RetireToMore Campaign: HSBC Mutual Fund's Retirement Investment Strategy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

RetireToMore Campaign: HSBC Mutual Fund's Retirement Investment Strategy for a Secure Future

Planning for retirement can feel daunting. The sheer scale of the task – securing enough funds to maintain your lifestyle for potentially decades – often leads to procrastination. But what if there was a straightforward, accessible strategy to help you achieve your retirement goals? HSBC Mutual Fund's RetireToMore campaign offers just that, providing a comprehensive approach to retirement investment. This article delves into the campaign's key features and how it can help you build a secure financial future.

Understanding the RetireToMore Campaign:

The RetireToMore campaign isn't just about selling mutual funds; it's about providing a holistic retirement planning solution. HSBC, a globally recognized financial institution, leverages its expertise to offer a range of services designed to help individuals navigate the complexities of retirement saving. The core of the campaign revolves around carefully curated mutual fund schemes tailored to different risk profiles and retirement goals.

Key Features of the HSBC RetireToMore Investment Strategy:

-

Diversified Portfolio Options: The campaign offers a selection of mutual funds catering to various risk appetites. From conservative options emphasizing capital preservation to more aggressive strategies targeting higher returns, investors can choose a portfolio aligned with their individual circumstances and comfort levels. This diversification is crucial in mitigating risk and maximizing long-term growth.

-

Long-Term Growth Focus: The strategy prioritizes long-term investment growth, acknowledging that retirement planning is a marathon, not a sprint. The funds are designed for those with a longer time horizon, allowing for potential market fluctuations to be absorbed over time.

-

Professional Management: Investing in mutual funds managed by experienced professionals relieves the burden of individual stock picking and market timing. HSBC's team of experts actively manages the portfolios, aiming to deliver optimal returns while minimizing risks.

-

Regular Monitoring and Adjustments: The RetireToMore campaign isn't a "set it and forget it" approach. Regular monitoring and portfolio adjustments based on market conditions ensure the strategy remains aligned with the investor's goals throughout their investment journey. This proactive management is a key differentiator.

Why Choose HSBC's RetireToMore Campaign?

HSBC's reputation for financial stability and its long history in the market provide investors with confidence and security. The transparency and clarity of the campaign's offerings make it easier for individuals to understand their investment options and make informed decisions. Furthermore, the availability of various resources and support channels, including financial advisors, adds a layer of personalized guidance to the process.

Building a Secure Retirement: A Step-by-Step Guide (Inspired by RetireToMore):

- Assess Your Retirement Needs: Determine your desired retirement lifestyle and calculate the approximate funds required.

- Determine Your Risk Tolerance: Understand your comfort level with potential market fluctuations.

- Choose a Suitable Portfolio: Select a mutual fund scheme from the RetireToMore range that aligns with your risk profile and retirement goals.

- Invest Regularly: Establish a consistent investment plan to maximize the power of compounding.

- Monitor Your Progress: Regularly review your portfolio and seek professional advice if needed.

Conclusion:

HSBC's RetireToMore campaign presents a valuable opportunity for individuals looking to secure their financial future. By offering a diverse range of carefully managed mutual funds and a focus on long-term growth, the campaign provides a comprehensive and accessible approach to retirement planning. While past performance is not indicative of future results, the strategic approach and professional management offered by HSBC make RetireToMore a compelling option for building a secure and comfortable retirement. Learn more about the RetireToMore campaign by visiting the . Remember to consult with a financial advisor to determine the best investment strategy for your individual circumstances.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on RetireToMore Campaign: HSBC Mutual Fund's Retirement Investment Strategy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

