GameStop (GME) Stock Surge: Reasons Behind Today's Jump

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

GameStop (GME) Stock Surge: Reasons Behind Today's Jump

GameStop (GME) stock experienced a significant surge today, leaving investors and analysts scrambling to understand the reasons behind this unexpected jump. While pinpointing a single cause is difficult, several factors likely contributed to the increased trading activity and price elevation. This article delves into the potential catalysts driving the GME stock surge, examining both short-term market fluctuations and the ongoing saga surrounding the company's transformation.

Understanding the Recent Volatility:

GameStop's stock price has historically been known for its volatility, attracting significant attention from retail investors and experiencing wild swings. Today's surge is just the latest chapter in this ongoing narrative. Unlike previous surges primarily driven by social media-fueled frenzies, the current situation appears more nuanced.

Potential Factors Contributing to the Surge:

Several factors could be contributing to the current GME stock price increase:

-

Short Squeeze Potential: While not the primary driver this time, the lingering possibility of a short squeeze continues to loom over GME. A substantial portion of GameStop's shares remain shorted, meaning investors are betting against the company. If buying pressure increases significantly, short sellers might be forced to cover their positions, triggering a rapid price increase. However, the impact of this factor is likely less pronounced than in previous surges.

-

Positive Financial Results (or Expectations Thereof): Any positive news regarding GameStop's financial performance, including better-than-expected earnings reports or promising sales figures, could significantly boost investor confidence. Speculation regarding potential positive announcements could be fueling the current price action. Investors are keenly awaiting the company's next earnings report and any updates on its turnaround strategy.

-

NFT Marketplace Activity: GameStop's foray into the non-fungible token (NFT) marketplace remains a key area of focus for investors. Any significant developments or positive traction within this sector could contribute to increased investor enthusiasm. The success of their NFT marketplace is seen as vital to the company's long-term growth strategy. Increased trading volume or user adoption within the marketplace could be fueling the current stock price action.

-

Overall Market Sentiment: Broader market trends also play a role. A generally positive market sentiment, with other tech stocks performing well, can create a ripple effect, influencing investor decisions regarding even volatile stocks like GME.

-

Social Media Influence (though less pronounced this time): While not the dominant factor as in previous spikes, social media chatter and online forums continue to influence investor sentiment and trading activity surrounding GameStop. However, the impact appears less pronounced than in previous, more heavily social media-driven events.

Looking Ahead:

While today's jump in GME stock price is significant, investors should remain cautious. The long-term prospects of GameStop remain uncertain, and the stock's volatility continues to present considerable risk. Analyzing the company's fundamental performance and its ongoing strategic initiatives remains crucial for informed investment decisions. It's essential to conduct thorough research and consider your own risk tolerance before investing in any highly volatile stock.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investing in the stock market involves inherent risks, and you could lose money.

Keywords: GameStop, GME, stock surge, stock price, stock market, volatility, short squeeze, NFT, non-fungible token, earnings report, investor sentiment, market trends, retail investors, investment risk, financial news.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on GameStop (GME) Stock Surge: Reasons Behind Today's Jump. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

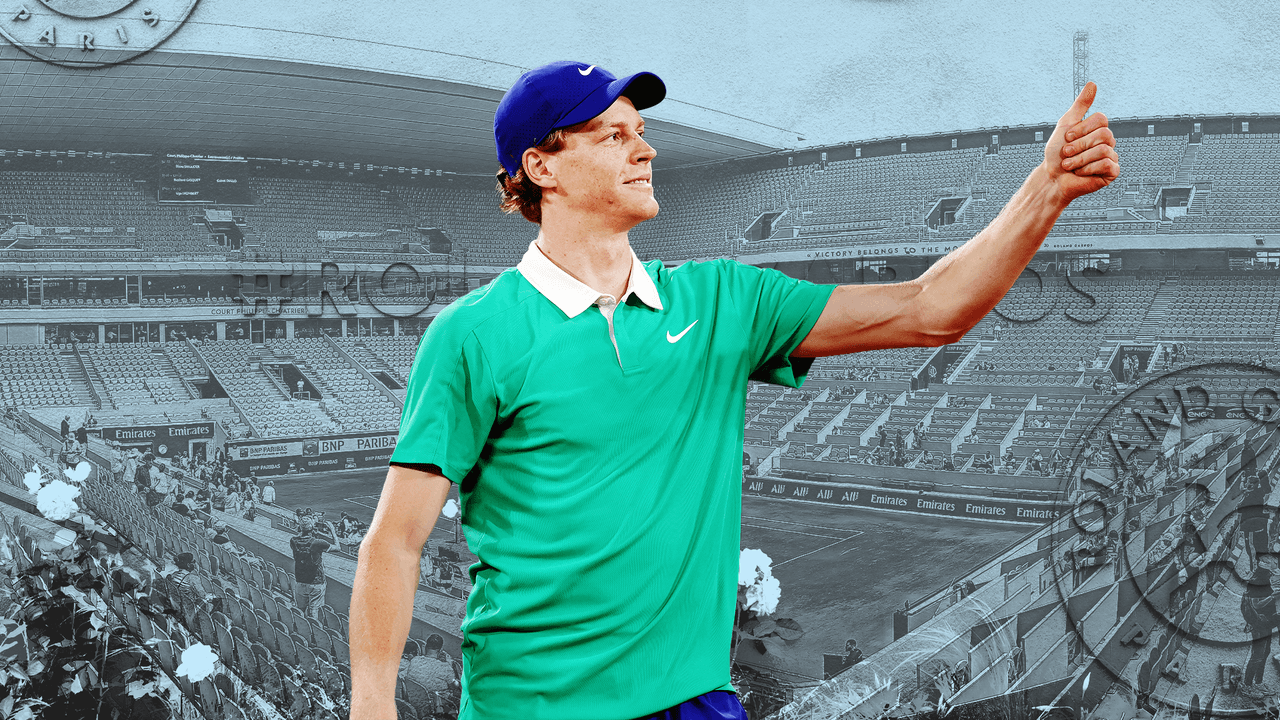

Streaming Roland Garros 2025 Segui Tutti I Match Di Sinner Inclusi Gli Incontri Contro Gasquet

May 28, 2025

Streaming Roland Garros 2025 Segui Tutti I Match Di Sinner Inclusi Gli Incontri Contro Gasquet

May 28, 2025 -

Fourth Consecutive Year Of Record Payouts At The Indianapolis 500

May 28, 2025

Fourth Consecutive Year Of Record Payouts At The Indianapolis 500

May 28, 2025 -

Thunder Secure 3 1 Lead Against Timberwolves Playoff Battle Heats Up

May 28, 2025

Thunder Secure 3 1 Lead Against Timberwolves Playoff Battle Heats Up

May 28, 2025 -

Game Stop Stock Update Key Announcement On June 9th

May 28, 2025

Game Stop Stock Update Key Announcement On June 9th

May 28, 2025 -

Should You Invest In Nio Stock Current Market Conditions Considered

May 28, 2025

Should You Invest In Nio Stock Current Market Conditions Considered

May 28, 2025