U.S. Treasury Market Reacts: Fed's 2025 Rate Cut Projection And Yield Implications

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Treasury Market Reacts: Fed's 2025 Rate Cut Projection and Yield Implications

The U.S. Treasury market experienced a significant shift following the Federal Reserve's recent projection of potential interest rate cuts in 2025. This unexpected announcement sent ripples through the financial world, prompting investors to reassess their strategies and sparking considerable debate among economists. Understanding the implications of this shift is crucial for anyone invested in the Treasury market.

The Fed's Surprise Prediction:

The Federal Open Market Committee (FOMC) surprised many by including rate cuts in its dot plot projections for 2025. This marked a departure from previous forecasts, which had indicated interest rates remaining elevated for a longer period. The shift reflects the Fed's evolving assessment of the economic landscape, factoring in potential slowing growth and the ongoing impact of inflation. While the Fed emphasized that these are merely projections and subject to change based on future economic data, the market reacted swiftly.

Impact on Treasury Yields:

The immediate consequence of the Fed's projection was a decline in Treasury yields. Yields, which move inversely to prices, fell as investors sought the relative safety of government bonds in anticipation of lower future interest rates. This particularly impacted longer-term Treasury yields, reflecting the market's expectation of future rate cuts. The 10-year and 30-year Treasury yields saw notable decreases, indicating a shift in investor sentiment.

Analyzing the Market Reaction:

Several factors contributed to the market's response:

- Reduced Inflation Expectations: The projection suggests the Fed anticipates a successful battle against inflation, eventually leading to lower rates. This eased some investor concerns about persistently high inflation.

- Economic Growth Concerns: The inclusion of rate cuts indicates the Fed may be anticipating a potential slowdown in economic growth, prompting investors to seek safer haven assets like Treasuries.

- Uncertainty and Speculation: The very act of introducing rate cut projections into the forecast introduced an element of uncertainty, leading to increased volatility and trading activity in the Treasury market.

What Does This Mean for Investors?

The Fed's shift in outlook presents both opportunities and challenges for investors. Those holding longer-term Treasuries might see increased value due to the decline in yields. However, the uncertainty surrounding the economic outlook warrants caution. Investors should carefully consider their risk tolerance and investment horizon before making any significant adjustments to their portfolios. Diversification remains a key strategy in navigating this period of market volatility.

Looking Ahead:

The coming months will be critical in determining the accuracy of the Fed's projections. Economic data releases, inflation reports, and the overall health of the economy will play a significant role in shaping market expectations and influencing Treasury yields. Closely monitoring these developments is essential for staying informed and making well-informed investment decisions. For detailed analysis and up-to-date market information, consider consulting reputable financial news sources and economic experts.

Call to Action: Stay informed on economic news and consult with a financial advisor before making any investment decisions. Understanding the nuances of the Treasury market is key to successful long-term investment strategies.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Treasury Market Reacts: Fed's 2025 Rate Cut Projection And Yield Implications. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Temperature Drop And Lingering Rain This Weeks Weather Outlook

May 21, 2025

Temperature Drop And Lingering Rain This Weeks Weather Outlook

May 21, 2025 -

Packers New Tush Push Rule Proposal A Closer Look At The Changes

May 21, 2025

Packers New Tush Push Rule Proposal A Closer Look At The Changes

May 21, 2025 -

Inter Miamis Messi Speaks Out We Will Come Through This

May 21, 2025

Inter Miamis Messi Speaks Out We Will Come Through This

May 21, 2025 -

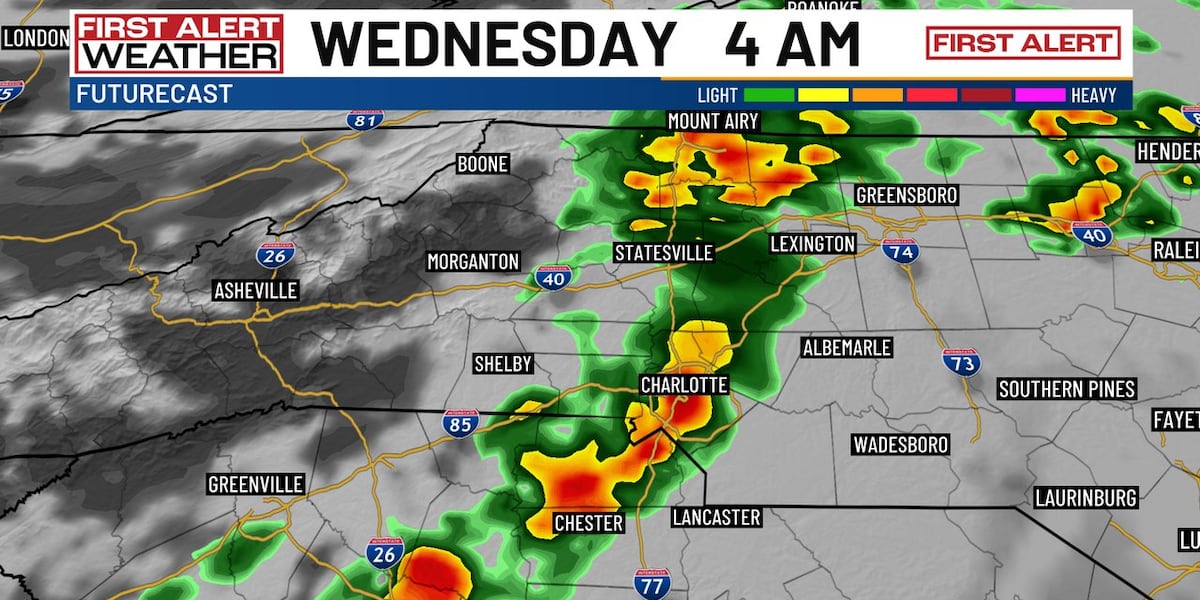

Charlotte Facing Overnight Storms Before Significant Temperature Drop

May 21, 2025

Charlotte Facing Overnight Storms Before Significant Temperature Drop

May 21, 2025 -

2025 Indy 500 Updated Odds After Shwartzmans Stunning Pole Win

May 21, 2025

2025 Indy 500 Updated Odds After Shwartzmans Stunning Pole Win

May 21, 2025