U.S. Treasury Yield Decline Follows Fed's 2025 Rate Cut Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Treasury Yield Decline Follows Fed's 2025 Rate Cut Outlook: What it Means for Investors

The U.S. Treasury market experienced a notable shift this week, with yields on government bonds declining following the Federal Reserve's updated economic projections. The central bank hinted at potential interest rate cuts as early as 2025, a projection that sent ripples through the financial landscape and significantly impacted investor sentiment. This article delves into the reasons behind this yield decline and explores its implications for investors.

The Fed's Shift in Stance and its Market Impact

The Federal Reserve's recent statement, signaling a potential pivot towards lower interest rates by 2025, marked a significant departure from its previous hawkish stance. This change reflects the Fed's assessment of slowing inflation and a potential economic slowdown. The expectation of future rate cuts immediately impacted Treasury yields, which are inversely related to bond prices. As investors anticipate lower rates, the demand for existing higher-yielding bonds increases, driving their prices up and consequently pushing yields down.

Understanding Treasury Yields and their Significance

Treasury yields represent the return an investor receives on a U.S. government bond. These yields serve as a benchmark for other interest rates in the economy, influencing borrowing costs for businesses and consumers. A decline in Treasury yields generally indicates a more relaxed monetary policy environment, potentially stimulating economic growth but also potentially leading to increased inflation down the line. Understanding the dynamics of Treasury yields is crucial for both individual and institutional investors making strategic financial decisions.

What Drove the Recent Yield Decline?

Several factors contributed to the recent decline in U.S. Treasury yields beyond the Fed's projections:

- Softening Inflation Data: Recent economic data suggests inflation may be cooling faster than initially anticipated, bolstering the case for future rate cuts.

- Recessionary Fears: Concerns about a potential economic recession are also influencing investor behavior, leading them to seek the perceived safety of government bonds.

- Geopolitical Uncertainty: Ongoing global uncertainties, including the war in Ukraine and rising geopolitical tensions, are contributing to safe-haven demand for U.S. Treasuries.

Implications for Investors:

The decline in Treasury yields presents both opportunities and challenges for investors:

- Bond Investors: Existing bondholders benefit from increased bond prices, while new investors may find lower yields less attractive. Careful consideration of bond duration and maturity is crucial in this shifting landscape.

- Stock Investors: Lower yields could potentially stimulate economic growth, supporting stock market performance. However, a slower economy could lead to decreased corporate profits, negatively impacting stock prices.

- Real Estate Investors: Lower interest rates generally translate to lower mortgage rates, potentially boosting the real estate market. However, economic uncertainty could dampen demand.

Looking Ahead: Navigating the Uncertain Terrain

The future direction of U.S. Treasury yields remains uncertain. While the Fed's projection of rate cuts suggests lower yields, unforeseen economic events could easily alter this trajectory. Investors should carefully monitor economic indicators, Fed pronouncements, and geopolitical developments to make informed investment decisions. Diversification across asset classes remains a prudent strategy in this period of economic flux.

Call to Action: Consult with a qualified financial advisor to develop a personalized investment strategy that aligns with your risk tolerance and financial goals in light of these recent market shifts. Staying informed about macroeconomic trends is key to navigating the complexities of the current investment landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Treasury Yield Decline Follows Fed's 2025 Rate Cut Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Shwartzman Shocks Indy Rookie Claims Pole Position Despite Lack Of Oval Experience

May 20, 2025

Shwartzman Shocks Indy Rookie Claims Pole Position Despite Lack Of Oval Experience

May 20, 2025 -

Market Rally Continues S And P 500 Dow And Nasdaq Rise Amidst Moodys Credit Rating Cut

May 20, 2025

Market Rally Continues S And P 500 Dow And Nasdaq Rise Amidst Moodys Credit Rating Cut

