U.S. Treasury Yields Fall As Federal Reserve Hints At Single 2025 Rate Decrease

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Treasury Yields Tumble as Fed Signals Potential Single Rate Cut in 2025

U.S. Treasury yields experienced a significant drop following the Federal Reserve's latest policy statement, which hinted at a possible single interest rate cut in 2025. This move sent ripples through the financial markets, sparking considerable debate among analysts and investors about the future trajectory of interest rates and the overall economic outlook.

The Federal Open Market Committee (FOMC) held its interest rates steady in its July meeting, maintaining the target range for the federal funds rate at 5.00% to 5.25%. However, the accompanying statement offered a more dovish tone than many had anticipated, suggesting a less aggressive approach to future monetary policy tightening. This subtle shift in language was enough to trigger a notable decline in Treasury yields, signaling a potential easing of monetary policy down the line.

What Drove the Yield Decline?

The market's reaction hinges on the FOMC's projection of a single 25-basis-point rate cut in 2025. This projection, while not a guarantee, implies that the Fed believes inflation is on a path towards its 2% target, albeit a slower path than previously anticipated. This expectation of future rate cuts led investors to sell higher-yielding assets and buy longer-term Treasury bonds, thus driving down yields. Several factors likely contributed to this more cautious outlook:

- Softening Inflation Data: While inflation remains above the Fed's target, recent data has shown signs of moderation, suggesting that the aggressive rate hikes implemented over the past year are starting to have the desired effect.

- Economic Uncertainty: Concerns about potential economic slowdown, particularly in the face of ongoing geopolitical uncertainty and tighter credit conditions, also played a role in the Fed's more cautious stance.

- Labor Market Dynamics: The labor market, while still strong, is showing some signs of cooling, reducing pressure on wages and potentially contributing to lower inflation.

Implications for Investors and the Economy

The decline in Treasury yields has significant implications for various sectors of the economy:

- Mortgage Rates: Lower Treasury yields generally translate to lower mortgage rates, potentially boosting the housing market. However, the impact might be muted due to other factors affecting the housing sector.

- Corporate Borrowing Costs: Reduced yields can lead to lower borrowing costs for corporations, encouraging investment and economic growth.

- Investment Strategies: Investors will likely re-evaluate their portfolios in light of the changed interest rate outlook. This could involve shifting allocations towards longer-term bonds or other assets perceived as less risky.

It is crucial to remember that the Fed's projections are subject to change based on future economic data. Any unforeseen economic shocks or shifts in inflation could alter the course of monetary policy.

Looking Ahead: Uncertainty Remains

While the single projected rate cut in 2025 offers a glimpse into the Fed's current thinking, significant uncertainty remains. The path of inflation, economic growth, and the labor market will continue to shape the central bank's future decisions. Investors and market analysts will be closely monitoring economic indicators in the coming months for further clues about the direction of interest rates. This situation highlights the need for a diversified investment strategy and careful risk management. Staying informed about the latest economic developments and seeking professional financial advice are crucial steps for navigating this dynamic environment.

What are your thoughts on the Fed's latest move and its implications for the economy? Share your insights in the comments below!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Treasury Yields Fall As Federal Reserve Hints At Single 2025 Rate Decrease. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ellen De Generes Post Loss Social Media Return A Celebration Of Resilience

May 21, 2025

Ellen De Generes Post Loss Social Media Return A Celebration Of Resilience

May 21, 2025 -

Ellen De Generes Emotional Tribute A Family Member Passes Away

May 21, 2025

Ellen De Generes Emotional Tribute A Family Member Passes Away

May 21, 2025 -

Buck Showalter Mets Discuss Baserunning With Juan Soto

May 21, 2025

Buck Showalter Mets Discuss Baserunning With Juan Soto

May 21, 2025 -

Nature Conservation Drives Corporate Value 160 Japanese Companies Lead The Way

May 21, 2025

Nature Conservation Drives Corporate Value 160 Japanese Companies Lead The Way

May 21, 2025 -

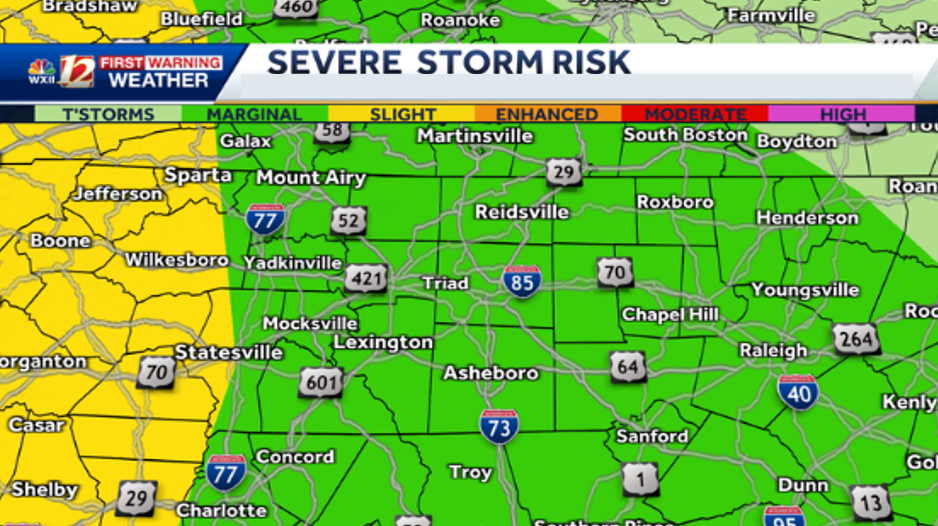

Overnight Storms And Heavy Rain Threaten North Carolina Severe Weather Warnings Issued

May 21, 2025

Overnight Storms And Heavy Rain Threaten North Carolina Severe Weather Warnings Issued

May 21, 2025