Wall Street's Focus: Broadcom's $250 Target Ahead Of Earnings

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wall Street Eyes $250: Broadcom's Earnings Set to Define Tech Sector Trajectory

Broadcom's upcoming earnings report is sending ripples through Wall Street, with analysts predicting a potential surge towards a $250 price target. The semiconductor giant is poised to release its financial results [insert date], and the market is holding its breath, anticipating figures that could significantly impact the broader tech sector's performance. This comes amidst a period of fluctuating market sentiment regarding the semiconductor industry and broader economic uncertainty.

The anticipation surrounding Broadcom (AVGO) is palpable. The company's diverse portfolio, spanning networking, infrastructure software, and wireless communication components, makes it a key barometer for the health of several crucial tech markets. A strong earnings report could signal robust demand and resilience within these sectors, potentially sparking a rally across the tech landscape. Conversely, a disappointing performance could trigger a sell-off, amplifying existing concerns about a potential slowdown.

<h3>Why the $250 Target?</h3>

Several factors contribute to the ambitious $250 price target floated by various Wall Street analysts. These include:

- Strong Demand for Semiconductors: Despite global economic headwinds, demand for semiconductors remains relatively strong, particularly in areas like data centers and 5G infrastructure. Broadcom's exposure to these growth markets positions it for continued success.

- Strategic Acquisitions: Broadcom's history of strategic acquisitions, including its recent purchase of VMware, significantly expands its market reach and potential revenue streams. The integration of these acquisitions and their contribution to future earnings will be closely scrutinized.

- Technological Leadership: Broadcom's reputation for technological innovation and its leadership in key semiconductor technologies provides a strong foundation for long-term growth. Their consistent investments in R&D are seen as a major positive.

- Positive Analyst Sentiment: Many analysts remain bullish on Broadcom's prospects, citing its strong fundamentals and positive growth trajectory. This widespread optimism is a significant factor driving the $250 target.

<h3>Potential Challenges and Risks</h3>

While the outlook is generally positive, certain risks could impact Broadcom's performance and potentially affect the achievement of the $250 target. These include:

- Global Economic Slowdown: The ongoing global economic uncertainty and potential recessionary pressures could dampen demand for semiconductors, impacting Broadcom's revenue and profitability.

- Supply Chain Disruptions: Lingering supply chain issues could continue to constrain Broadcom's production capacity and negatively affect its ability to meet market demand.

- Competition: Intense competition within the semiconductor industry could put pressure on pricing and margins.

<h3>What to Watch for in the Earnings Report</h3>

Investors will be keenly watching several key metrics in Broadcom's earnings report, including:

- Revenue Growth: The overall revenue growth rate will provide a clear indication of market demand for Broadcom's products.

- Profit Margins: Maintaining healthy profit margins amidst potential cost pressures will be crucial.

- Guidance: Broadcom's guidance for future quarters will be a key indicator of its confidence in its outlook.

- Impact of VMware Integration: The initial impact of the VMware acquisition on Broadcom's financial performance will be a key focus.

The upcoming Broadcom earnings report is a significant event for the tech sector. Reaching the $250 price target hinges on navigating the complex interplay of market forces, technological advancements, and global economic conditions. The coming days will offer a clearer picture of Broadcom's trajectory and the broader implications for the tech industry. Stay tuned for updates following the release of the earnings report. Learn more about semiconductor industry trends by visiting [link to reputable financial news source].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Wall Street's Focus: Broadcom's $250 Target Ahead Of Earnings. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Evaluating Backup Qbs Predicting A 2024 Nfl Playoff Contender From The Bench

