Impact Of Fed's Projected Single 2025 Rate Cut On U.S. Treasury Yields

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Fed's Projected Single 2025 Rate Cut: Ripple Effects on U.S. Treasury Yields

The Federal Reserve's recent projections hint at a single interest rate cut in 2025, a forecast that's already sending ripples through the financial markets and significantly impacting U.S. Treasury yields. This seemingly small adjustment in monetary policy holds considerable weight, influencing investor behavior and potentially shaping the economic landscape in the coming years. Understanding this impact is crucial for anyone invested in the U.S. Treasury market.

The Fed's Prediction and Market Reaction:

The Fed's "dot plot," a chart showing individual policymakers' interest rate projections, indicated a single rate cut in 2025. This projection, while seemingly mild, contrasts sharply with previous expectations of holding rates steady or even implementing further hikes. The market reacted swiftly, with Treasury yields immediately dropping. This reflects a shift in investor sentiment, anticipating a less aggressive monetary policy stance from the Fed. The implication is clear: investors believe a rate cut suggests a potential economic slowdown or even a recessionary environment.

Why is a Single Rate Cut Significant?

While seemingly minor, this single projected rate cut carries significant weight for several reasons:

- Signal of Economic Slowdown: The anticipation of a rate cut usually signals that the Fed anticipates slowing economic growth, potentially leading to lower inflation. This is because lower interest rates are a tool used to stimulate the economy.

- Impact on Inflation Expectations: A rate cut can influence inflation expectations. If the market believes the Fed is cutting rates because inflation is falling, this can contribute to a self-fulfilling prophecy, leading to further decreases in inflation. However, if inflation remains stubbornly high, the rate cut could be perceived as less effective, leading to market volatility.

- Attractiveness of Treasury Bonds: Lower interest rates generally make Treasury bonds less attractive compared to other investments offering higher yields. However, the safe-haven nature of Treasuries might still attract investors seeking stability in an uncertain economic climate.

Analyzing the Impact on Treasury Yields:

The projected rate cut has already influenced the yield curve, which illustrates the relationship between Treasury bond yields and their maturities. A flattening or even inversion of the yield curve (where shorter-term yields exceed longer-term yields) is often seen as a predictor of an economic recession. The impact on specific Treasury yields will depend on factors such as the timing and magnitude of the rate cut, as well as broader economic conditions.

Looking Ahead: Uncertainty and Volatility:

The future remains uncertain. The projected single rate cut is just one piece of the puzzle. Several external factors, including geopolitical instability and unexpected economic shocks, could significantly influence Treasury yields. Investors should carefully monitor economic indicators, Fed announcements, and global events to navigate this complex and potentially volatile market.

Key Takeaways:

- The Fed's projected single rate cut in 2025 signifies a shift in monetary policy expectations.

- This projection has already impacted U.S. Treasury yields, leading to a decrease.

- The impact on the yield curve and overall market stability remains to be seen, demanding close monitoring of economic indicators and global events.

Disclaimer: This article provides general information and analysis only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Impact Of Fed's Projected Single 2025 Rate Cut On U.S. Treasury Yields. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

