Australia's Central Bank Cuts Rates: Inflation Concerns Recede

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Australia's Central Bank Cuts Rates: Inflation Concerns Recede

Australia's Reserve Bank (RBA) delivered a surprise rate cut today, dropping the official cash rate by 25 basis points to 3.85%. This unexpected move marks a significant shift in monetary policy and signals a potential easing of the aggressive tightening cycle seen over the past year. The decision comes as inflation shows signs of cooling, offering some respite to consumers and businesses grappling with rising costs.

The RBA's Governor, Philip Lowe, cited moderating inflation pressures as the primary reason for the cut. While inflation remains above the bank's target band of 2-3%, recent data suggests a slowing in the pace of price increases. This deceleration, coupled with weakening economic growth forecasts, prompted the central bank to adjust its course.

Easing Inflationary Pressures: A Closer Look

The RBA's decision reflects a growing confidence that inflation has peaked. Several key indicators support this assessment:

- Falling CPI Growth: Recent Consumer Price Index (CPI) data showed a smaller-than-expected increase, suggesting that the rate of inflation is slowing. This is a crucial factor in the RBA's decision-making process.

- Cooling Wage Growth: While wages are still rising, the pace of growth has moderated, lessening inflationary pressures. This indicates that the tight labor market, while still robust, is showing some signs of easing.

- Global Economic Slowdown: The global economic slowdown is also contributing to lower inflationary pressures in Australia. Reduced global demand is helping to temper price increases for imported goods and services.

Impact on the Australian Economy:

The rate cut is anticipated to provide a boost to the Australian economy in several ways:

- Stimulating Investment: Lower interest rates make borrowing cheaper for businesses, potentially encouraging investment and job creation.

- Boosting Consumer Spending: Reduced borrowing costs may lead to increased consumer spending, further stimulating economic activity.

- Easing Mortgage Payments: Homeowners with variable-rate mortgages will see a reduction in their monthly payments, freeing up disposable income.

However, the RBA acknowledged that the impact of the rate cut will depend on several factors, including global economic conditions and the ongoing strength of the Australian labor market.

Market Reaction and Future Outlook:

The Australian dollar initially weakened following the announcement, reflecting the market's surprise at the unexpected rate cut. However, the long-term impact on the currency remains to be seen. Analysts are divided on the RBA's future trajectory, with some predicting further rate cuts while others anticipate a pause or even a potential rate hike later in the year, depending on future economic data releases and inflationary trends.

Concerns Remain:

While the rate cut offers positive signs, challenges remain. The RBA continues to monitor the inflation outlook closely, and further adjustments to monetary policy may be necessary depending on the evolving economic landscape. The ongoing impact of global uncertainty and potential supply chain disruptions also present ongoing risks.

In conclusion, the RBA's rate cut signifies a shift in its approach to monetary policy, reflecting a cautious optimism about the cooling inflationary pressures in Australia. The long-term effects of this decision will unfold over time, and the RBA will continue to carefully assess the economic data to guide future policy decisions. Further updates and analysis will be provided as the situation develops. For more detailed economic analysis, you can refer to the .

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Australia's Central Bank Cuts Rates: Inflation Concerns Recede. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Yankees Affiliate Devastated Scrantons 20 Run Defeat Highlights Prospect Struggles

May 20, 2025

Yankees Affiliate Devastated Scrantons 20 Run Defeat Highlights Prospect Struggles

