Wall Street Defies Moody's: Six-Day Winning Streak For S&P 500

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wall Street Defies Moody's Downgrade: S&P 500 Extends Winning Streak to Six Days

Wall Street shrugged off Moody's downgrade of several US banks, powering the S&P 500 to a remarkable six-day winning streak. This unexpected surge defies analysts' predictions and showcases the resilience of the US stock market in the face of significant economic headwinds. The rally has investors wondering: is this a temporary bounce or the start of a sustained bull market?

The recent downgrade by Moody's, a leading credit rating agency, raised concerns about the stability of the US banking sector. However, the market's reaction has been surprisingly positive, with major indices climbing steadily despite the negative news. This defiance highlights the complex interplay of factors influencing market performance and suggests that investors are focusing on other economic indicators.

What Fueled the Six-Day Rally?

Several factors contributed to this impressive run for the S&P 500:

- Strong Corporate Earnings: Better-than-expected earnings reports from several major corporations have boosted investor confidence. Companies demonstrating strong resilience and profitability are driving positive sentiment. This underscores the importance of fundamental analysis in understanding market trends.

- Softening Inflation Data: Recent economic data suggests a potential cooling of inflation, easing concerns about aggressive interest rate hikes by the Federal Reserve. Lower inflation expectations can significantly impact investor behavior and market valuations.

- Resilient Consumer Spending: Despite economic uncertainty, consumer spending remains relatively robust, indicating continued strength in the US economy. This suggests that the impact of inflation and rising interest rates may be less severe than initially anticipated.

- Technical Factors: Technical analysis suggests that the market may be entering a period of consolidation after a significant downturn. This could be contributing to the recent surge, irrespective of fundamental economic news.

Moody's Downgrade and its Limited Impact:

Moody's decision to downgrade several US banks, citing concerns about credit risk, was expected to negatively impact the market. However, the impact has been surprisingly muted. This suggests that investors may already have factored in potential risks associated with the banking sector, or that other positive factors are outweighing the negative news. [Link to Moody's report here - replace with actual link].

Looking Ahead: Sustainable Growth or Temporary Bounce?

While the six-day winning streak is undeniably impressive, investors remain cautious. The current rally may be a temporary phenomenon driven by short-term factors, or it could signal the beginning of a more sustained period of growth. Several key factors will determine the market's trajectory in the coming weeks and months, including:

- Further inflation data: Continued cooling of inflation will likely support market gains.

- Federal Reserve policy: The Fed's upcoming decisions on interest rates will play a crucial role in shaping market sentiment.

- Geopolitical events: Global instability could quickly impact market stability.

Conclusion:

The S&P 500's six-day winning streak, defying Moody's downgrade, is a significant event with implications for investors worldwide. While the reasons behind this rally are multifaceted, it highlights the dynamic and often unpredictable nature of the stock market. Investors should remain vigilant, carefully considering both positive and negative economic indicators before making any investment decisions. Staying informed and diversifying your portfolio are essential strategies in navigating these uncertain times.

Keywords: S&P 500, Wall Street, Moody's, stock market, six-day winning streak, US economy, inflation, interest rates, banking sector, credit rating, investment, market analysis, economic outlook.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Wall Street Defies Moody's: Six-Day Winning Streak For S&P 500. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tom Aspinall Fight Delay Is Jon Jones Retiring From The Ufc

May 20, 2025

Tom Aspinall Fight Delay Is Jon Jones Retiring From The Ufc

May 20, 2025 -

Adelman Earns Respect Nuggets Players Back Embattled Coach

May 20, 2025

Adelman Earns Respect Nuggets Players Back Embattled Coach

May 20, 2025 -

Us Treasury Yields Fall On Feds Rate Hike Projection

May 20, 2025

Us Treasury Yields Fall On Feds Rate Hike Projection

May 20, 2025 -

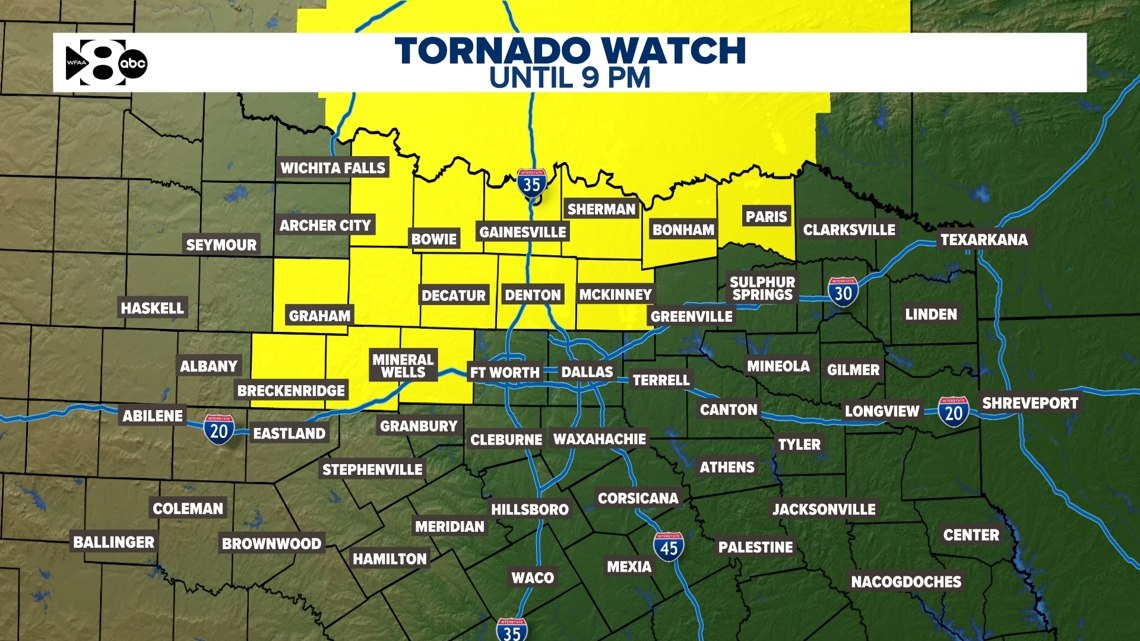

North Texas Weather Forecast Post Storm Calm Before Tuesdays Cold Front

May 20, 2025

North Texas Weather Forecast Post Storm Calm Before Tuesdays Cold Front

May 20, 2025 -

Panthers Commanding Game 7 Win Sends Maple Leafs Packing

May 20, 2025

Panthers Commanding Game 7 Win Sends Maple Leafs Packing

May 20, 2025