Nio Stock Price Prediction: Is Now The Right Time To Invest?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Nio Stock Price Prediction: Is Now the Right Time to Invest?

The electric vehicle (EV) market is booming, and Nio (NIO) is a key player vying for a significant share. But with stock prices fluctuating wildly, many investors are asking: is now the right time to buy Nio stock? This article delves into Nio's performance, market position, and future prospects to help you make an informed decision.

Nio's Recent Performance and Challenges:

Nio has experienced a rollercoaster ride in recent years. While the company has demonstrated impressive growth in vehicle deliveries and technological innovation, it's also faced significant headwinds. These include intense competition from established automakers like Tesla and emerging Chinese EV brands, supply chain disruptions, and macroeconomic uncertainties impacting consumer spending. Understanding these challenges is crucial before considering an investment.

- Strong Delivery Numbers but…: Nio consistently reports strong vehicle delivery figures, showcasing growing consumer demand for its premium EVs. However, these numbers need to be viewed in the context of the broader market competition and potential slowing of overall EV sales growth.

- Battery as a Service (BaaS) Model: Nio's innovative Battery as a Service (BaaS) model, allowing customers to lease batteries separately, is a key differentiator. This model lowers the upfront cost of vehicle ownership and could attract a wider customer base. However, the long-term profitability of this model remains to be seen.

- Expanding Market Presence: Nio is aggressively expanding its presence in both domestic and international markets. Success in these expansions will be critical for future growth and revenue generation.

Nio Stock Price Prediction: Analyst Opinions and Forecasts:

Predicting stock prices is inherently difficult, and no prediction is guaranteed. However, analyzing analyst forecasts and market sentiment can provide valuable insights. Many analysts offer varying predictions, ranging from cautiously optimistic to more bearish outlooks. These predictions are often based on factors like projected sales growth, market share gains, and the overall health of the global EV market. It's vital to consult multiple sources and not rely on a single prediction. Remember to always conduct your own thorough research.

Factors to Consider Before Investing:

Before investing in Nio stock, consider these key factors:

- Market Competition: The EV market is intensely competitive. Nio faces stiff competition from established players and new entrants.

- Technological Innovation: Nio's success hinges on its ability to continuously innovate and develop cutting-edge EV technology.

- Financial Performance: Closely examine Nio's financial statements, including revenue, profitability, and debt levels.

- Macroeconomic Conditions: Global economic conditions, interest rates, and consumer spending patterns can significantly impact the stock price.

- Risk Tolerance: Investing in Nio stock carries significant risk. Only invest what you can afford to lose.

Where to Find More Information:

For up-to-date information on Nio's stock price and financial performance, you can consult reputable financial news websites like and . You can also access Nio's investor relations section on their official website for company announcements and financial reports.

Conclusion:

Deciding whether to invest in Nio stock requires careful consideration of its strengths, weaknesses, and the broader market conditions. While the company shows potential for long-term growth, it's crucial to understand the inherent risks involved. Thorough research, diversification, and a long-term investment strategy are essential for navigating the complexities of the EV market and making informed investment decisions. This analysis is not financial advice; consult a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Nio Stock Price Prediction: Is Now The Right Time To Invest?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

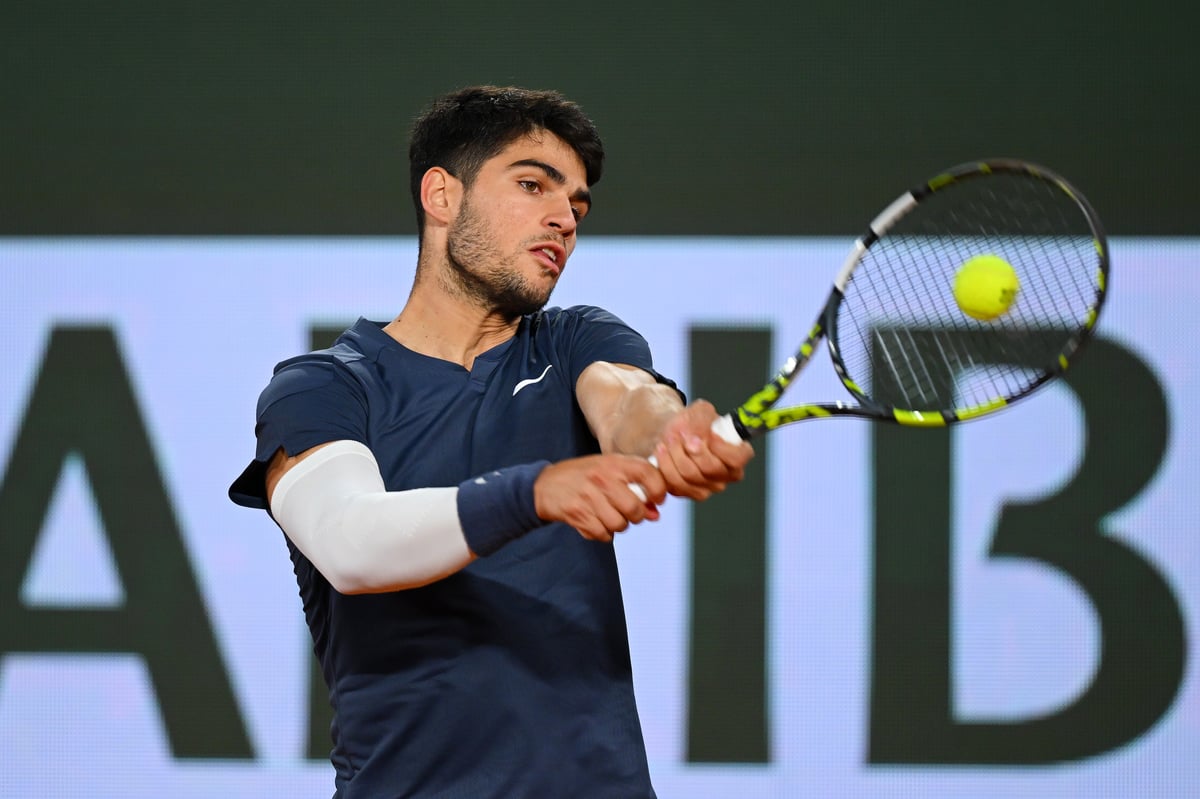

French Open 2025 Live Stream Raducanu Vs Wang Roland Garros Results

May 27, 2025

French Open 2025 Live Stream Raducanu Vs Wang Roland Garros Results

May 27, 2025 -

Is Smci Stock Overvalued A P E Ratio Analysis

May 27, 2025

Is Smci Stock Overvalued A P E Ratio Analysis

May 27, 2025 -

Sources Say Knicks Weighing Starting Lineup Change Ahead Of Crucial Game 3

May 27, 2025

Sources Say Knicks Weighing Starting Lineup Change Ahead Of Crucial Game 3

May 27, 2025 -

Watch The French Open 2025 In The Uk Live Stream And Tv Coverage

May 27, 2025

Watch The French Open 2025 In The Uk Live Stream And Tv Coverage

May 27, 2025 -

Alex Palou From Oval Doubts To Indy 500 Victory

May 27, 2025

Alex Palou From Oval Doubts To Indy 500 Victory

May 27, 2025