Ethereum Investment Surge: $200 Million Inflows After Pectra Upgrade

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Ethereum Investment Surge: $200 Million Inflows After Shanghai Upgrade

The Ethereum network has witnessed a significant influx of capital following the highly anticipated Shanghai upgrade, with over $200 million flowing into the market in just the first few days. This substantial investment surge signals a renewed confidence in the second-largest cryptocurrency and highlights the positive impact of the upgrade on investor sentiment. The upgrade, also known as the "Shanghai" hard fork, allowed for the withdrawal of staked ETH, a long-awaited feature that had previously locked up a substantial portion of the cryptocurrency's supply.

This unprecedented influx of capital signifies more than just a short-term market fluctuation; it reflects a growing belief in Ethereum's long-term potential. Analysts point to several factors contributing to this surge.

Unleashing Staked ETH: A Key Catalyst

The ability to withdraw staked ETH was the primary driver behind the investment surge. Before the Shanghai upgrade, millions of ETH were locked in staking contracts, limiting liquidity and impacting market dynamics. The unlocking of this significant amount of ETH has injected much-needed liquidity into the market, making it more attractive to both institutional and individual investors. This is a crucial step in Ethereum's evolution towards a more accessible and dynamic ecosystem. Furthermore, the successful execution of the upgrade itself, demonstrating the network's stability and resilience, played a crucial role in boosting investor confidence.

Increased Institutional Interest in Ethereum

The Shanghai upgrade has also piqued the interest of institutional investors, who have historically been hesitant to invest heavily in staked ETH due to liquidity concerns. The ability to now readily access their staked assets significantly reduces the risk associated with long-term staking, making Ethereum a more attractive investment option for large-scale institutional portfolios. This influx of institutional capital is likely to further stabilize the market and contribute to long-term price growth.

Beyond the Shanghai Upgrade: Future Developments

The positive impact of the Shanghai upgrade extends beyond the immediate investment surge. The successful implementation demonstrates Ethereum's ability to adapt and innovate, strengthening its position as a leading blockchain platform for decentralized applications (dApps) and smart contracts. Upcoming developments, such as the continued rollout of layer-2 scaling solutions and the exploration of new consensus mechanisms, are further expected to drive future growth and attract even more investment.

What This Means for Investors

While the $200 million inflow is undeniably positive news for Ethereum, investors should always proceed with caution. Cryptocurrency markets remain volatile, and external factors can significantly impact price movements. It's crucial to conduct thorough research and understand the risks involved before making any investment decisions. Remember to diversify your portfolio and only invest what you can afford to lose.

Learn More About the Ethereum Shanghai Upgrade:

For a deeper dive into the technical aspects of the Shanghai upgrade and its implications for the future of Ethereum, you can explore resources like the Ethereum Foundation website and reputable cryptocurrency news outlets. [Link to Ethereum Foundation website] [Link to a reputable cryptocurrency news source]

Conclusion:

The $200 million investment surge following the Shanghai upgrade is a significant milestone for Ethereum. It underscores the growing confidence in the network's long-term viability and its capacity to adapt to evolving market demands. While future price movements remain unpredictable, the positive impact of this upgrade is clear, setting the stage for further growth and innovation within the Ethereum ecosystem. Stay tuned for further updates as the Ethereum network continues to evolve.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Ethereum Investment Surge: $200 Million Inflows After Pectra Upgrade. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Brett Favres Complex Legacy A Conversation With The Director Of Fall Of Favre

