Should You Invest In Nio Stock? Current Market Conditions Considered

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should You Invest in Nio Stock? Navigating the Current Market Volatility

The electric vehicle (EV) market is a rollercoaster, and Nio, a prominent player in the Chinese EV sector, is no exception. Its stock price has experienced significant fluctuations, leaving investors wondering: is now the right time to buy Nio stock? This in-depth analysis examines Nio's current market position, considering recent performance and future prospects to help you make an informed investment decision.

Nio's Recent Performance: A Rollercoaster Ride

Nio's journey hasn't been smooth sailing. While the company boasts innovative technology and a growing range of attractive EVs, market factors like supply chain disruptions, intense competition, and broader economic concerns have impacted its stock price. Recent quarterly reports have shown a mixed bag, with periods of strong delivery growth followed by periods of slower sales. Understanding these fluctuations is crucial before considering any investment.

Key Factors Influencing Nio's Stock Price:

- Competition: The Chinese EV market is fiercely competitive, with established players like BYD and new entrants constantly vying for market share. Nio faces pressure to maintain its innovation edge and competitive pricing.

- Supply Chain: Global supply chain issues continue to affect the automotive industry, impacting production and delivery timelines for Nio. Addressing these challenges is vital for sustained growth.

- Economic Uncertainty: Global economic headwinds, including inflation and potential recessions, can significantly impact consumer spending on luxury goods like electric vehicles, influencing Nio's sales figures.

- Government Regulations: Changes in government policies and regulations regarding EVs in China and other key markets can affect Nio's operational landscape and profitability.

- Battery Technology & Innovation: Nio's battery swap technology is a key differentiator. Continued investment in this technology and further innovation will be critical for maintaining its competitive advantage.

Analyzing Nio's Long-Term Potential:

Despite the short-term volatility, Nio possesses several strengths that suggest long-term potential:

- Brand Recognition: Nio has cultivated a strong brand identity, particularly among younger, tech-savvy consumers.

- Technological Innovation: Its battery swap technology and commitment to advanced features place it at the forefront of EV innovation.

- Expanding Market Presence: Nio is actively expanding its presence in international markets, aiming to diversify its revenue streams and reduce reliance on the Chinese market alone.

- Government Support: The Chinese government continues to support the development of the domestic EV industry, providing a supportive regulatory environment for companies like Nio.

Should You Invest? A Cautious Approach:

The decision of whether or not to invest in Nio stock requires careful consideration. While the company possesses long-term potential, the current market volatility presents significant risk. Before investing, consider:

- Your Risk Tolerance: Investing in Nio stock involves a higher degree of risk compared to more established companies. Assess your comfort level with potential losses.

- Diversification: Diversifying your investment portfolio is crucial to mitigate risk. Don't put all your eggs in one basket.

- Long-Term Perspective: Investing in Nio is a long-term play. Short-term fluctuations should not deter you if your investment strategy aligns with the company's long-term potential.

- Thorough Research: Conduct thorough due diligence, researching financial reports, analyst predictions, and news articles to form your own informed opinion.

Conclusion:

Investing in Nio stock presents both opportunities and challenges. The company's innovative technology and expanding market presence are compelling, but the current market volatility demands a cautious and well-informed approach. Conduct your own research, consider your risk tolerance, and seek professional financial advice before making any investment decisions. The EV market is dynamic, and staying updated on industry trends is paramount for successful investing. Remember, this article is for informational purposes only and is not financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Invest In Nio Stock? Current Market Conditions Considered. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Survey Reveals Portugal As The Most Popular European Destination For American Expats

May 28, 2025

Survey Reveals Portugal As The Most Popular European Destination For American Expats

May 28, 2025 -

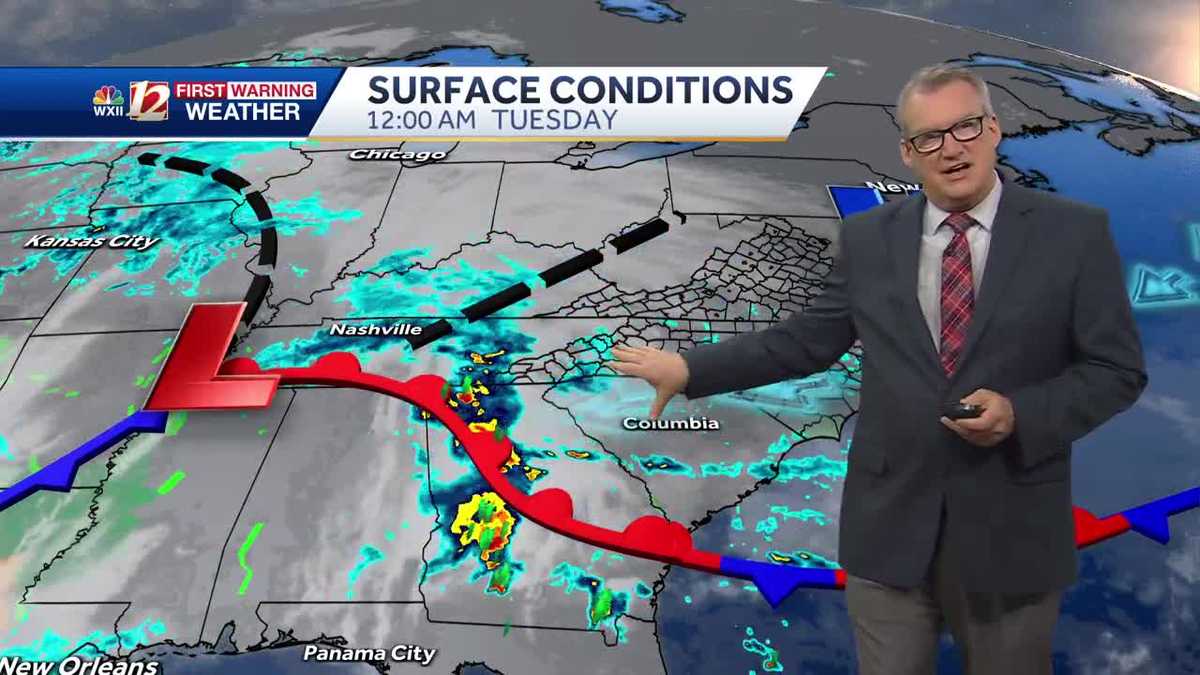

Cool Wet Tuesday Ahead Weather Alert Issued

May 28, 2025

Cool Wet Tuesday Ahead Weather Alert Issued

May 28, 2025 -

Expert Prediction Haddad Maia Vs Baptiste French Open 2025

May 28, 2025

Expert Prediction Haddad Maia Vs Baptiste French Open 2025

May 28, 2025 -

Understanding The Game Stop Gme Stock Price Increase A Deep Dive

May 28, 2025

Understanding The Game Stop Gme Stock Price Increase A Deep Dive

May 28, 2025 -

Spectators Viewership Impacts Roland Garros Night Match Schedule Official Confirms

May 28, 2025

Spectators Viewership Impacts Roland Garros Night Match Schedule Official Confirms

May 28, 2025