May 20, 2025 -

Marvel Reveals Galactuss Design In Fantastic Four First Steps Promo Art

May 20, 2025

Marvel Reveals Galactuss Design In Fantastic Four First Steps Promo Art

May 20, 2025 -

Wnba Fan Misconduct Under Scrutiny Clark Reese Incident Sparks Inquiry

May 20, 2025

Wnba Fan Misconduct Under Scrutiny Clark Reese Incident Sparks Inquiry

May 20, 2025 -

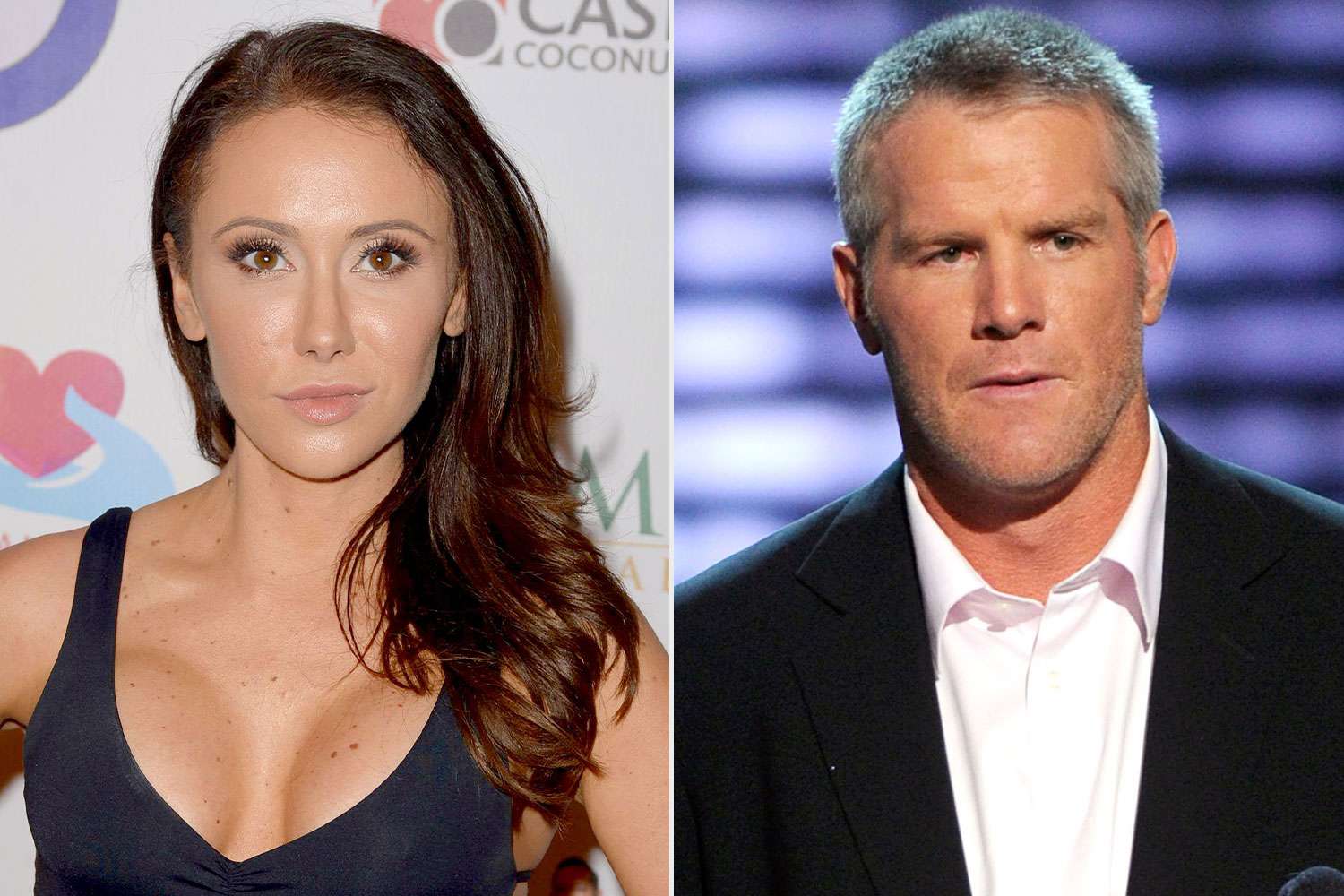

Jenn Sterger Reflects On The Brett Favre Scandal Lack Of Humanity And Lasting Scars

May 20, 2025

Jenn Sterger Reflects On The Brett Favre Scandal Lack Of Humanity And Lasting Scars

May 20, 2025 -

New Marvel Character Revealed Funko Pops Fantastic Four First Steps Leak

May 20, 2025

New Marvel Character Revealed Funko Pops Fantastic Four First Steps Leak

May 20, 2025