U.S. Treasury Market Reaction: Fed Signals Limited Rate Cuts

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Treasury Market Reaction: Fed Signals Limited Rate Cuts, Yields Rise

The U.S. Treasury market experienced a noticeable shift following the Federal Reserve's recent pronouncements, signaling a less aggressive stance on interest rate cuts than some market analysts had anticipated. This has led to a rise in Treasury yields, impacting everything from borrowing costs for businesses to the attractiveness of government bonds.

Fed's Hawkish Tilt Shakes Market Confidence

The Federal Reserve's commitment to tackling inflation, even at the cost of potentially slower economic growth, has sent ripples through the financial markets. While acknowledging the recent banking sector turmoil, the Fed maintained a relatively hawkish tone, suggesting that further rate cuts are not imminent. This contrasts with the expectations of some investors who predicted a more rapid and significant easing of monetary policy. The perceived shift towards a more cautious approach, focusing on inflation control over immediate economic stimulus, surprised many market participants.

Impact on Treasury Yields:

The less dovish-than-expected stance from the Fed immediately impacted Treasury yields. Yields, which move inversely to prices, saw a noticeable uptick across the curve. This means that investors are demanding higher returns to hold U.S. government debt, reflecting a reassessment of the risk-reward profile. The longer-term Treasury yields experienced a more pronounced increase, suggesting concerns about the potential for sustained inflation.

What This Means for Investors:

- Bondholders: Existing bondholders might see a decline in the value of their holdings as yields rise. This is a crucial consideration for investors with significant exposure to the fixed-income market.

- Borrowers: Higher Treasury yields generally translate into higher borrowing costs for businesses and consumers. This could potentially dampen economic activity as borrowing becomes more expensive.

- Economic Outlook: The Fed's cautious approach reflects a complex economic outlook. The central bank is attempting to navigate a delicate balance between controlling inflation and preventing a sharp economic downturn. This balancing act makes economic forecasting more challenging than ever.

Analyzing the Market Reaction:

Several factors contributed to the market's reaction:

- Inflation Concerns: Persistent inflationary pressures remain a major concern for the Fed, influencing its decision-making process.

- Banking Sector Instability: The recent banking sector troubles added another layer of complexity, requiring the Fed to carefully weigh the risks of further rate cuts.

- Economic Data: Upcoming economic data releases will play a crucial role in shaping market expectations and the Fed's future policy decisions. Close monitoring of inflation figures, employment reports, and consumer spending data will be key.

Looking Ahead: Uncertainty Remains

The future direction of interest rates and Treasury yields remains uncertain. The Fed's actions will continue to be closely scrutinized, and any unexpected economic developments could significantly impact the market. Investors should stay informed about the evolving economic landscape and consider consulting financial advisors for personalized guidance. The ongoing interplay between inflation, economic growth, and the Fed's policy decisions will dictate the trajectory of the U.S. Treasury market in the coming months. Stay tuned for further updates as the situation unfolds.

Keywords: U.S. Treasury Market, Treasury Yields, Federal Reserve, Interest Rates, Rate Cuts, Inflation, Economic Growth, Bond Market, Fixed Income, Monetary Policy, Hawkish, Dovish, Banking Sector, Economic Outlook, Investment Strategy

Related Articles: (Links to other relevant articles on your website, if applicable) [Link to article about inflation] [Link to article about the banking crisis]

Disclaimer: This article provides general information and should not be considered financial advice. Consult a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Treasury Market Reaction: Fed Signals Limited Rate Cuts. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Underdog Alert Nfls Top Fringe Playoff Hopefuls For 2023

May 20, 2025

Underdog Alert Nfls Top Fringe Playoff Hopefuls For 2023

May 20, 2025 -

Inter Miamis Messi Speaks Out A Plea For Unity During Difficult Times

May 20, 2025

Inter Miamis Messi Speaks Out A Plea For Unity During Difficult Times

May 20, 2025 -

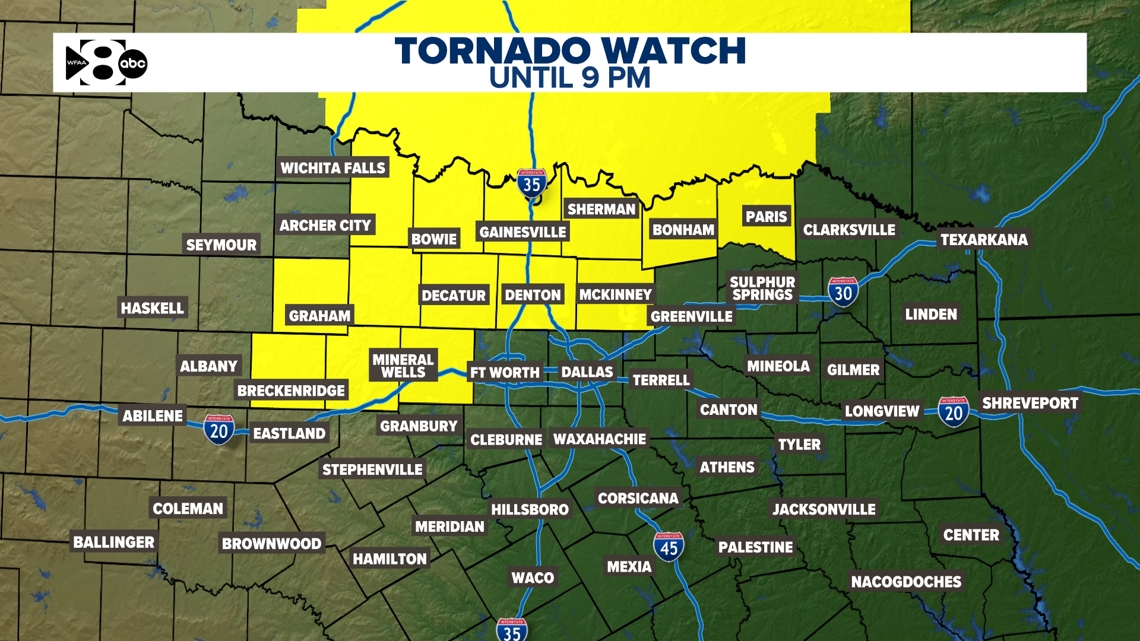

Dallas Fort Worth Weather Update Storms Clear Cold Front Incoming Tuesday

May 20, 2025

Dallas Fort Worth Weather Update Storms Clear Cold Front Incoming Tuesday

May 20, 2025 -

Pga Championship Jon Rahms Final Round Collapse And Positive Outlook

May 20, 2025

Pga Championship Jon Rahms Final Round Collapse And Positive Outlook

May 20, 2025 -

Bali Introduces Stricter Regulations To Combat Irresponsible Tourism

May 20, 2025

Bali Introduces Stricter Regulations To Combat Irresponsible Tourism

May 20, 2025