Evaluating The Risk Of A Super Micro Computer Stock Correction

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Evaluating the Risk of a Super Micro Computer Stock Correction

Super Micro Computer (SMCI) has enjoyed a remarkable run, fueled by strong demand for its server and storage solutions, particularly within the burgeoning AI sector. However, the question on many investors' minds is: how sustainable is this growth, and what's the risk of a significant stock correction? This article delves into the factors influencing SMCI's performance and assesses the potential for a downturn.

The Bull Case for Super Micro Computer:

Super Micro's success stems from several key factors:

- AI Boom: The explosive growth of artificial intelligence is driving immense demand for high-performance computing (HPC) infrastructure, a market where Super Micro is a key player. Their servers are increasingly crucial for training large language models (LLMs) and powering AI applications.

- Data Center Expansion: Global data center construction continues at a rapid pace, requiring massive amounts of computing power and storage. Super Micro is well-positioned to benefit from this ongoing expansion.

- Green Computing Initiatives: Super Micro's focus on energy-efficient server designs aligns with growing industry concerns about sustainability, giving them a competitive edge.

- Strong Financials: The company has consistently demonstrated strong financial performance, with increasing revenue and profitability.

The Bear Case and Potential for Correction:

Despite the positive outlook, several factors could trigger a Super Micro stock correction:

- Overvaluation: Some analysts argue that SMCI's stock price may be inflated, reflecting overly optimistic future growth projections. A reassessment of valuation could lead to a price decline.

- Supply Chain Issues: Global supply chain disruptions could impact Super Micro's production capabilities and lead to delays in fulfilling orders. This could negatively affect revenue and investor sentiment.

- Competition: The server market is fiercely competitive, with established players like Dell and HP constantly innovating. Increased competition could erode Super Micro's market share.

- Economic Slowdown: A broader economic slowdown could dampen demand for IT infrastructure, impacting Super Micro's sales and profitability. This is a significant risk factor to consider.

- Interest Rate Hikes: Rising interest rates increase borrowing costs for businesses, potentially slowing down investments in new IT infrastructure and impacting Super Micro's growth.

Analyzing the Risk:

The risk of a Super Micro stock correction is not insignificant. While the company benefits from strong tailwinds in the AI and data center markets, the potential for overvaluation, supply chain challenges, and macroeconomic headwinds cannot be ignored. Investors should carefully analyze the company's financials, consider its competitive landscape, and assess the broader economic outlook before making any investment decisions.

What to Watch For:

Keep a close eye on the following indicators:

- Earnings reports: Monitor Super Micro's quarterly earnings reports for any signs of slowing revenue growth or margin compression.

- Analyst ratings: Pay attention to changes in analyst ratings and price targets for SMCI.

- Macroeconomic indicators: Stay informed about broader economic trends and their potential impact on the IT sector.

- Competitor activity: Track the activities of Super Micro's main competitors to assess their impact on the market.

Conclusion:

Super Micro Computer's future prospects remain promising, driven by the growth of AI and data centers. However, investors must remain vigilant and carefully assess the potential risks associated with a stock correction. Thorough due diligence and a diversified investment strategy are crucial for mitigating potential losses. This analysis is not financial advice; always consult with a financial professional before making investment decisions. Remember to conduct your own thorough research before investing in any stock.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Evaluating The Risk Of A Super Micro Computer Stock Correction. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Crash Ends Kyle Larsons Bid For Indy 500 And Nascar Double