May 20, 2025 -

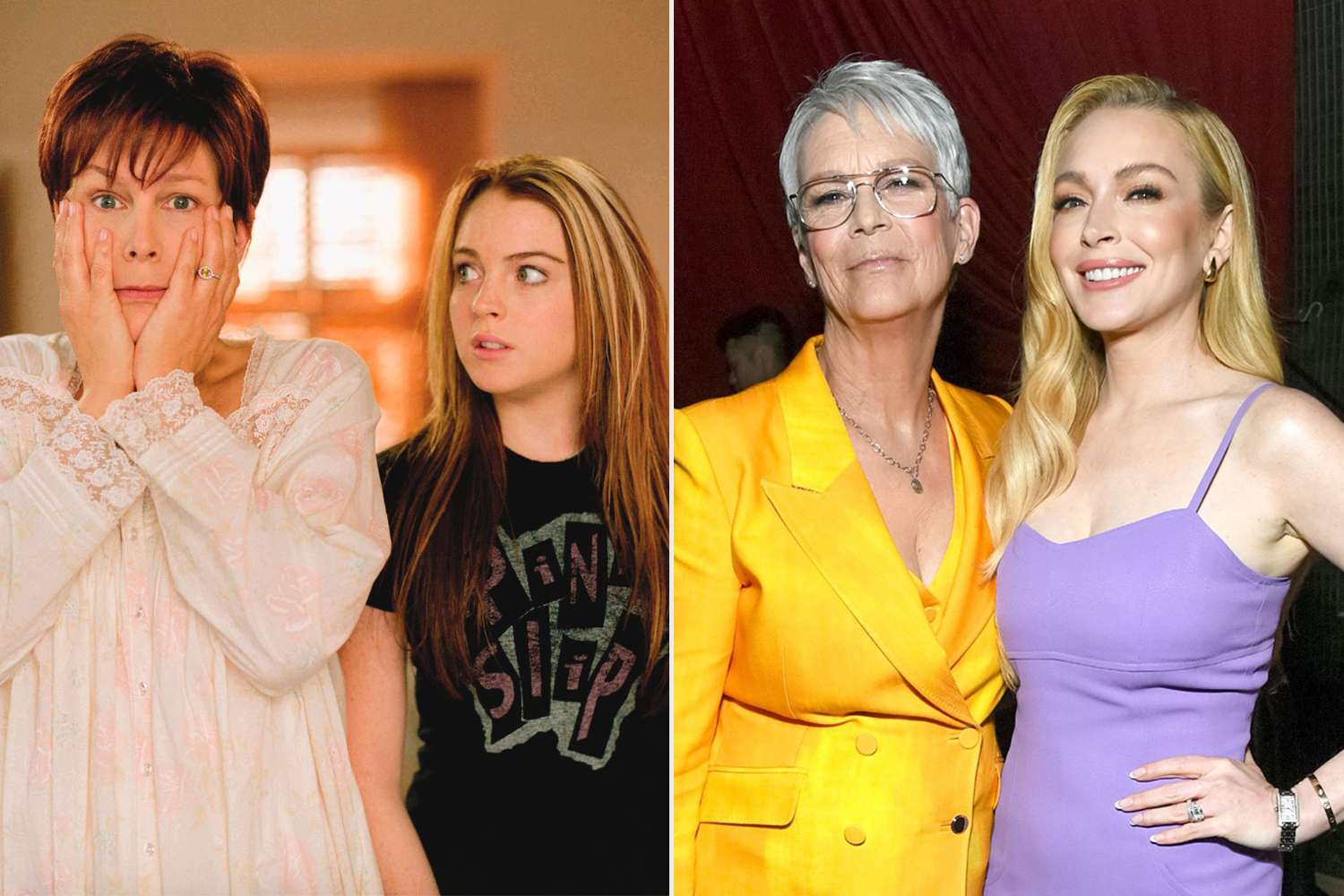

Freaky Friday Reunion Jamie Lee Curtis Discusses Her Connection With Lindsay Lohan

May 20, 2025

Freaky Friday Reunion Jamie Lee Curtis Discusses Her Connection With Lindsay Lohan

May 20, 2025 -

Can These Backup Quarterbacks Carry An Nfl Team To The Playoffs In 2024

May 20, 2025

Can These Backup Quarterbacks Carry An Nfl Team To The Playoffs In 2024

May 20, 2025 -

New Rules For Bali Tourists Curbing Misbehavior And Protecting The Island

May 20, 2025

New Rules For Bali Tourists Curbing Misbehavior And Protecting The Island

May 20, 2025