Investor Sentiment Turns Negative: CoreWeave (CRWV) Stock Takes A Hit

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investor Sentiment Turns Negative: CoreWeave (CRWV) Stock Takes a Hit

CoreWeave's (CRWV) recent stock performance has sent shockwaves through the market, with investor sentiment shifting dramatically from bullish to bearish. The company, a prominent player in the rapidly expanding cloud computing infrastructure sector, has seen its share price plummet, raising concerns about its future prospects. This downturn prompts crucial questions about the sustainability of its business model and the overall health of the AI-driven cloud computing market.

The dramatic fall in CRWV stock price isn't an isolated incident. We've seen similar trends impacting other tech companies recently, reflecting a broader market correction and a reassessment of valuations in the high-growth sector. However, CoreWeave's situation warrants specific attention due to its reliance on the burgeoning AI infrastructure market.

What Triggered the Downturn?

While pinpointing a single cause for the negative sentiment is difficult, several factors likely contributed to the decline in CoreWeave's stock price:

-

Increased Competition: The cloud computing market is incredibly competitive. Established giants like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) constantly innovate, posing a significant challenge to newer entrants like CoreWeave. This intense competition pressures pricing and profit margins.

-

Concerns about Profitability: Many investors are scrutinizing CoreWeave's path to profitability. While the company boasts impressive growth in terms of client acquisition and infrastructure expansion, demonstrating consistent profitability remains a key hurdle. Investors are demanding clear evidence of a sustainable business model that can deliver long-term returns.

-

Macroeconomic Headwinds: The broader economic climate plays a significant role. Rising interest rates, inflation, and recessionary fears have made investors more risk-averse, leading them to favor established, profitable companies over high-growth, yet potentially less stable, ventures.

-

Recent Market Trends: The tech sector as a whole has experienced a significant correction. This general downturn has amplified the negative sentiment surrounding CoreWeave, pulling its stock price down along with other tech stocks.

Analyzing CoreWeave's Future:

Despite the recent setbacks, CoreWeave isn't without its strengths. Its focus on providing specialized infrastructure for AI workloads positions it well within a rapidly growing market. However, the company needs to address investor concerns regarding profitability and competition to regain market confidence. This might involve:

-

Strategic Partnerships: Collaborating with established players in the tech ecosystem could provide access to wider markets and reduce reliance on organic growth.

-

Enhanced Operational Efficiency: Streamlining operations and improving cost management are crucial for demonstrating a sustainable path to profitability.

-

Clearer Communication: Transparent communication with investors regarding its business strategy, financial performance, and future plans is essential to rebuild trust.

Looking Ahead:

The future of CoreWeave (CRWV) remains uncertain. While the recent downturn presents significant challenges, the company's position within the lucrative AI cloud computing market offers potential for a turnaround. However, successful navigation of the current headwinds will depend on its ability to address investor concerns, enhance operational efficiency, and execute its business strategy effectively. Investors should carefully monitor the company's performance and upcoming announcements before making any investment decisions. For more in-depth market analysis, consider consulting with a qualified financial advisor.

Keywords: CoreWeave, CRWV, stock price, investor sentiment, cloud computing, AI, artificial intelligence, tech stock, market correction, profitability, competition, macroeconomic headwinds, investment, financial advisor.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investor Sentiment Turns Negative: CoreWeave (CRWV) Stock Takes A Hit. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

