Powin's Financial Challenges Highlight Broader Issues In The Energy Storage Industry

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Powin's Financial Challenges Highlight Broader Issues in the Energy Storage Industry

Powin Energy's recent financial struggles serve as a stark warning sign, exposing underlying vulnerabilities within the rapidly expanding energy storage sector. The company, a significant player in the battery energy storage system (BESS) market, filed for Chapter 11 bankruptcy protection, raising concerns about the long-term stability of some companies within this burgeoning industry. This isn't just about one company; it highlights crucial challenges facing the entire energy storage landscape.

The Powin Case: A Symptom, Not the Disease

Powin's bankruptcy filing wasn't a sudden shock. The company had been grappling with mounting debt and delays in project completion for some time. While specific details surrounding their financial difficulties remain complex, the situation underscores the inherent risks involved in large-scale energy storage projects. These risks include:

- Supply chain disruptions: The global supply chain continues to be volatile, impacting the availability and cost of crucial components like lithium-ion batteries. This instability directly affects project timelines and profitability.

- Project financing complexities: Securing adequate funding for large-scale BESS projects is challenging. Investors often demand strong financial guarantees and a clear path to profitability, which can be difficult to achieve, particularly in a nascent market.

- Permitting and regulatory hurdles: Navigating the often complex and lengthy permitting processes for energy storage projects adds significant time and cost to the overall development cycle. Regulatory uncertainty in some regions further compounds these issues.

- Competition and pricing pressures: The energy storage market is becoming increasingly competitive, with numerous players vying for market share. This can lead to price wars and squeezed profit margins.

Beyond Powin: Systemic Risks in the Energy Storage Sector

Powin's situation isn't an isolated incident. While the industry is experiencing explosive growth, fueled by the global transition to renewable energy, several systemic risks remain:

- Technological advancements: The rapid pace of technological innovation in battery chemistry and energy storage technologies creates challenges for companies trying to keep up with the latest developments while managing existing projects. Investing in R&D is crucial but can strain already tight budgets.

- Scaling up production: Meeting the growing demand for energy storage solutions requires significant scaling up of manufacturing capacity. This requires substantial capital investment and poses logistical challenges.

- Workforce development: A skilled workforce is critical for the design, installation, and maintenance of energy storage systems. The industry faces a shortage of trained professionals, limiting growth potential.

The Path Forward: Strengthening the Energy Storage Ecosystem

The challenges facing the energy storage industry are significant, but not insurmountable. To ensure long-term sustainability and growth, several key steps are needed:

- Improved project financing mechanisms: Developing innovative financing models, such as public-private partnerships and green bonds, is crucial to attract investment and reduce project risks.

- Streamlined permitting processes: Simplifying and accelerating the permitting process for energy storage projects will help reduce development costs and timelines.

- Supply chain diversification: Diversifying the supply chain for key components will reduce reliance on single suppliers and enhance resilience to disruptions.

- Investment in R&D and workforce development: Continued investment in research and development, along with robust training programs, is essential for fostering innovation and building a skilled workforce.

The energy storage sector is vital for the transition to a cleaner energy future. While Powin's struggles serve as a cautionary tale, they also provide a valuable opportunity to address underlying systemic issues and build a more resilient and sustainable industry. The future of clean energy depends on it. Learn more about the challenges and opportunities facing the energy storage industry by following reputable sources like the .

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Powin's Financial Challenges Highlight Broader Issues In The Energy Storage Industry. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Broadcom Earnings Imminent Why Wall Street Is Focused On 250

Jun 05, 2025

Broadcom Earnings Imminent Why Wall Street Is Focused On 250

Jun 05, 2025 -

Relive Mays Top 10 Sports Moments A Recap

Jun 05, 2025

Relive Mays Top 10 Sports Moments A Recap

Jun 05, 2025 -

Broadcoms Q Quarter Earnings Why Wall Street Is Watching Closely

Jun 05, 2025

Broadcoms Q Quarter Earnings Why Wall Street Is Watching Closely

Jun 05, 2025 -

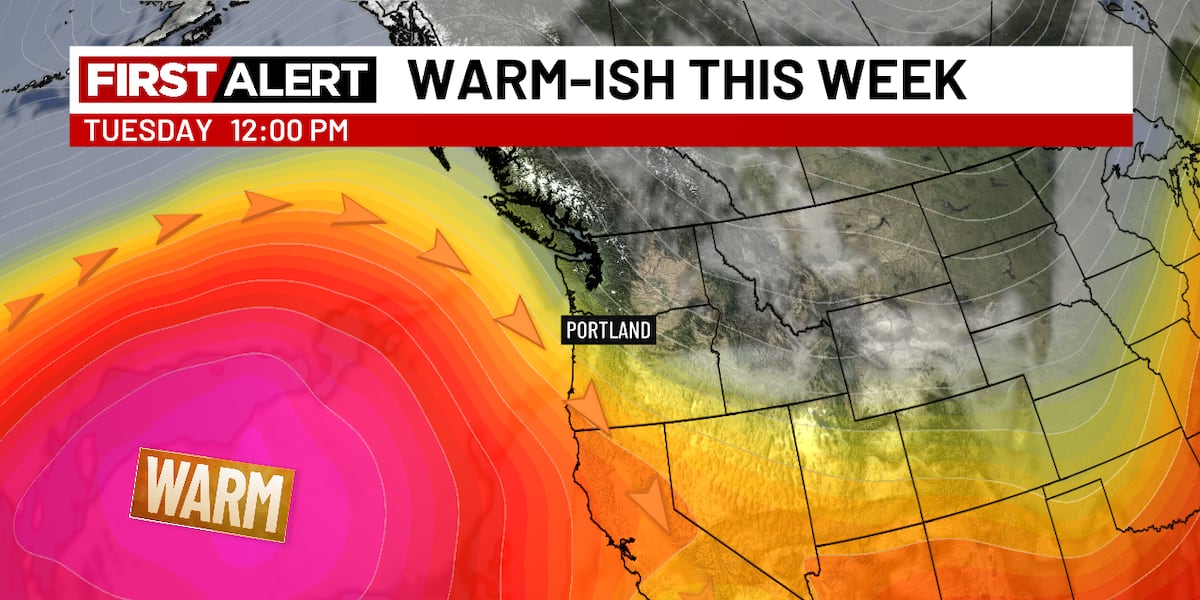

Dry And Sunny Skies To Dominate Early June

Jun 05, 2025

Dry And Sunny Skies To Dominate Early June

Jun 05, 2025 -

Robinhood Stock Analyzing The Risks And Rewards For Investors

Jun 05, 2025

Robinhood Stock Analyzing The Risks And Rewards For Investors

Jun 05, 2025