CoreWeave (CRWV) Tanks 23.8% After Core Scientific Merger Announcement

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

CoreWeave (CRWV) Stock Plunges 23.8% Following Core Scientific Merger Announcement

CoreWeave Inc. (NYSE: CRWV), a rapidly growing provider of cloud computing services specializing in artificial intelligence (AI) and high-performance computing (HPC), experienced a significant stock price drop on [Date of Stock Drop] following the announcement of its merger with bankrupt cryptocurrency mining company, Core Scientific. The news sent shockwaves through the market, with CRWV shares plummeting 23.8%, leaving investors scrambling to understand the implications of this unexpected partnership.

The merger, initially presented as a strategic move to consolidate assets and expand CoreWeave's infrastructure, failed to impress investors. The substantial decline in CRWV's stock price suggests a lack of confidence in the long-term benefits of the acquisition, raising questions about the financial health and future prospects of the combined entity.

Why the Market Reacted Negatively

Several factors contributed to the negative market reaction. Primarily, the perception that Core Scientific's significant debt and ongoing bankruptcy proceedings outweigh the potential benefits of its mining infrastructure overshadowed the strategic rationale behind the merger. Investors appear concerned about:

- Increased Debt Burden: Core Scientific’s substantial debt will likely be absorbed by CoreWeave, potentially impacting its financial stability and future growth prospects. This added financial strain could hinder CoreWeave's ability to invest in research and development, limiting its competitive edge in the burgeoning AI and HPC markets.

- Dilution of Shareholder Value: The merger terms likely involve issuing new shares to Core Scientific's creditors and shareholders, diluting the ownership stake of existing CoreWeave investors. This dilution directly impacts the value of each existing share, contributing to the significant stock price drop.

- Operational Challenges: Integrating Core Scientific's operations into CoreWeave's existing infrastructure will be a complex undertaking, potentially leading to operational disruptions and unforeseen costs. Successfully navigating this integration will be crucial to the merged company's success.

- Market Sentiment Towards Crypto Mining: The overall negative sentiment surrounding the cryptocurrency mining industry, exacerbated by recent market volatility and regulatory uncertainty, likely played a role in the negative investor reaction. This broader market context further dampened investor enthusiasm for the merger.

What's Next for CoreWeave?

The coming weeks will be crucial for CoreWeave. The company will need to effectively communicate its post-merger strategy to reassure investors and demonstrate the long-term value proposition of the combined entity. This will likely involve:

- Detailed Financial Projections: Transparent and detailed financial projections demonstrating the synergistic benefits of the merger and a clear path to profitability are essential to regain investor confidence.

- Strategic Partnerships: Announcing strategic partnerships with key players in the AI and HPC sectors could help alleviate investor concerns and highlight the combined company's market position.

- Focus on Operational Efficiency: A clear plan to streamline operations and maximize efficiency post-merger will be critical to address concerns about operational challenges.

The CoreWeave (CRWV) and Core Scientific merger presents a complex situation. While the merger aims for strategic expansion, the market's sharp reaction highlights the risks involved in acquiring a distressed asset. Only time will tell if this bold move will ultimately benefit CoreWeave or prove to be a costly mistake. Investors will be closely watching for further announcements and developments from the newly merged entity.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you should conduct thorough research before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on CoreWeave (CRWV) Tanks 23.8% After Core Scientific Merger Announcement. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Liv Golf Andalucia Team And Individual Champions Crowned

Jul 16, 2025

Liv Golf Andalucia Team And Individual Champions Crowned

Jul 16, 2025 -

2025 Mlb Draft Washington Nationals Take High School Ss Eli Willits

Jul 16, 2025

2025 Mlb Draft Washington Nationals Take High School Ss Eli Willits

Jul 16, 2025 -

Tracking The Chase Managers Poised To Join Terry Franconas 2 000 Win Legacy

Jul 16, 2025

Tracking The Chase Managers Poised To Join Terry Franconas 2 000 Win Legacy

Jul 16, 2025 -

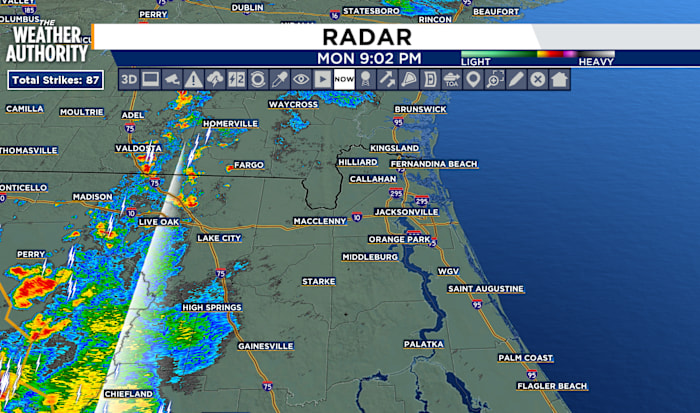

Tropical Disturbance Invest 93 L Forecasts And Preparedness Advice For Florida

Jul 16, 2025

Tropical Disturbance Invest 93 L Forecasts And Preparedness Advice For Florida

Jul 16, 2025 -

Wet Weather And Shifting Winds A Boost For Invest 93 Development

Jul 16, 2025

Wet Weather And Shifting Winds A Boost For Invest 93 Development

Jul 16, 2025

Wisconsin Tornado Watch Alerts Expire Friday Cleanup Begins

Wisconsin Tornado Watch Alerts Expire Friday Cleanup Begins

1 Million Deposit Investigating Dr Buckinghams B And B Activities

1 Million Deposit Investigating Dr Buckinghams B And B Activities