US Treasury Yields Fall On Fed's Rate Hike Projection

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Treasury Yields Fall Despite Fed's Rate Hike Projection: A Sign of Easing Inflation?

US Treasury yields experienced an unexpected decline on Wednesday, even after the Federal Reserve hinted at further interest rate hikes in its latest projections. This counterintuitive market reaction has sparked considerable debate amongst economists and investors, raising questions about the future trajectory of inflation and the overall health of the US economy. The benchmark 10-year Treasury yield fell to [Insert Current Yield Percentage], while the 2-year yield also dropped. This movement suggests that investors may be anticipating a less aggressive stance from the Fed in the coming months, or perhaps a quicker-than-expected slowdown in economic growth.

Why the Unexpected Dip in Treasury Yields?

The Fed's decision to raise interest rates by a quarter-point, as widely anticipated, was accompanied by projections suggesting further increases throughout the year. Typically, such projections would push Treasury yields higher, reflecting increased borrowing costs. However, the market reacted differently, signaling a potential shift in investor sentiment. Several factors might contribute to this unexpected decline:

-

Easing Inflation Concerns: While inflation remains above the Fed's target, recent data points to a potential cooling in price pressures. Lower-than-expected inflation readings could be influencing investor expectations, leading them to bet on a less hawkish monetary policy in the future. This is particularly relevant given the recent positive reports on [cite specific economic data, e.g., Consumer Price Index (CPI) or Producer Price Index (PPI)].

-

Concerns about Economic Slowdown: The possibility of a recession continues to loom large. Investors might be factoring in the risk of a significant economic slowdown, anticipating that the Fed might ultimately need to pivot towards a more accommodative monetary policy to prevent a deeper downturn. This fear of a recession is reflected in other market indicators as well, including [mention relevant market indicators, e.g., stock market performance].

-

Global Economic Uncertainty: The ongoing war in Ukraine, persistent supply chain disruptions, and geopolitical tensions globally all contribute to a heightened sense of uncertainty. Investors might be seeking the perceived safety of US Treasury bonds, even with lower yields, in times of global economic instability. This flight to safety could explain the demand for these bonds, thus depressing yields.

What Does This Mean for Investors?

The fall in Treasury yields presents a complex scenario for investors. While lower yields mean lower returns for new investments in Treasury bonds, it could also signal opportunities in other asset classes. For instance, the decreased yields might make other investments, like corporate bonds or equities, relatively more attractive.

Investors should:

- Diversify their portfolios: Spreading investments across various asset classes is crucial to mitigate risk in uncertain market conditions.

- Monitor economic indicators: Staying informed about inflation data, GDP growth, and other key economic indicators is essential for making informed investment decisions.

- Consult with a financial advisor: Seeking professional advice can help investors navigate the complexities of the current market and tailor their investment strategies accordingly.

The Road Ahead for Treasury Yields

Predicting the future trajectory of Treasury yields is inherently challenging, given the intricate interplay of economic and geopolitical factors. However, closely monitoring inflation data, the Fed's policy decisions, and overall economic growth will be crucial in gauging the likely direction of yields in the coming months. The market's reaction to Wednesday's announcement underscores the unpredictable nature of financial markets and highlights the importance of informed decision-making. Stay tuned for further updates as the economic landscape continues to evolve.

(Note: Remember to replace bracketed information with current and accurate data before publishing.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Treasury Yields Fall On Fed's Rate Hike Projection. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

From Knicks Nemesis To Thunder Star Trae Youngs Fan Interactions

May 20, 2025

From Knicks Nemesis To Thunder Star Trae Youngs Fan Interactions

May 20, 2025 -

Jon Jones Aspinall Comments Spark Outrage Fans React To Strip The Duck Remark

May 20, 2025

Jon Jones Aspinall Comments Spark Outrage Fans React To Strip The Duck Remark

May 20, 2025 -

Western Conference Finals Bound Thunders Gritty Win Against The Nuggets

May 20, 2025

Western Conference Finals Bound Thunders Gritty Win Against The Nuggets

May 20, 2025 -

Post Game Rivalry Trae Youngs Comments On Knicks And Thunder Fans

May 20, 2025

Post Game Rivalry Trae Youngs Comments On Knicks And Thunder Fans

May 20, 2025 -

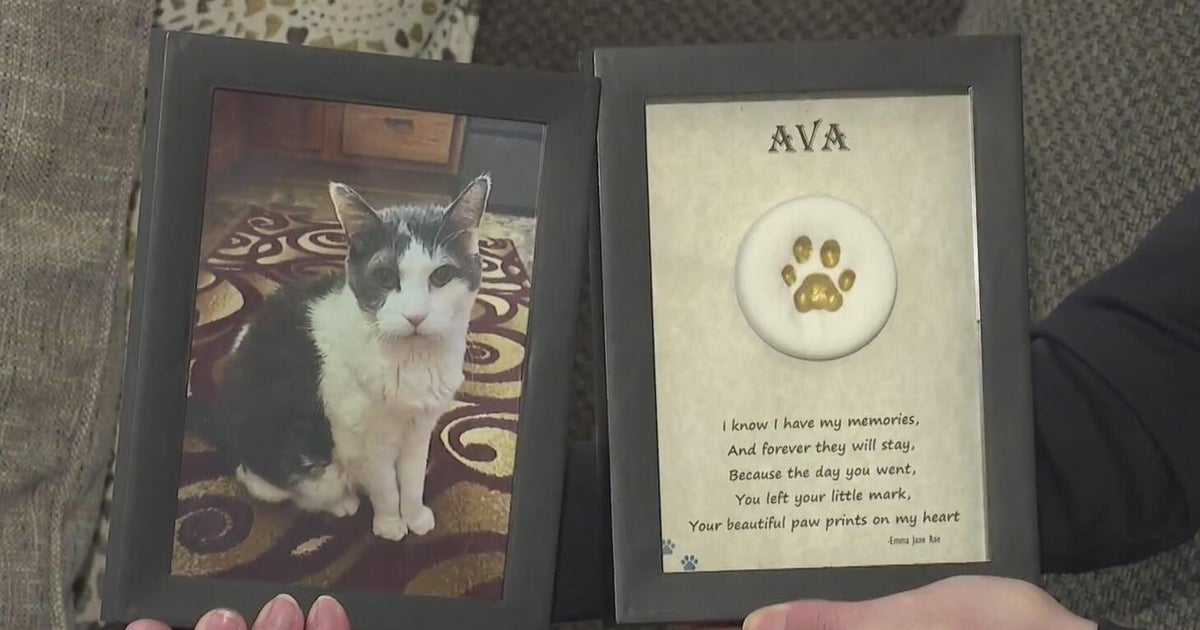

Lost Pets Memorial Service Follows Funeral Home Cremains Scandal

May 20, 2025

Lost Pets Memorial Service Follows Funeral Home Cremains Scandal

May 20, 2025