Jun 05, 2025

Evaluating Backup Qbs Predicting A 2024 Nfl Playoff Contender From The Bench

Jun 05, 2025 -

Two Us Stocks Dumped By Warren Buffett A Detailed Analysis

Jun 05, 2025

Two Us Stocks Dumped By Warren Buffett A Detailed Analysis

Jun 05, 2025 -

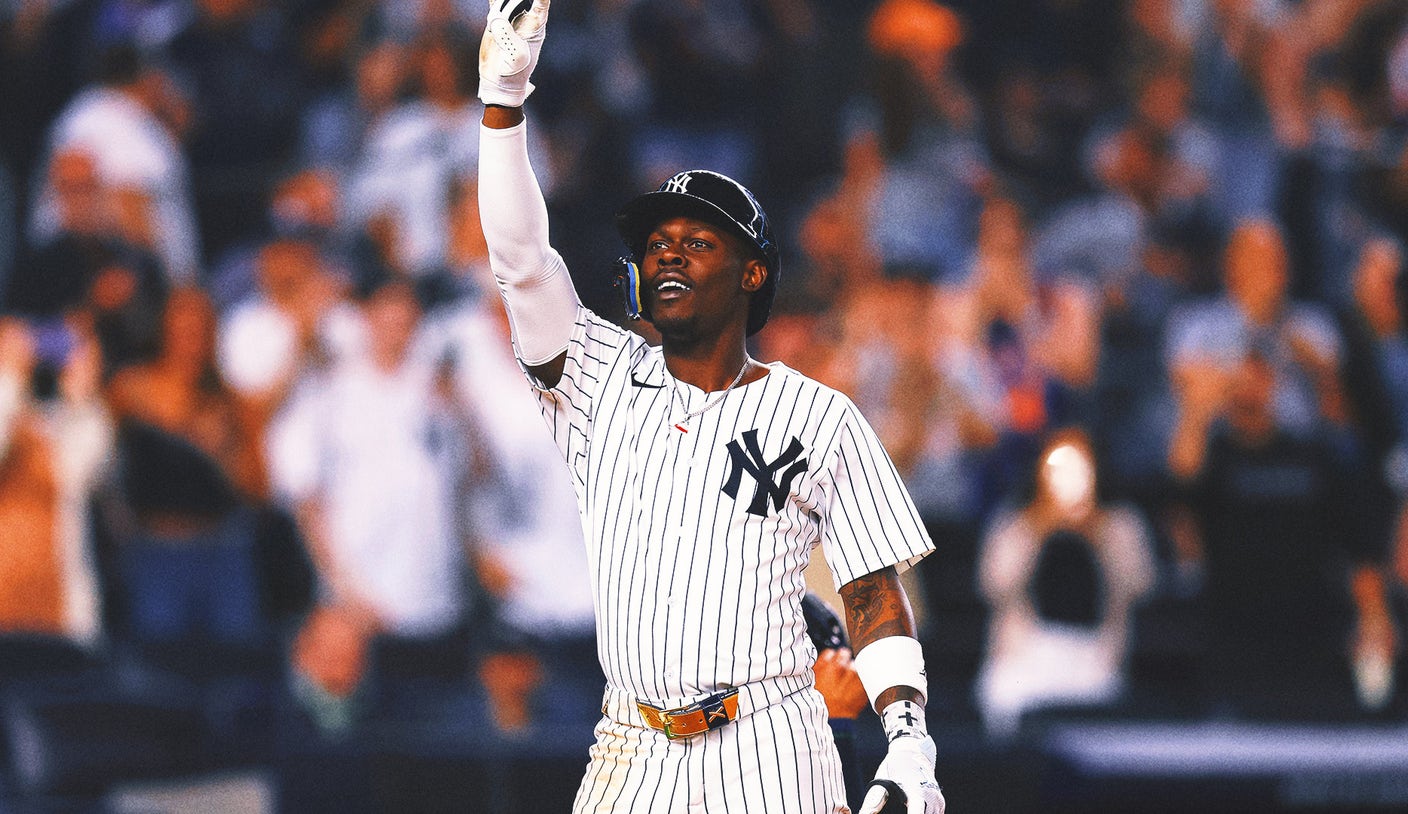

Yankees Win Chisholm Jr Returns With Game Changing Home Run

Jun 05, 2025

Yankees Win Chisholm Jr Returns With Game Changing Home Run

Jun 05, 2025 -

France Vs Spain Nations League Semifinal Live Stream Tv Channel And Match Time

Jun 05, 2025

France Vs Spain Nations League Semifinal Live Stream Tv Channel And Match Time

Jun 05, 2025 -

Grace Potter Opens The Vault Unveiling Lost Gems From Her Career

Jun 05, 2025

Grace Potter Opens The Vault Unveiling Lost Gems From Her Career

Jun 05, 2025