White Sox Fall To Tigers As Kerry Carpenter Explodes For Three Home Runs

Jun 05, 2025

White Sox Fall To Tigers As Kerry Carpenter Explodes For Three Home Runs

Jun 05, 2025 -

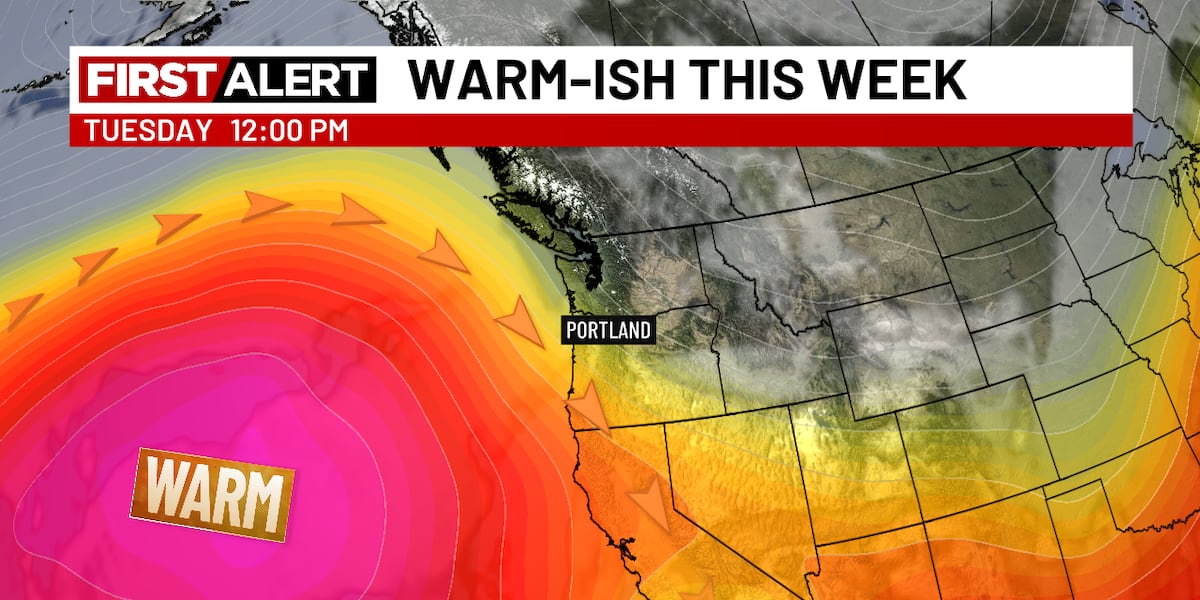

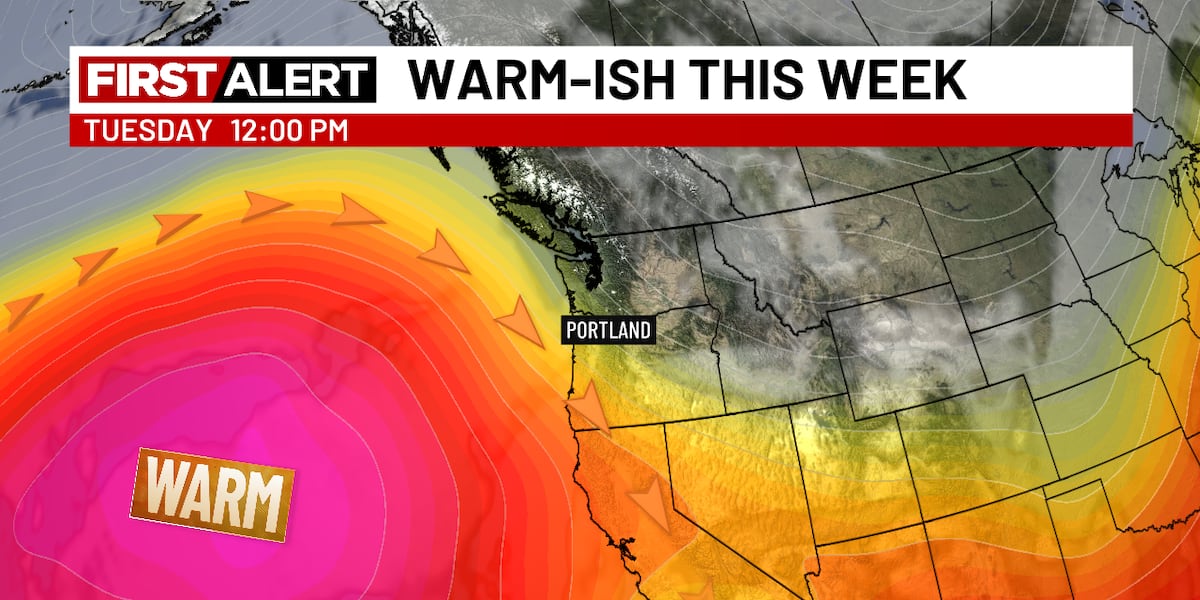

Fair Weather Forecast June Begins Sunny And Dry

Jun 05, 2025

Fair Weather Forecast June Begins Sunny And Dry

Jun 05, 2025 -

Grace Potter On The Release Of Her New Album Key Soundbites

Jun 05, 2025

Grace Potter On The Release Of Her New Album Key Soundbites

Jun 05, 2025 -

Fair And Pleasant June Begins With Warm Dry Conditions

Jun 05, 2025

Fair And Pleasant June Begins With Warm Dry Conditions

Jun 05, 2025 -

Robinhood Stock Performance Analysis And Future Outlook

Jun 05, 2025

Robinhood Stock Performance Analysis And Future Outlook

Jun 05, 2025