Stock Market Surge: S&P 500's Six-Day Rally Defies Moody's Negative Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stock Market Surge: S&P 500's Six-Day Rally Defies Moody's Negative Outlook

The S&P 500 has staged a remarkable six-day rally, defying Moody's recent downgrade of several US banking institutions and its negative outlook on the US banking sector. This unexpected surge has left investors and analysts scrambling to understand the driving forces behind this market defiance. While some point to positive earnings reports and a cooling inflation narrative, others remain cautious, highlighting the fragility of the current market optimism.

Moody's Downgrade and the Market's Response

Moody's decision to downgrade 10 US banks and place others on review for potential downgrades sent shockwaves through the financial markets earlier this month. The credit rating agency cited concerns about the deteriorating credit quality of banks' assets and the potential for further losses from rising interest rates and economic uncertainty. This news, logically, should have triggered a significant market downturn. However, the S&P 500's subsequent performance tells a different story.

The Six-Day Rally: A Closer Look

The six-day rally witnessed a significant increase in the S&P 500 index, defying expectations and leaving many puzzled. Several factors may have contributed to this unexpected surge:

- Stronger-than-expected corporate earnings: Several major corporations have released better-than-anticipated earnings reports in recent weeks, boosting investor confidence. This positive news has overshadowed the concerns raised by Moody's.

- Easing inflation concerns: While inflation remains a concern, recent data suggests a potential cooling, offering a glimmer of hope that the Federal Reserve might slow its aggressive interest rate hikes. This expectation has fueled investor optimism.

- Technical factors: Some analysts attribute the rally to technical factors, such as short-covering and bargain hunting. After the initial dip following Moody's announcement, investors may have seen an opportunity to buy stocks at discounted prices.

- Resilience of the US economy: Despite the challenges, the US economy continues to show signs of resilience, further contributing to investor confidence. This resilience, however, remains a subject of ongoing debate among economists.

Is the Rally Sustainable? A Cautious Outlook

While the six-day rally is impressive, it's crucial to maintain a cautious outlook. The underlying economic challenges remain, and Moody's concerns about the banking sector are far from resolved. The rally could be a temporary reprieve, and a more significant correction might still be on the horizon.

What to Watch For:

- Further economic data releases: Upcoming inflation and employment reports will be crucial in determining the market's future direction.

- Federal Reserve policy decisions: The Federal Reserve's next interest rate decision will significantly impact market sentiment.

- Further developments in the banking sector: Any further negative news from the banking sector could trigger another market downturn.

Conclusion:

The S&P 500's six-day rally is a fascinating development that challenges the conventional wisdom. While positive corporate earnings and easing inflation fears have contributed to this surge, the underlying risks remain significant. Investors should remain vigilant and monitor economic indicators closely before making any investment decisions. This unexpected rally underscores the volatility and unpredictable nature of the stock market, highlighting the need for a diversified investment strategy and a long-term perspective. Consult a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stock Market Surge: S&P 500's Six-Day Rally Defies Moody's Negative Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

