Robinhood Stock: Analyzing The Risks And Rewards For Investors.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood Stock: Weighing the Risks and Rewards for Investors

Robinhood, the commission-free trading app that revolutionized retail investing, has had a rollercoaster ride since its IPO. While its disruptive model initially captivated investors, the stock's performance has been anything but predictable. This article delves into the current state of Robinhood stock, analyzing the potential risks and rewards for investors considering adding it to their portfolios.

The Allure of Robinhood: A Disruptive Force in Finance

Robinhood's meteoric rise was fueled by its user-friendly interface and its elimination of trading commissions, democratizing access to the stock market for a younger generation. This innovative approach attracted millions of users, driving significant growth in the company's early years. Its gamified platform, complete with celebratory confetti after successful trades, further cemented its appeal. However, this initial success masks a more complex reality for potential investors.

Understanding the Risks:

-

Regulatory Scrutiny: Robinhood has faced increasing regulatory scrutiny, particularly concerning its handling of high-risk investments like options trading and its role in the GameStop saga. These investigations could result in significant fines and stricter regulations, impacting the company's profitability.

-

Competition: The commission-free trading model, once a unique selling proposition, is now commonplace. Established players and new entrants are vying for market share, creating a fiercely competitive landscape. Robinhood needs to constantly innovate to maintain its edge.

-

Dependence on Transaction Revenue: A significant portion of Robinhood's revenue is derived from transaction-based fees, making it vulnerable to fluctuations in trading volume. Periods of low market volatility can negatively impact its bottom line.

-

Customer Acquisition Costs: Attracting new users is expensive, requiring substantial marketing investments. Maintaining a strong user base requires ongoing expenditure, placing pressure on profit margins.

-

Financial Performance: Robinhood's recent financial performance has been mixed, with periods of strong growth followed by setbacks. Investors need to carefully analyze its financial statements and assess its long-term sustainability. [Link to Robinhood's investor relations page]

Potential Rewards:

-

Growth Potential: Despite the challenges, Robinhood still possesses significant growth potential. Its large user base and brand recognition provide a solid foundation for future expansion.

-

Innovation: Robinhood continues to innovate, expanding its product offerings beyond trading to include cryptocurrencies and other investment options. Successful diversification could boost revenue streams.

-

Market Share: Despite increased competition, Robinhood retains a significant market share in the retail brokerage sector. Maintaining and expanding this share would contribute to long-term growth.

-

Long-Term Investment: For long-term investors with a high-risk tolerance, Robinhood might offer the potential for significant returns if the company successfully navigates the challenges and executes its strategic plans.

Should You Invest in Robinhood Stock?

The decision to invest in Robinhood stock is highly dependent on individual risk tolerance and investment goals. Before investing, it's crucial to conduct thorough due diligence, analyzing the company's financial performance, competitive landscape, and regulatory environment. Consider consulting a qualified financial advisor to discuss your options and determine if Robinhood aligns with your investment strategy.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood Stock: Analyzing The Risks And Rewards For Investors.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

