US Treasury Market Reaction: Fed's 2025 Rate Cut Projection

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Treasury Market Reaction: Fed's 2025 Rate Cut Projection Sends Shockwaves

The US Treasury market experienced significant volatility following the Federal Reserve's unexpected projection of potential interest rate cuts as early as 2025. This projection, unveiled during the latest Federal Open Market Committee (FOMC) meeting, directly contradicts previous statements suggesting rates would remain elevated for a considerable period. The market's reaction highlights the delicate balance the Fed is attempting to strike between combating inflation and avoiding a potential economic recession.

The Fed's Unexpected Pivot: A Shift in Market Sentiment

The Fed's "dot plot," which illustrates individual policymakers' rate expectations, showed a notable shift. Several members now anticipate rate cuts beginning in 2025, a stark contrast to previous forecasts that pointed towards holding rates steady throughout the year. This unexpected pivot fueled speculation about the Fed's confidence in its ability to engineer a "soft landing" – a scenario where inflation is brought under control without triggering a recession.

This shift in outlook sent ripples through the Treasury market, influencing the pricing of government bonds. Longer-term Treasury yields, which are inversely related to bond prices, fell significantly, indicating increased demand for these safer assets. Investors, interpreting the rate cut projection as a signal of potential future economic slowdown, sought refuge in the relative safety of government bonds.

Analyzing the Market's Response: Implications for Investors

The immediate market reaction was characterized by:

- Lower Treasury Yields: Yields on 10-year and 30-year Treasury notes experienced a noticeable decline, reflecting increased investor demand. This signifies a reduced expectation of future inflation and potential economic growth.

- Increased Demand for Safe Havens: The flight to safety was evident, with investors seeking refuge in government bonds, considered relatively low-risk investments.

- Dollar Volatility: The US dollar also experienced some volatility in response to the announcement, reflecting uncertainty about the future trajectory of US monetary policy.

What Does This Mean for the Future? Uncertainty and Ongoing Volatility

The Fed's projection, while offering a glimpse into potential future policy, does not guarantee rate cuts in 2025. The actual timing and extent of any rate reductions will depend heavily on upcoming economic data, specifically inflation figures and employment numbers. Therefore, continued market volatility is likely as investors grapple with the uncertainty surrounding future monetary policy.

Navigating the Uncertainty: Expert Perspectives

Experts remain divided on the implications of the Fed's projection. Some analysts view it as a sign of the Fed's increasing concern about the economy's resilience, while others believe it reflects overconfidence in the ability to control inflation. This division underscores the complexity of the economic landscape and the challenges faced by the central bank.

Further complicating the picture is the ongoing geopolitical uncertainty, supply chain disruptions, and the persistent threat of inflation. These factors can significantly impact the Fed's decision-making process and the subsequent market reactions.

Conclusion: A Watchful Wait

The Federal Reserve's projection of potential rate cuts in 2025 has injected considerable uncertainty into the US Treasury market. While the immediate reaction suggests a shift towards a more dovish stance, the actual path of interest rates remains heavily dependent on future economic developments. Investors and market watchers should remain vigilant and closely monitor economic indicators for a clearer understanding of the evolving situation. The coming months will be critical in determining whether the Fed’s projection accurately reflects the future economic trajectory. Stay informed and consult with financial professionals for personalized advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Treasury Market Reaction: Fed's 2025 Rate Cut Projection. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jamie Lee Curtis Lindsay Lohan Has Always Been Honest With Me

