Super Micro Stock: Investor Concerns Highlight Potential For Underperformance

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Super Micro Stock: Investor Concerns Highlight Potential for Underperformance

Super Micro Computer, Inc. (SMCI) has seen its stock price fluctuate recently, prompting concerns among investors about the company's potential for underperformance. While Super Micro remains a significant player in the server market, several factors are contributing to this cautious outlook. Understanding these concerns is crucial for anyone considering investing in or currently holding SMCI stock.

H2: Declining Profit Margins and Increased Competition

One of the primary drivers of investor apprehension is the erosion of Super Micro's profit margins. Increased competition from larger players like Dell and Hewlett Packard Enterprise (HPE), coupled with rising component costs, is squeezing profitability. This pressure on margins directly impacts the company's bottom line and overall financial health, leading to anxieties about future growth. Analysts are closely watching SMCI's ability to navigate this challenging landscape and maintain competitive pricing while preserving profit margins.

H2: Supply Chain Disruptions and Geopolitical Risks

Like many technology companies, Super Micro is vulnerable to global supply chain disruptions. The ongoing semiconductor shortage and geopolitical instability, particularly concerning the US-China trade relationship, pose significant risks to the company's manufacturing and distribution capabilities. Any further escalation of these challenges could severely impact Super Micro's production capacity and ultimately, its financial performance. Investors are keenly aware of these vulnerabilities and are pricing them into the current stock valuation.

H3: Dependence on Specific Industries

Super Micro's reliance on specific sectors, such as data centers and cloud computing, exposes it to cyclical market fluctuations. A slowdown in these industries could directly translate into decreased demand for Super Micro's products, impacting revenue and potentially leading to further stock price declines. Diversification into other market segments might be crucial for mitigating this risk in the future.

H2: Analyst Downgrades and Price Target Revisions

Several financial analysts have recently downgraded their ratings on Super Micro stock, citing the concerns mentioned above. Furthermore, price targets have been revised downwards, reflecting a more pessimistic outlook for the company's short-to-medium-term performance. These actions by analysts often influence investor sentiment and can contribute to further downward pressure on the stock price.

H2: What to Watch For:

Investors should carefully monitor Super Micro's upcoming earnings reports for key performance indicators such as revenue growth, profit margins, and guidance for future quarters. Pay close attention to management commentary regarding supply chain issues, competitive pressures, and strategies to address these challenges. Analyzing the company's response to these challenges will provide valuable insights into its future prospects.

H2: The Bottom Line:

While Super Micro remains a player in the server market, a confluence of factors— declining profit margins, increased competition, supply chain vulnerabilities, and geopolitical risks— have fueled investor concerns and contributed to a more cautious outlook on the stock. Potential investors should conduct thorough due diligence and carefully weigh the risks before making any investment decisions. Staying informed about the company’s performance and the broader technological landscape is crucial for navigating the uncertainties surrounding SMCI stock.

Disclaimer: This article provides general information and should not be considered financial advice. Always consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Super Micro Stock: Investor Concerns Highlight Potential For Underperformance. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

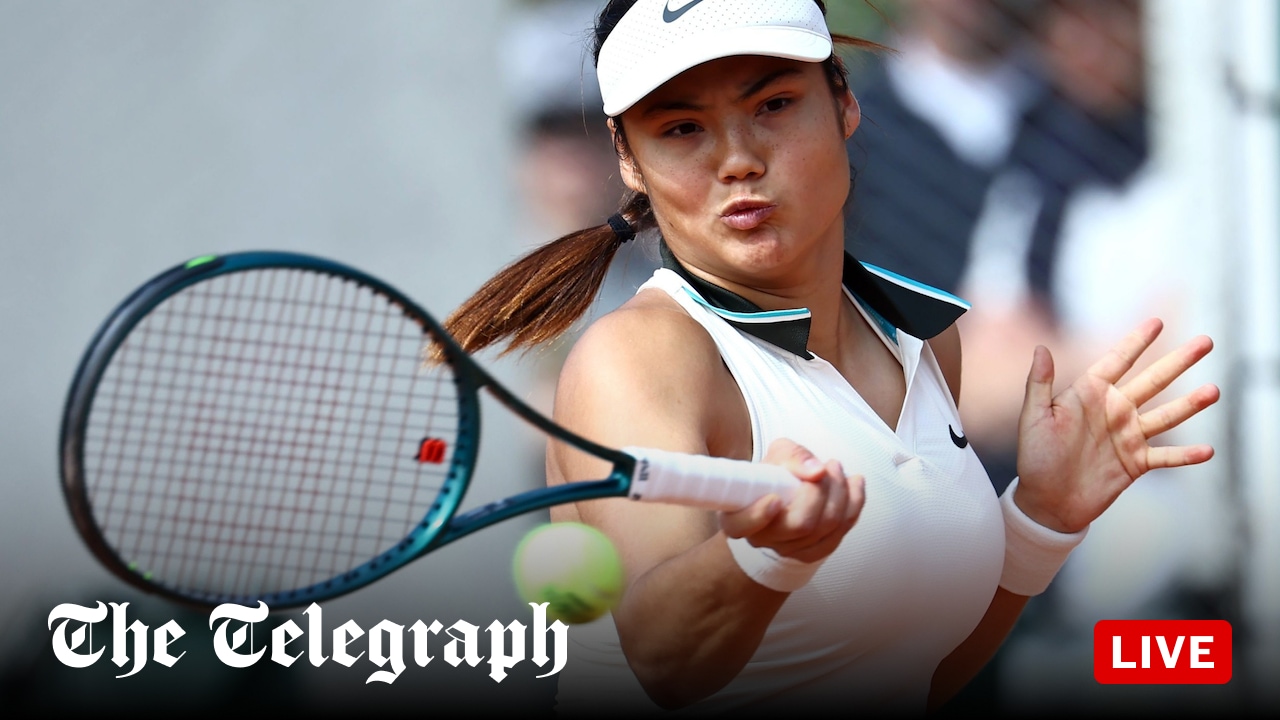

Roland Garros Get The Latest On Raducanu Vs Wang Xinyu

May 27, 2025

Roland Garros Get The Latest On Raducanu Vs Wang Xinyu

May 27, 2025 -

Elena Rybakina Vs Belinda Bencic Who Wins The French Open 2025

May 27, 2025

Elena Rybakina Vs Belinda Bencic Who Wins The French Open 2025

May 27, 2025 -

Silence The Noise Juan Sotos Xbh For The Mets Ends Long Wait

May 27, 2025

Silence The Noise Juan Sotos Xbh For The Mets Ends Long Wait

May 27, 2025 -

Wedbush Predicts Teslas Autonomous Driving Revolution A Golden Age On The Horizon

May 27, 2025

Wedbush Predicts Teslas Autonomous Driving Revolution A Golden Age On The Horizon

May 27, 2025 -

Evaluating The Risk Of A Super Micro Computer Stock Correction

May 27, 2025

Evaluating The Risk Of A Super Micro Computer Stock Correction

May 27, 2025