Investing In Robinhood Stock: Analyzing The Pros And Cons

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investing in Robinhood Stock: Weighing the Pros and Cons

The meteoric rise and subsequent fall of Robinhood Markets, Inc. (HOOD) has captivated investors. This commission-free trading platform, once a darling of Wall Street, now faces a more complex landscape. So, is investing in Robinhood stock a smart move? Let's delve into the pros and cons to help you make an informed decision.

The Allure of Robinhood: A Look at the Potential Upsides

Robinhood's initial success was built on its user-friendly interface and commission-free trading, attracting a wave of millennial and Gen Z investors. This massive user base presents a significant potential upside for long-term growth. Here are some key pros:

- Large and Growing User Base: Robinhood boasts millions of users, a key indicator of its potential for revenue generation through various financial products and services. This expansive reach offers significant scale advantages.

- Expansion into New Financial Products: Beyond stock trading, Robinhood is expanding into areas like crypto trading, options trading, and wealth management. Diversification into these lucrative markets can significantly boost revenue streams.

- Technological Innovation: Robinhood's technology is constantly evolving, aiming to enhance the user experience and attract new customers. Continuous innovation is crucial in the competitive fintech industry.

- Potential for Market Share Growth: While facing stiff competition from established players like Fidelity and Charles Schwab, Robinhood still has the potential to capture a larger share of the market, particularly among younger investors.

Navigating the Challenges: Understanding the Downsides

Despite its potential, investing in Robinhood stock involves significant risks. The company faces numerous challenges:

- Regulatory Scrutiny: Robinhood has faced intense regulatory scrutiny, including investigations and fines, impacting its reputation and financial stability. Future regulatory changes could pose further challenges.

- Increased Competition: The brokerage industry is highly competitive. Established players and new entrants constantly vie for market share, putting pressure on Robinhood's pricing and profitability.

- Volatile Stock Price: HOOD's stock price has been extremely volatile, reflecting the market's uncertainty about its long-term prospects. This volatility presents significant risk for investors.

- Dependence on Trading Volume: Robinhood's revenue is heavily reliant on trading volume. A decline in trading activity, potentially driven by market downturns or changes in investor behavior, could significantly impact its financial performance.

- Negative Public Perception: Following several controversies, including allegations of manipulative trading practices, Robinhood's public image has suffered, potentially impacting user acquisition and retention.

Should You Invest? A Cautious Approach

Investing in Robinhood stock requires careful consideration of both its potential and its inherent risks. While the company's massive user base and expansion into new financial products offer potential for growth, regulatory hurdles, intense competition, and stock price volatility present substantial challenges.

Before investing in HOOD, conduct thorough due diligence. Consider your risk tolerance, investment timeline, and diversification strategy. Consulting a financial advisor is highly recommended. Remember, past performance is not indicative of future results. Investing in the stock market always involves risk, and losses are possible.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investing In Robinhood Stock: Analyzing The Pros And Cons. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Patriots Address Stefon Diggs Video Player Remains On Roster

Jun 05, 2025

Patriots Address Stefon Diggs Video Player Remains On Roster

Jun 05, 2025 -

Max Homas Caddie Split Leads To Diy Bag Carrying At U S Open Qualifier

Jun 05, 2025

Max Homas Caddie Split Leads To Diy Bag Carrying At U S Open Qualifier

Jun 05, 2025 -

Tom Thibodeau Out Predicting The Next New York Knicks Head Coach

Jun 05, 2025

Tom Thibodeau Out Predicting The Next New York Knicks Head Coach

Jun 05, 2025 -

Wall Streets Focus Broadcoms 250 Target Ahead Of Earnings

Jun 05, 2025

Wall Streets Focus Broadcoms 250 Target Ahead Of Earnings

Jun 05, 2025 -

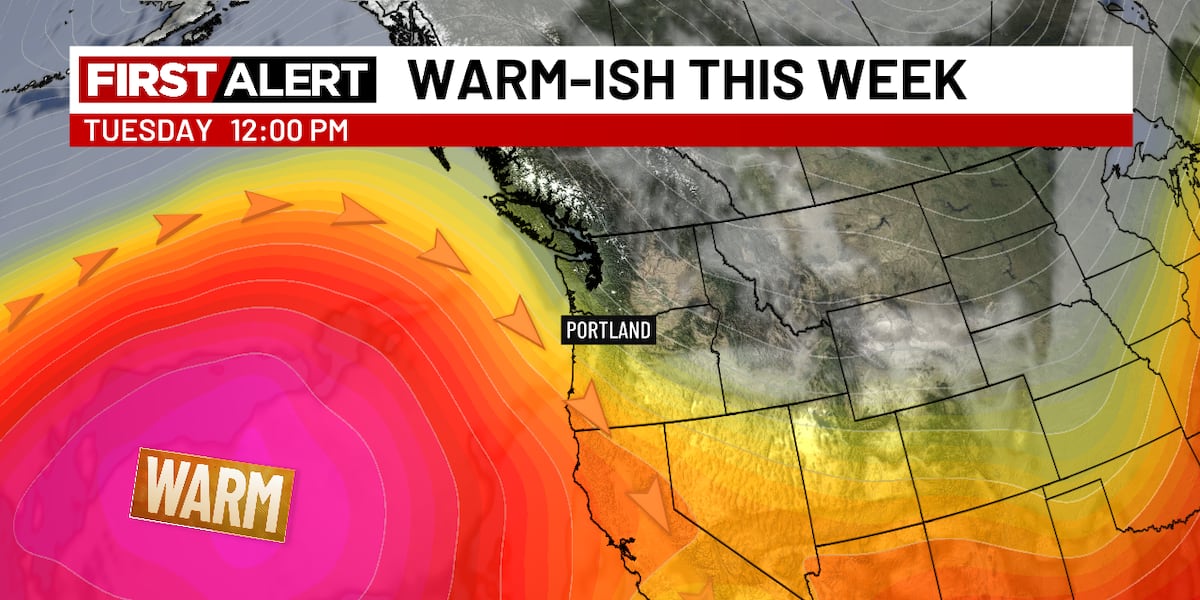

Early June Brings Warmth Sunshine And Dry Conditions

Jun 05, 2025

Early June Brings Warmth Sunshine And Dry Conditions

Jun 05, 2025