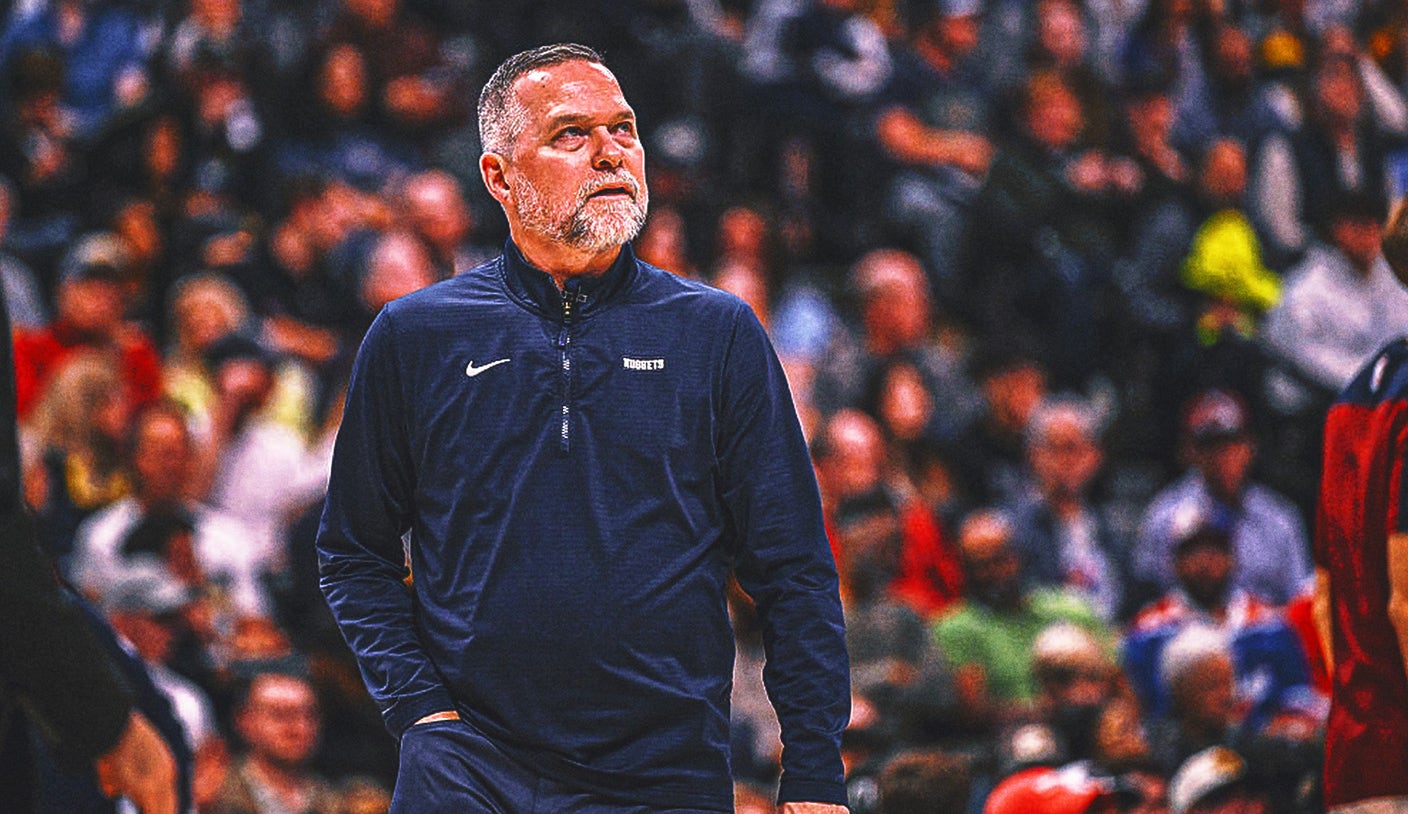

Next Knicks Coach Odds Analyzing The Favorites To Replace Thibodeau

Jun 05, 2025

Next Knicks Coach Odds Analyzing The Favorites To Replace Thibodeau

Jun 05, 2025 -

Bruno Fernandes Future Settled Hes Staying At Manchester United

Jun 05, 2025

Bruno Fernandes Future Settled Hes Staying At Manchester United

Jun 05, 2025 -

Broadcom Stock Traders Outlook After Latest Earnings Report

Jun 05, 2025

Broadcom Stock Traders Outlook After Latest Earnings Report

Jun 05, 2025 -

Boisson Stuns Andreeva Wild Cards Cinderella Run Continues At Espn

Jun 05, 2025

Boisson Stuns Andreeva Wild Cards Cinderella Run Continues At Espn

Jun 05, 2025 -

Why This Former Nfl And Penn State Stars Jersey Is Now In The Smithsonian

Jun 05, 2025

Why This Former Nfl And Penn State Stars Jersey Is Now In The Smithsonian

Jun 05, 2025