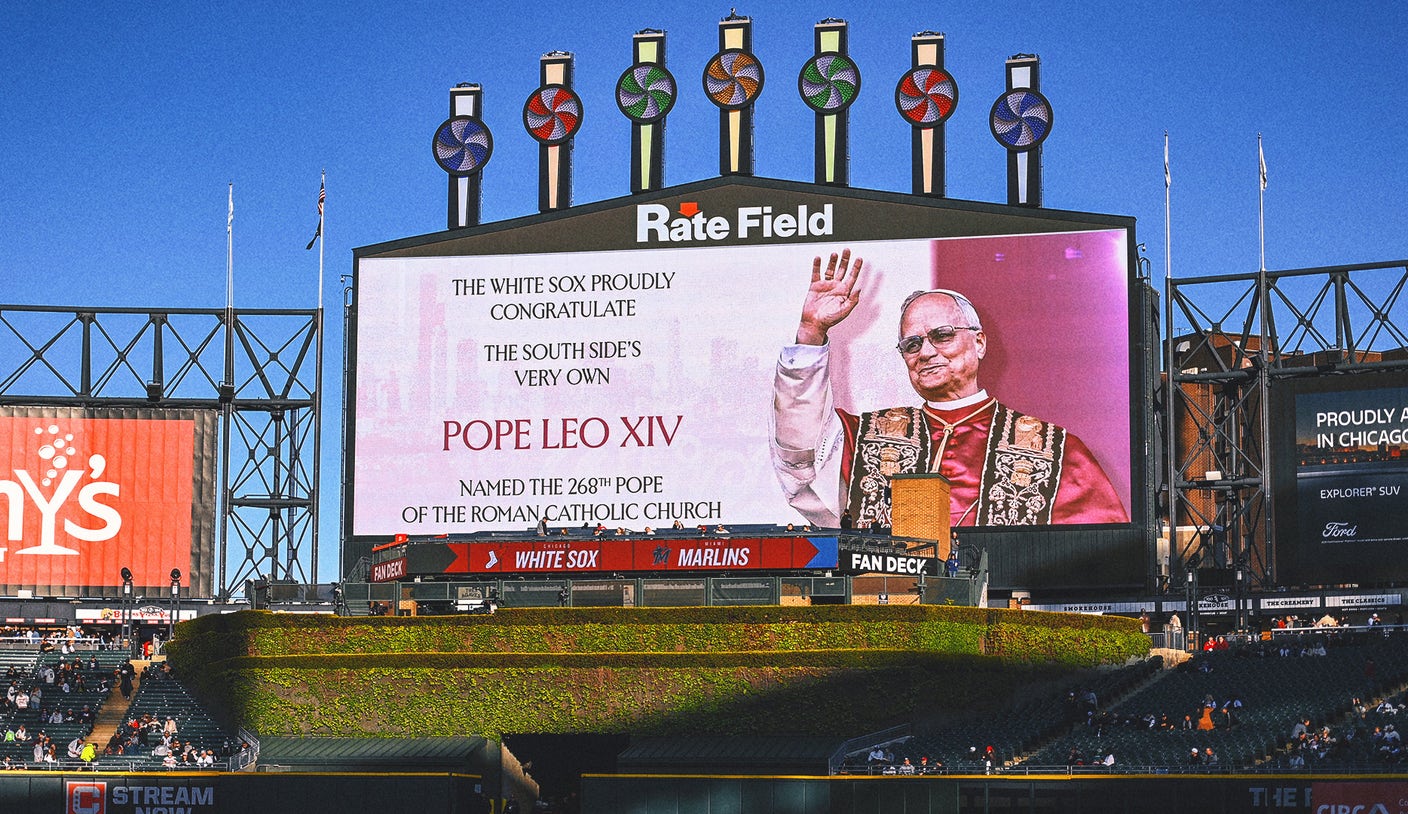

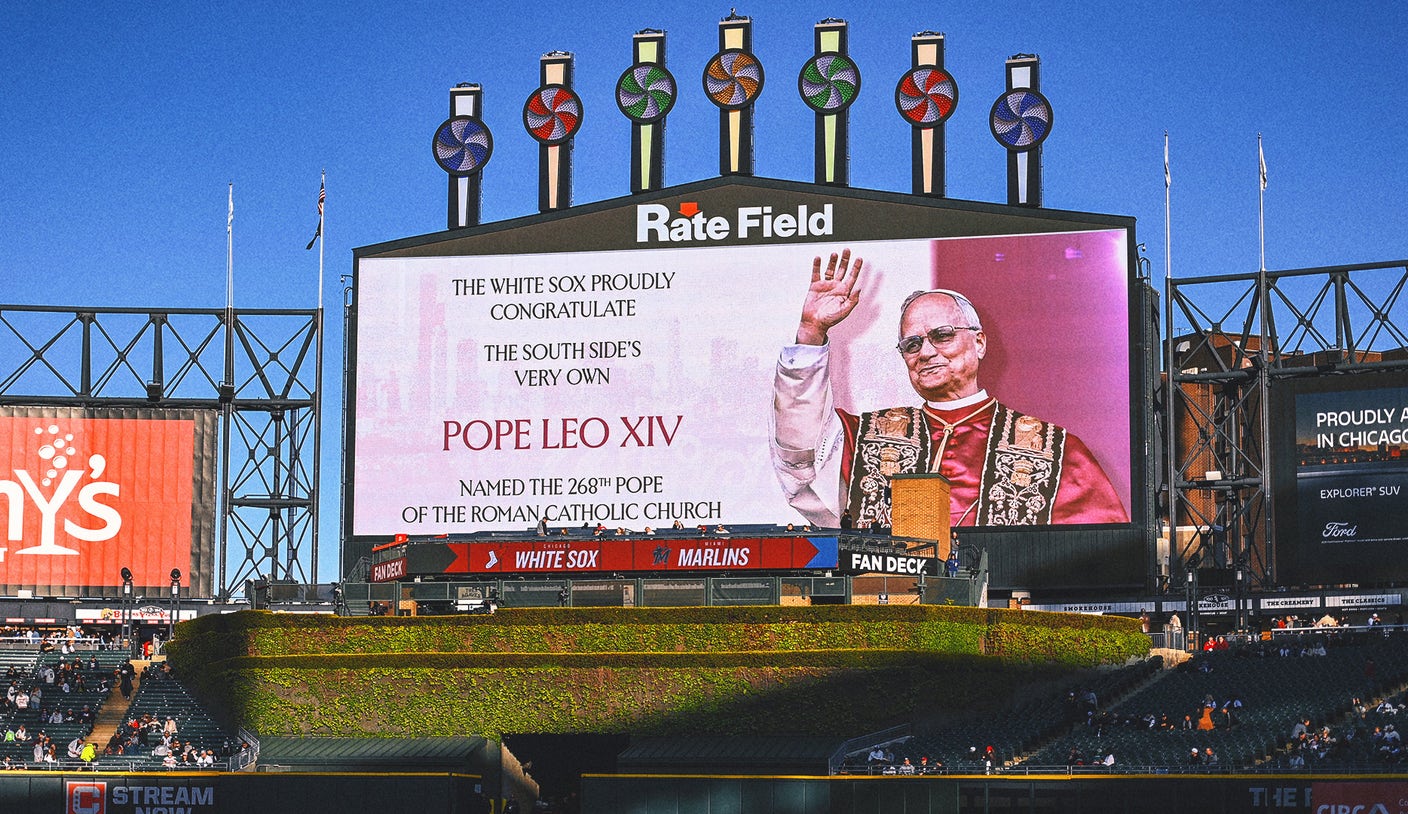

White Soxs Guaranteed Rate Field Showcases Powerful Pope Leo Xiii Tribute

May 21, 2025

White Soxs Guaranteed Rate Field Showcases Powerful Pope Leo Xiii Tribute

May 21, 2025 -

A Papal Tribute White Sox Stadium Features Stunning Leo Xiii Graphic Art

May 21, 2025

A Papal Tribute White Sox Stadium Features Stunning Leo Xiii Graphic Art

May 21, 2025 -

U S Treasury Yields Fall As Federal Reserve Hints At Single 2025 Rate Decrease

May 21, 2025

U S Treasury Yields Fall As Federal Reserve Hints At Single 2025 Rate Decrease

May 21, 2025 -

Nuggets Adelman Receives Well Deserved Praise Strong Player Backing

May 21, 2025

Nuggets Adelman Receives Well Deserved Praise Strong Player Backing

May 21, 2025 -

Ubisofts Reasoning No Animal Killing In Assassins Creed Shadows

May 21, 2025

Ubisofts Reasoning No Animal Killing In Assassins Creed Shadows

May 21, 2025