May 20, 2025

Jamie Lee Curtis Lindsay Lohan Has Always Been Honest With Me

May 20, 2025 -

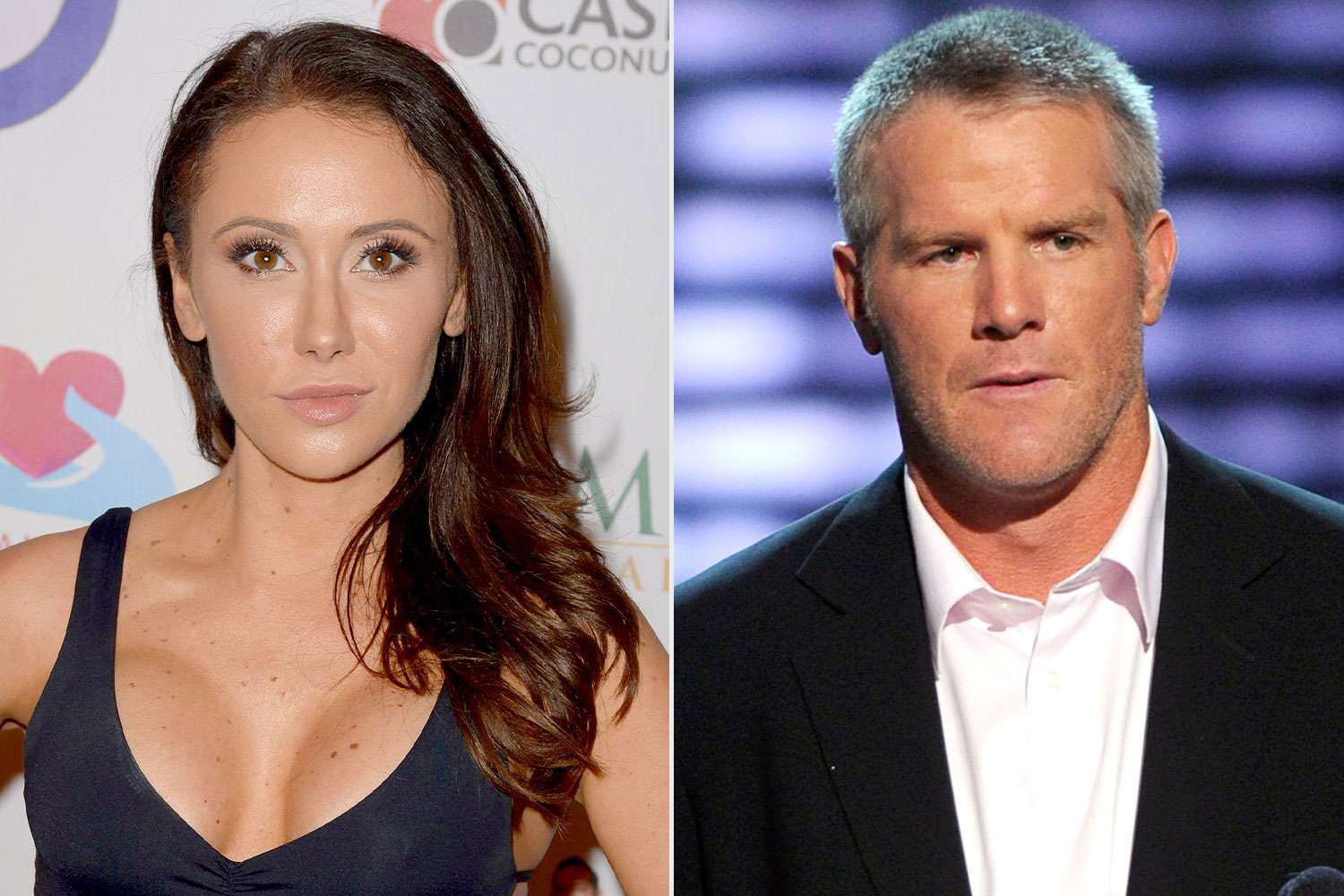

Brett Favre Sexting Scandal Jenn Sterger Details The Emotional Toll

May 20, 2025

Brett Favre Sexting Scandal Jenn Sterger Details The Emotional Toll

May 20, 2025 -

Trump Announces Imminent Russia Ukraine Truce Talks

May 20, 2025

Trump Announces Imminent Russia Ukraine Truce Talks

May 20, 2025 -

Pet Cremation Scandal Fuels Calls For Stronger Consumer Protections

May 20, 2025

Pet Cremation Scandal Fuels Calls For Stronger Consumer Protections

May 20, 2025 -

Australias Central Bank Cuts Rates Inflation Concerns Recede

May 20, 2025

Australias Central Bank Cuts Rates Inflation Concerns Recede

May 20, 2025