Robinhood Stock Performance: Analysis And Future Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood Stock Performance: Analysis and Future Outlook

Robinhood, the commission-free trading app that stormed onto the financial scene, has experienced a rollercoaster ride since its IPO. Its initial public offering (IPO) in July 2021 was met with mixed reactions, and the stock's performance since then has been anything but predictable. This article delves into Robinhood's stock performance, analyzes key factors influencing its trajectory, and offers insights into its future outlook.

Early Hype and Subsequent Dip:

The initial excitement surrounding Robinhood's IPO, fueled by its disruptive business model and massive user base, quickly waned. The stock price, which opened at $38, saw a significant decline in the months following its debut. Several factors contributed to this downturn, including:

- Increased competition: Established brokerages began offering commission-free trading, eroding Robinhood's competitive advantage.

- Regulatory scrutiny: The company faced increased regulatory scrutiny, impacting investor confidence.

- Market volatility: The broader market downturn also significantly impacted Robinhood's stock price.

- Concerns about revenue growth: Questions surrounding the sustainability of its revenue model and future growth prospects added to investor concerns.

Recent Performance and Key Developments:

While the stock has experienced periods of recovery, it hasn't fully regained its initial IPO price. However, recent developments suggest a potential shift in trajectory:

- Expansion of services: Robinhood has been actively expanding its offerings beyond stock trading, including options trading, cryptocurrency trading, and even a debit card. This diversification strategy aims to increase revenue streams and attract a broader customer base.

- Improved financial performance: While still facing challenges, Robinhood has shown signs of improved financial performance in recent quarters, suggesting a potential turnaround. This includes increased user engagement and a growing customer base.

- Strategic partnerships: The company is also forging strategic partnerships to expand its reach and capabilities.

Factors Influencing Future Outlook:

Several factors will play a crucial role in shaping Robinhood's future stock performance:

- Regulatory landscape: The evolving regulatory environment will continue to impact Robinhood's operations and profitability. Keeping pace with changing regulations and maintaining compliance will be critical.

- Competition: The competitive landscape remains intense, with established players and new entrants vying for market share. Innovation and differentiation will be key to success.

- Economic conditions: Macroeconomic factors, such as interest rates and inflation, will undoubtedly influence investor sentiment and trading activity.

- Successful execution of strategy: The success of Robinhood's diversification strategy and its ability to attract and retain users will be crucial determinants of its future growth.

Investing in Robinhood: A Cautious Approach:

Investing in Robinhood, or any stock for that matter, involves inherent risks. While the company shows signs of improvement, its future remains uncertain. Investors should conduct thorough research and carefully consider their risk tolerance before investing in Robinhood stock. It's advisable to consult with a qualified financial advisor before making any investment decisions.

Conclusion:

Robinhood's stock performance has been a complex journey marked by both highs and lows. While challenges remain, the company is demonstrating a commitment to innovation and diversification. Its future outlook hinges on its ability to navigate the competitive landscape, adapt to regulatory changes, and effectively execute its strategic plans. Careful monitoring of key performance indicators and a comprehensive understanding of the market dynamics are crucial for any investor considering a position in Robinhood. Remember to always do your own due diligence before investing.

Keywords: Robinhood stock, Robinhood stock price, Robinhood IPO, Robinhood performance, Robinhood future, commission-free trading, stock market, investment, trading app, financial technology, fintech, regulatory scrutiny, competition, revenue growth, diversification strategy, stock market analysis, investment advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood Stock Performance: Analysis And Future Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Making Of Grace Potters Latest Album Insights And Soundbites