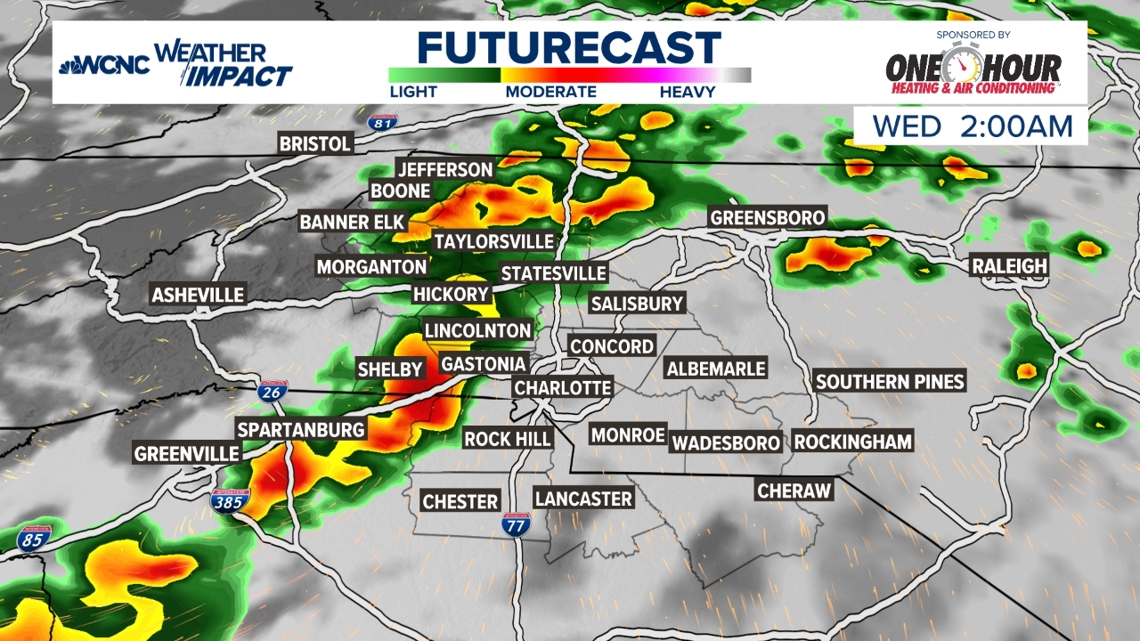

Isolated Strong Storms Possible Tuesday Night Weather Alert

May 21, 2025

Isolated Strong Storms Possible Tuesday Night Weather Alert

May 21, 2025 -

Controversy Erupts Players Comments On Angel Reese Spark Debate

May 21, 2025

Controversy Erupts Players Comments On Angel Reese Spark Debate

May 21, 2025 -

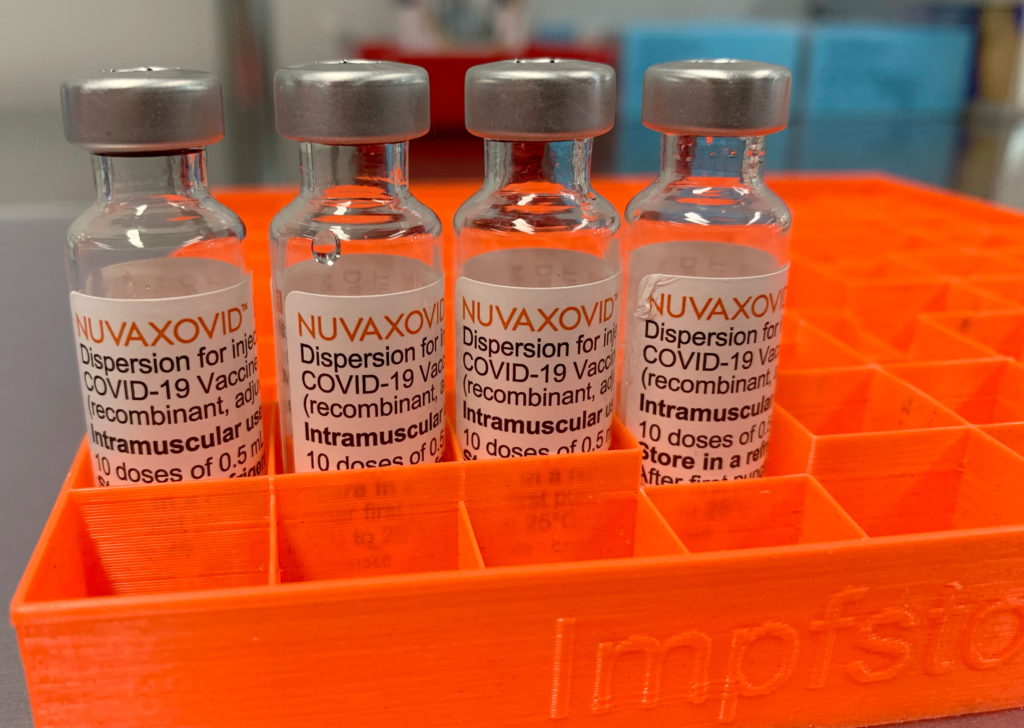

Conditional Approval Fda Authorizes Novavax Covid 19 Vaccine With Specific Guidelines

May 21, 2025

Conditional Approval Fda Authorizes Novavax Covid 19 Vaccine With Specific Guidelines

May 21, 2025 -

Ellen De Generes Back On Social Media Following Devastating Loss

May 21, 2025

Ellen De Generes Back On Social Media Following Devastating Loss

May 21, 2025 -

Nfl Owners Meeting Focus On Tush Push Ban Playoffs And Flag Football

May 21, 2025

Nfl Owners Meeting Focus On Tush Push Ban Playoffs And Flag Football

May 21, 2025