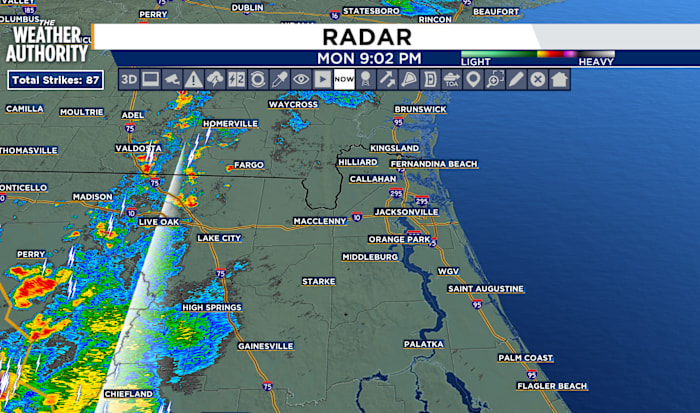

Invest 93 Development Chances Rise As Soggy Weather Persists

Jul 16, 2025

Invest 93 Development Chances Rise As Soggy Weather Persists

Jul 16, 2025 -

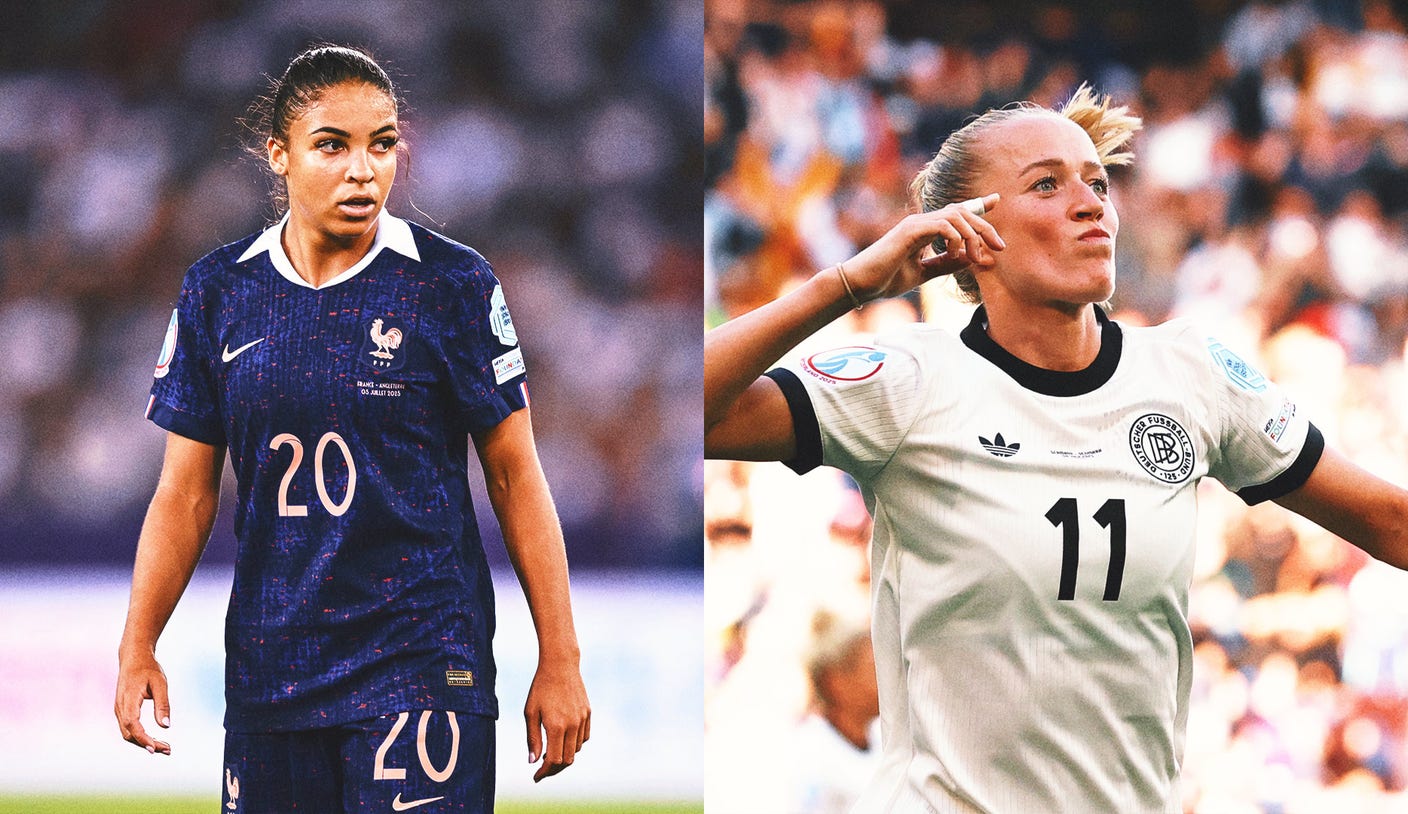

Uefa Womens Euro 2025 Analyzing The Crucial France Germany Quarterfinal

Jul 16, 2025

Uefa Womens Euro 2025 Analyzing The Crucial France Germany Quarterfinal

Jul 16, 2025 -

Breaking News Central Florida Under Severe Weather Alerts Live Updates

Jul 16, 2025

Breaking News Central Florida Under Severe Weather Alerts Live Updates

Jul 16, 2025 -

Core Weave Crwv Tanks 23 8 After Core Scientific Merger Announcement

Jul 16, 2025

Core Weave Crwv Tanks 23 8 After Core Scientific Merger Announcement

Jul 16, 2025 -

2025 Mlb Draft Washington Nationals Take High School Ss Eli Willits

Jul 16, 2025

2025 Mlb Draft Washington Nationals Take High School Ss Eli Willits

Jul 16, 2025

Latest Posts

-

Do All Star Games Doom Hosts The Atlanta Braves Case Study

Jul 17, 2025

Do All Star Games Doom Hosts The Atlanta Braves Case Study

Jul 17, 2025 -

Uncaged Johnny Cage Takes Center Stage In New Mortal Kombat Ii Poster

Jul 17, 2025

Uncaged Johnny Cage Takes Center Stage In New Mortal Kombat Ii Poster

Jul 17, 2025 -

Pre Mortal Kombat 2 Hype Warner Bros Johnny Cage Imdb Hoax

Jul 17, 2025

Pre Mortal Kombat 2 Hype Warner Bros Johnny Cage Imdb Hoax

Jul 17, 2025 -

Hilarious Moment Kings Guards Reaction To Being Zoomed In During Nba Summer League Game

Jul 17, 2025

Hilarious Moment Kings Guards Reaction To Being Zoomed In During Nba Summer League Game

Jul 17, 2025 -

Mc Laurins Contract Frustration Commanders Star Wide Receiver Speaks Out

Jul 17, 2025

Mc Laurins Contract Frustration Commanders Star Wide Receiver Speaks Out

Jul 17, 2025