Jun 05, 2025

The Making Of Grace Potters Latest Album Insights And Soundbites

Jun 05, 2025 -

Four Goal Win Over Jamaica Uswnt Finishes International Friendlies Undefeated

Jun 05, 2025

Four Goal Win Over Jamaica Uswnt Finishes International Friendlies Undefeated

Jun 05, 2025 -

Bateman Breaks The Bank Highest Paid Gophers Wr In Nfl History

Jun 05, 2025

Bateman Breaks The Bank Highest Paid Gophers Wr In Nfl History

Jun 05, 2025 -

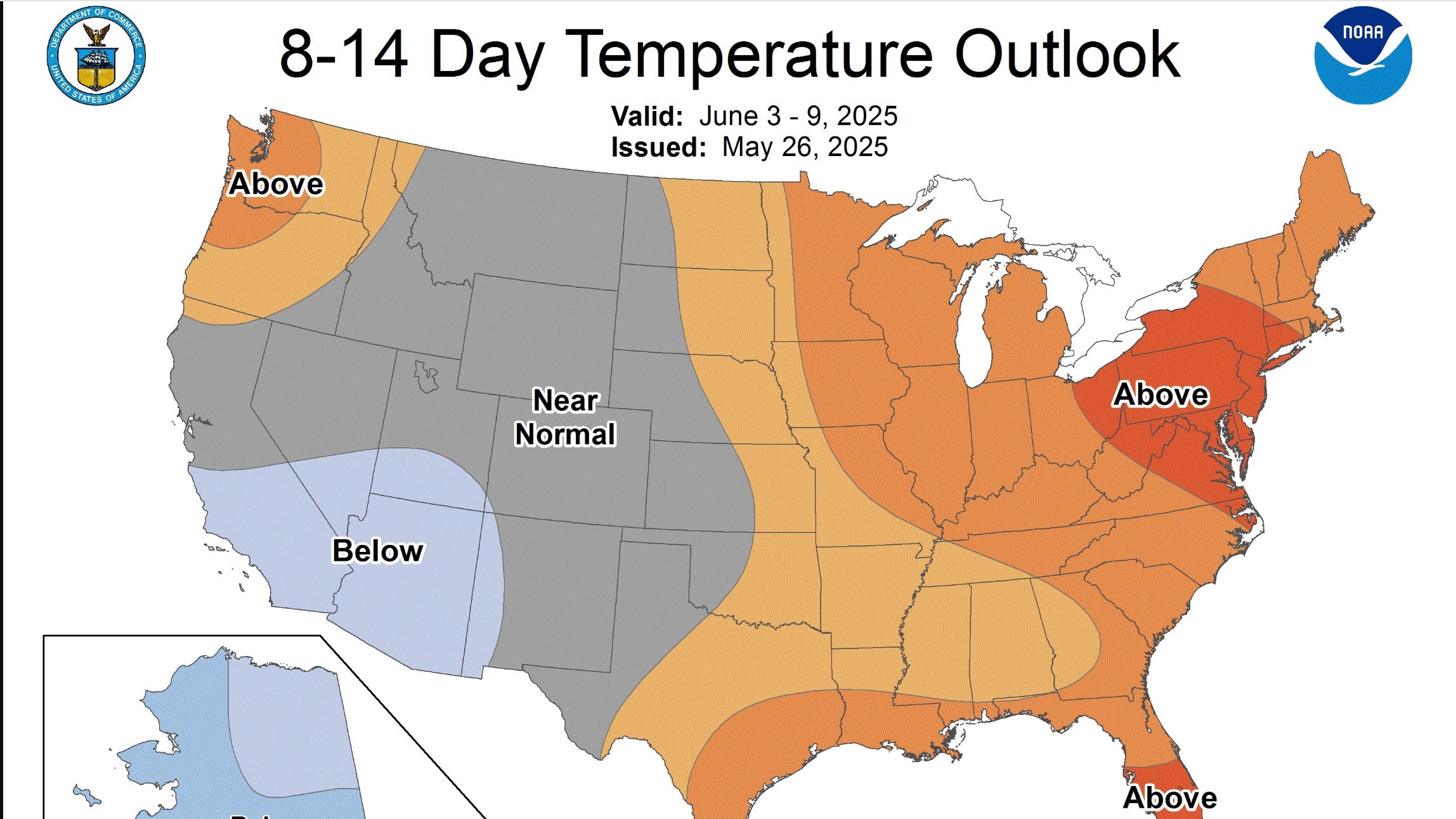

Scorching Temperatures Ahead Willamette Valley Oregon To Bake Under High 80s And 90s

Jun 05, 2025

Scorching Temperatures Ahead Willamette Valley Oregon To Bake Under High 80s And 90s

Jun 05, 2025 -

The Karen Read Trial Reasons For Todays Recess

Jun 05, 2025

The Karen Read Trial Reasons For Todays Recess

Jun 05, 2025