May 20, 2025

Brett Favres Complex Legacy A Conversation With The Director Of Fall Of Favre

May 20, 2025 -

The Putin Trump Dynamic Shifts A Power Play Analysis

May 20, 2025

The Putin Trump Dynamic Shifts A Power Play Analysis

May 20, 2025 -

Nascar All Star Race 2024 Live Updates And Top Plays From North Wilkesboro

May 20, 2025

Nascar All Star Race 2024 Live Updates And Top Plays From North Wilkesboro

May 20, 2025 -

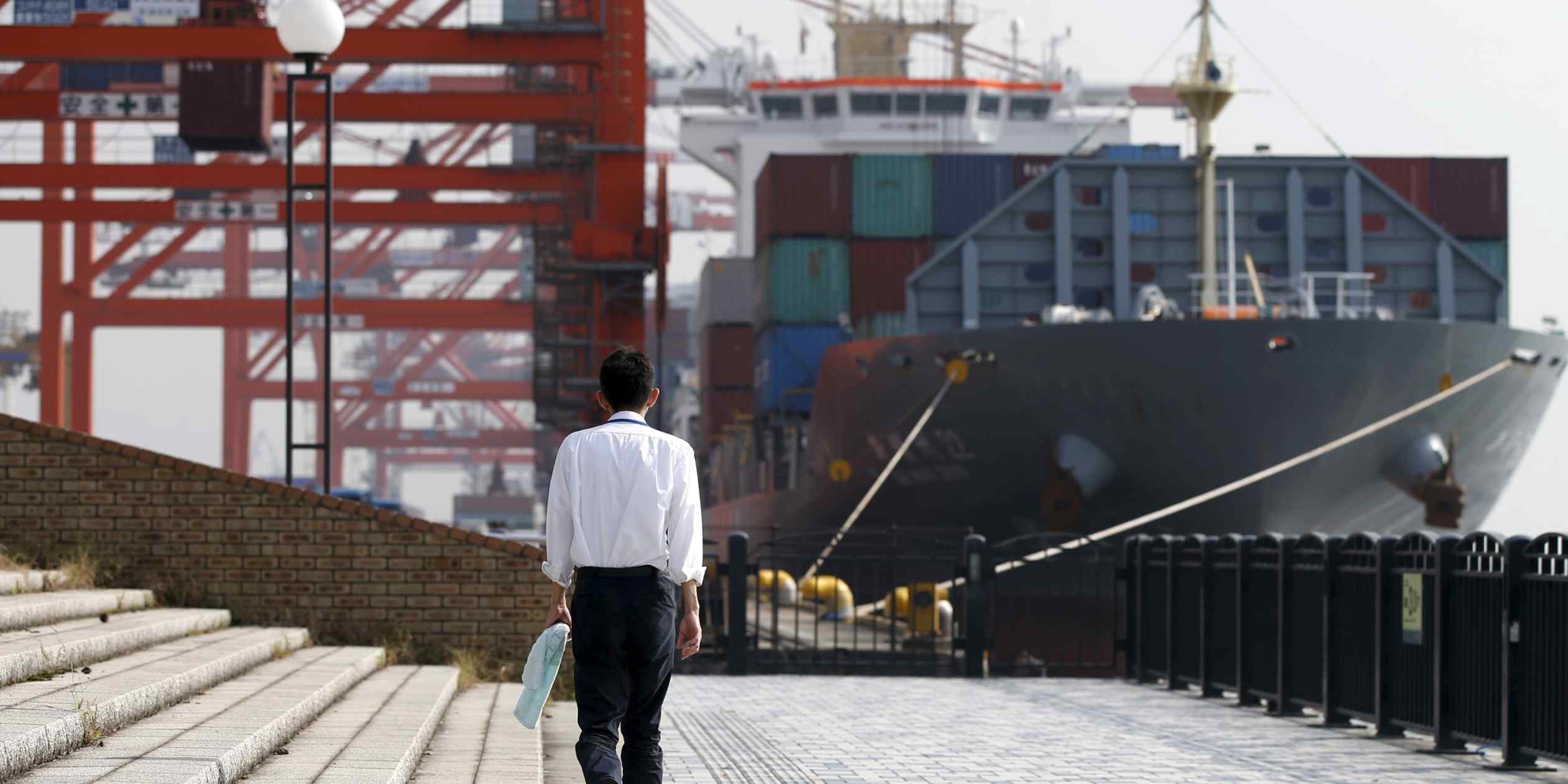

Shifting Sands Japans Revised Stance On Us Tariff Reductions

May 20, 2025

Shifting Sands Japans Revised Stance On Us Tariff Reductions

May 20, 2025 -

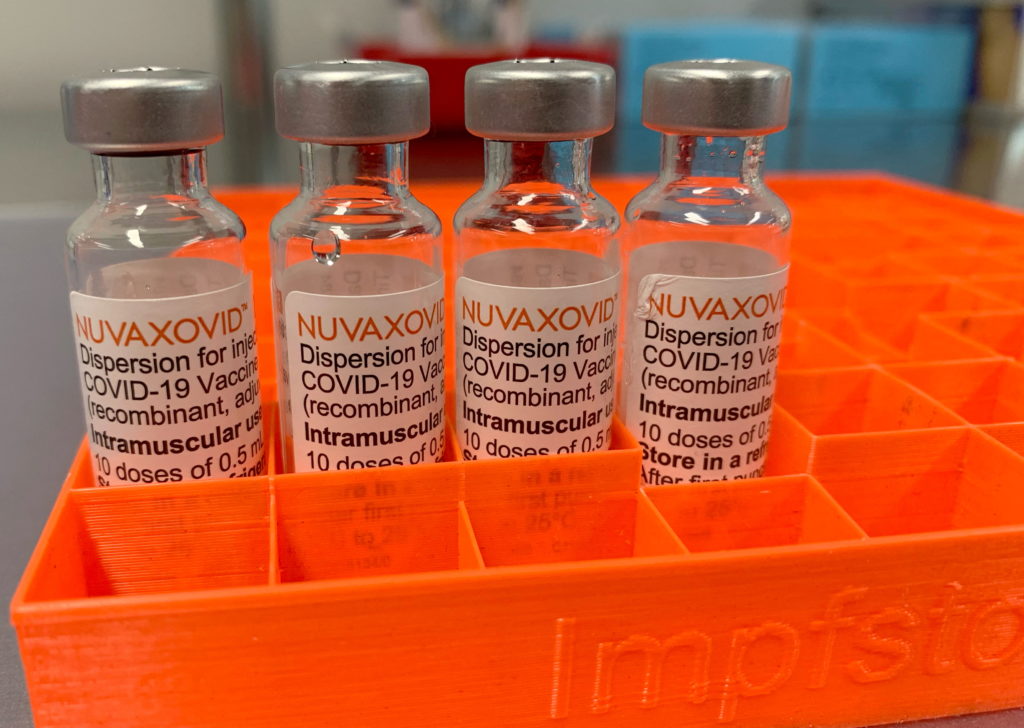

Fda Approval For Novavax Covid 19 Vaccine Understanding The Conditions

May 20, 2025

Fda Approval For Novavax Covid 19 Vaccine Understanding The Conditions

May 20, 2025