U.S. Treasury Market Reacts: Yields Fall On Fed's Single Rate Cut Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Treasury Market Reacts: Yields Fall on Fed's Single Rate Cut Outlook

The U.S. Treasury market experienced a significant shift on [Date], with yields falling sharply following the Federal Reserve's indication of a single interest rate cut in the near future. This move, deviating from market expectations of multiple rate reductions, sent ripples through the bond market, prompting a reassessment of future monetary policy and its impact on inflation and economic growth.

The Fed's decision, announced after the conclusion of its [Month] meeting, surprised many analysts who had anticipated a more aggressive approach to combatting slowing economic growth and persistent inflation. The statement emphasized the central bank's cautious approach, highlighting the need to carefully monitor economic data before implementing further rate adjustments. This cautious stance, coupled with the suggestion of a single rate cut, significantly impacted investor sentiment.

Yields Plummet Across the Curve:

The immediate reaction in the Treasury market was a decline in yields across the entire yield curve. The 2-year Treasury yield, which is highly sensitive to short-term interest rate expectations, dropped noticeably, reflecting the market's interpretation of a less hawkish Fed. Longer-term yields also fell, indicating reduced expectations for future inflation and a potential slowing of economic activity.

- 2-year Treasury Yield: Decreased by [percentage] to [yield percentage].

- 10-year Treasury Yield: Decreased by [percentage] to [yield percentage].

- 30-year Treasury Yield: Decreased by [percentage] to [yield percentage].

This drop in yields suggests that investors are now pricing in a lower probability of further rate cuts, at least in the short term. This contrasts with previous market forecasts that anticipated a more prolonged period of rate reductions.

Market Analysis and Implications:

The market's response highlights the delicate balancing act the Fed faces. While aiming to curb inflation, the central bank must also avoid triggering a significant economic slowdown. The single rate cut outlook reflects a desire to carefully assess the impact of previous policy decisions before making further adjustments.

Several analysts believe that the Fed's decision reflects a growing concern about the potential for a recession. The recent slowdown in economic growth, coupled with persistent inflation, has created a challenging environment for policymakers. The market's reaction suggests that investors share this concern, with the fall in yields reflecting a flight to safety.

Looking Ahead: Uncertainty Remains:

While the immediate market reaction was clear, uncertainty remains about the future direction of interest rates. The Fed's decision emphasizes the data-dependent nature of its policymaking, meaning future rate decisions will hinge on incoming economic data, including inflation figures and employment reports. Investors will be closely monitoring these reports to gauge the likelihood of further adjustments to monetary policy. This uncertainty underscores the need for continued vigilance in navigating the current economic climate. Stay updated on the latest economic news and analysis to make informed financial decisions. [Link to relevant economic news source]

Keywords: U.S. Treasury Market, Treasury Yields, Federal Reserve, Interest Rate Cut, Bond Market, Monetary Policy, Inflation, Economic Growth, Recession, Yield Curve, Market Reaction, Investment Strategy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Treasury Market Reacts: Yields Fall On Fed's Single Rate Cut Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

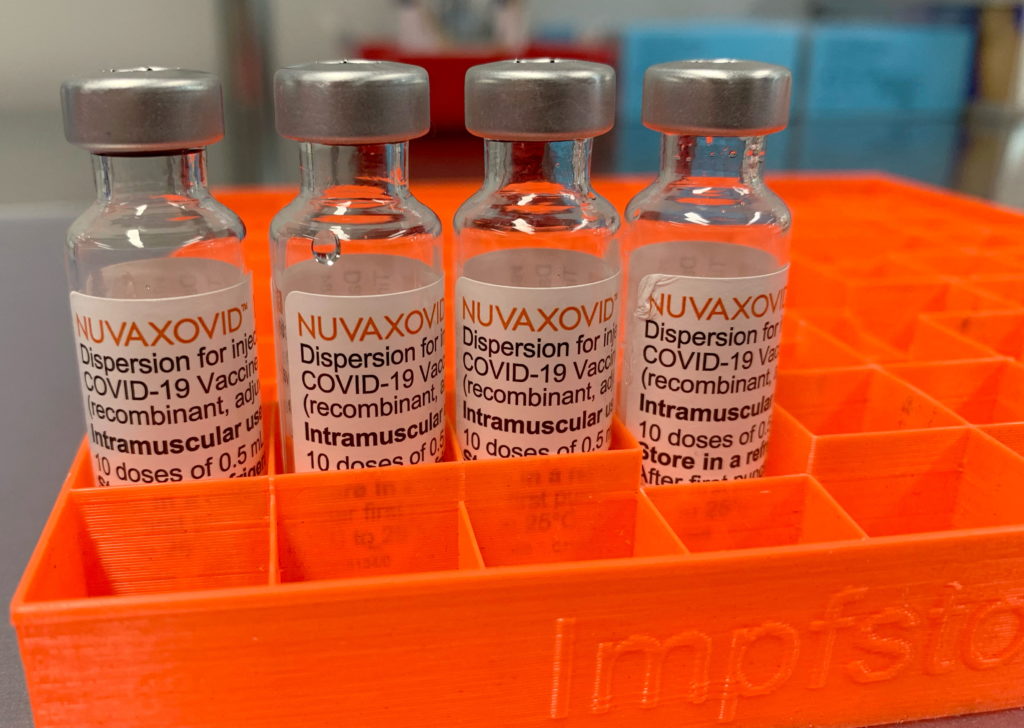

Novavax Covid 19 Vaccine Fda Approval Comes With Unusual Usage Constraints

May 20, 2025

Novavax Covid 19 Vaccine Fda Approval Comes With Unusual Usage Constraints

May 20, 2025 -

Western Conference Finals Bound Thunders Powerful Performance Defeats Nuggets

May 20, 2025

Western Conference Finals Bound Thunders Powerful Performance Defeats Nuggets

May 20, 2025 -

Bali Tightens Tourist Rules New Guidelines To Combat Misbehavior

May 20, 2025

Bali Tightens Tourist Rules New Guidelines To Combat Misbehavior

May 20, 2025 -

Shift In Japans Stance Partial Tariff Cuts Accepted From The Us

May 20, 2025

Shift In Japans Stance Partial Tariff Cuts Accepted From The Us

May 20, 2025 -

Jon Rahm Stays Positive Despite Crushing Pga Championship Loss

May 20, 2025

Jon Rahm Stays Positive Despite Crushing Pga Championship Loss

May 20, 2025