Diversification: As with any investment, diversification is key. Don't put all your eggs in one basket. Spread your investments across different asset classes to mitigate risk.

Conclusion:

Robinhood's recent performance presents a complex picture. While the company shows potential, significant challenges remain. Thorough research, considering the factors discussed above, and aligning your investment strategy with your risk tolerance are crucial before making any decisions. Consult with a qualified financial advisor for personalized guidance. Remember to always conduct your own due diligence before investing in any stock. This analysis provides insights but should not be considered financial advice.

Keywords: Robinhood, stock price, investment, trading app, financial technology, fintech, revenue, profitability, market volatility, competition, regulation, buy, sell, hold, investment strategy, risk tolerance, financial advisor, due diligence, quarterly earnings, Monthly Active Users (MAU).

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood's Recent Performance: A Buy Or Sell Signal?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Outperforming The Market Understanding Ibms Current Stock Situation

Jun 06, 2025

Outperforming The Market Understanding Ibms Current Stock Situation

Jun 06, 2025 -

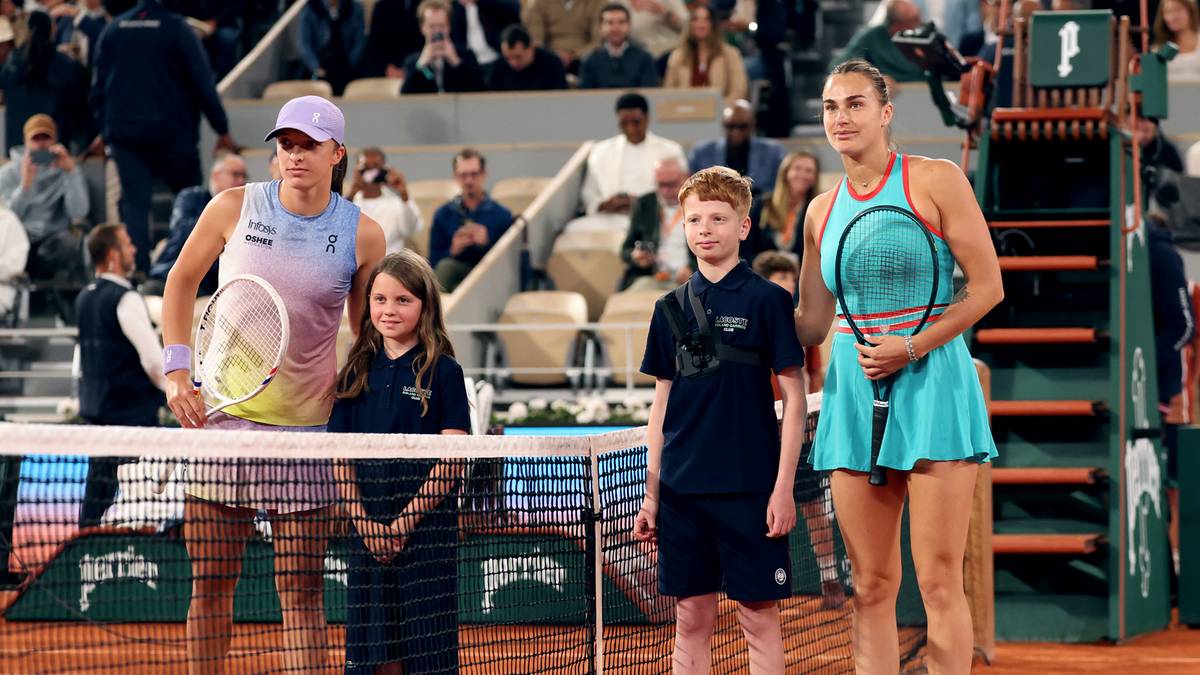

Iga Swiatek I Aryna Sabalenka Mecz Na Zywo Z Roland Garros Relacja Online

Jun 06, 2025

Iga Swiatek I Aryna Sabalenka Mecz Na Zywo Z Roland Garros Relacja Online

Jun 06, 2025 -

Boston Bruins Coaching Search Time Is Of The Essence Dont Wait For De Boer

Jun 06, 2025

Boston Bruins Coaching Search Time Is Of The Essence Dont Wait For De Boer

Jun 06, 2025 -

Bruins Coaching Search Time Is Of The Essence Dont Wait On De Boer

Jun 06, 2025

Bruins Coaching Search Time Is Of The Essence Dont Wait On De Boer

Jun 06, 2025 -

Whats Next For Avgo Trader Expectations Following Broadcoms Earnings

Jun 06, 2025

Whats Next For Avgo Trader Expectations Following Broadcoms Earnings

Jun 06, 2025