May 27, 2025

Crash Ends Kyle Larsons Bid For Indy 500 And Nascar Double

May 27, 2025 -

Rybakina Vs Riera Betting Odds Prediction And Analysis For Roland Garros 2025

May 27, 2025

Rybakina Vs Riera Betting Odds Prediction And Analysis For Roland Garros 2025

May 27, 2025 -

Roland Garros 2025 Live Get The Latest Scores From The Raducanu Wang Match

May 27, 2025

Roland Garros 2025 Live Get The Latest Scores From The Raducanu Wang Match

May 27, 2025 -

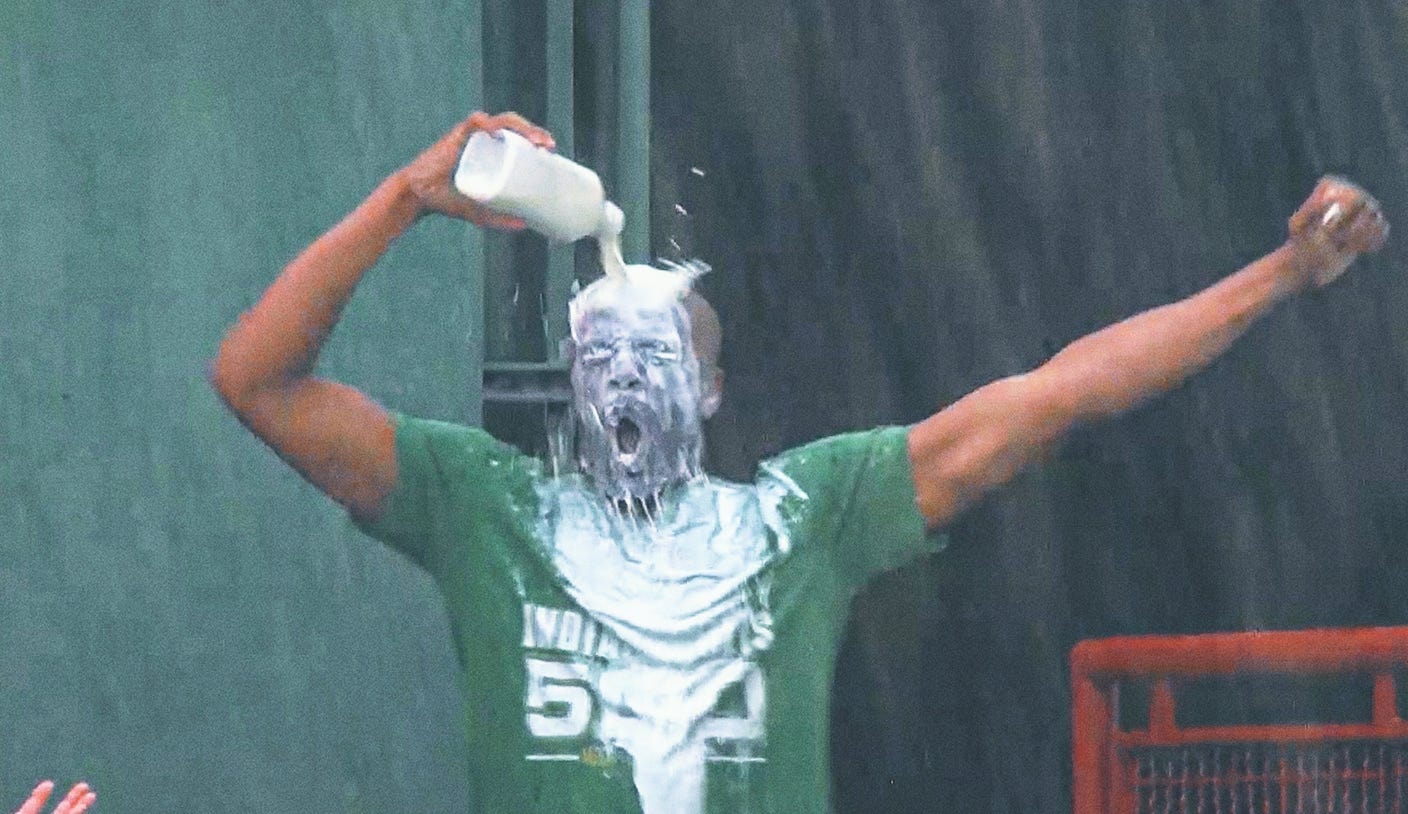

Milk Soaked Celebrations The Unexpected Link Between Indy 500 And Baseball

May 27, 2025

Milk Soaked Celebrations The Unexpected Link Between Indy 500 And Baseball

May 27, 2025 -

Thunders Game 3 Victory A Crushing Display Of Physicality Against The Wolves

May 27, 2025

Thunders Game 3 Victory A Crushing Display Of Physicality Against The Wolves

May 27, 2025