Deutsche Bank AG Increases AMC Entertainment Holdings (AMC) Stake

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Deutsche Bank Boosts AMC Entertainment Holdings Stake: A Bullish Sign for the Meme Stock?

Deutsche Bank AG's increased stake in AMC Entertainment Holdings (AMC) has sent ripples through the financial markets, sparking renewed interest in the volatile meme stock. The move, revealed in recent regulatory filings, signifies a surprising vote of confidence in a company that has been a focal point of intense retail investor activity and significant market volatility. This article delves into the implications of this significant investment and explores what it could mean for AMC's future.

The Details of the Investment:

While the exact size of the increase hasn't been publicly disclosed in granular detail, regulatory filings confirm Deutsche Bank's enhanced position in AMC. This strategic move by a major financial institution like Deutsche Bank is noteworthy, particularly given AMC's turbulent history and its association with the meme stock phenomenon. It suggests a potential shift in institutional perception of the company's long-term prospects.

Why is this significant?

The significance of Deutsche Bank's action lies in several key factors:

- Institutional Investor Confidence: The involvement of a major player like Deutsche Bank can signal a degree of legitimacy and stability to other institutional investors who may have previously been hesitant to invest in AMC due to its volatile nature and association with retail trading frenzies.

- Potential Catalyst for Price Movement: News of increased institutional investment often acts as a catalyst for price appreciation. While AMC's price is notoriously volatile, this news could attract more buyers, potentially driving the share price higher.

- Shifting Market Sentiment: The move might indicate a softening of negative sentiment surrounding AMC. Despite its challenges, the company has been working to improve its financial position, and this investment could be seen as a validation of those efforts.

AMC's Ongoing Challenges and Future Outlook:

It's crucial to acknowledge that AMC still faces significant challenges. The company's debt load remains substantial, and the movie theater industry continues to grapple with the long-term effects of streaming services. However, AMC's aggressive debt reduction strategies and its expansion into new revenue streams, such as its foray into the NFT market, represent attempts to navigate these challenges.

What does this mean for investors?

This development presents a complex scenario for investors. While the increased stake from Deutsche Bank could be interpreted as bullish, it's essential to remember that AMC remains a highly volatile stock. Investors should conduct thorough due diligence before making any investment decisions and consider their own risk tolerance.

Other Factors Influencing AMC's Stock Price:

Beyond Deutsche Bank's investment, several other factors influence AMC's stock price, including:

- Box office performance: Successful movie releases can significantly impact AMC's revenue and stock price.

- Competition from streaming services: The ongoing competition from streaming platforms remains a major challenge.

- Overall market conditions: Broader market trends and economic factors also play a role in AMC's stock performance.

Conclusion:

Deutsche Bank's increased stake in AMC Entertainment Holdings is a significant development that warrants attention. While it represents a potential vote of confidence in the company, investors should remain cautious due to the inherent volatility of the stock and the ongoing challenges faced by the movie theater industry. Further analysis and careful consideration of the various factors influencing AMC's performance are crucial before making any investment decisions. Stay tuned for further updates and analysis as the situation unfolds. Do your own research before investing. This article is for informational purposes only and not financial advice.

Keywords: AMC Entertainment Holdings, AMC stock, Deutsche Bank, meme stock, institutional investment, stock market, movie theater, volatility, investment analysis, financial news, market trends.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Deutsche Bank AG Increases AMC Entertainment Holdings (AMC) Stake. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Super Micro Computers Stock Price Assessing The Risk Of Correction

May 28, 2025

Super Micro Computers Stock Price Assessing The Risk Of Correction

May 28, 2025 -

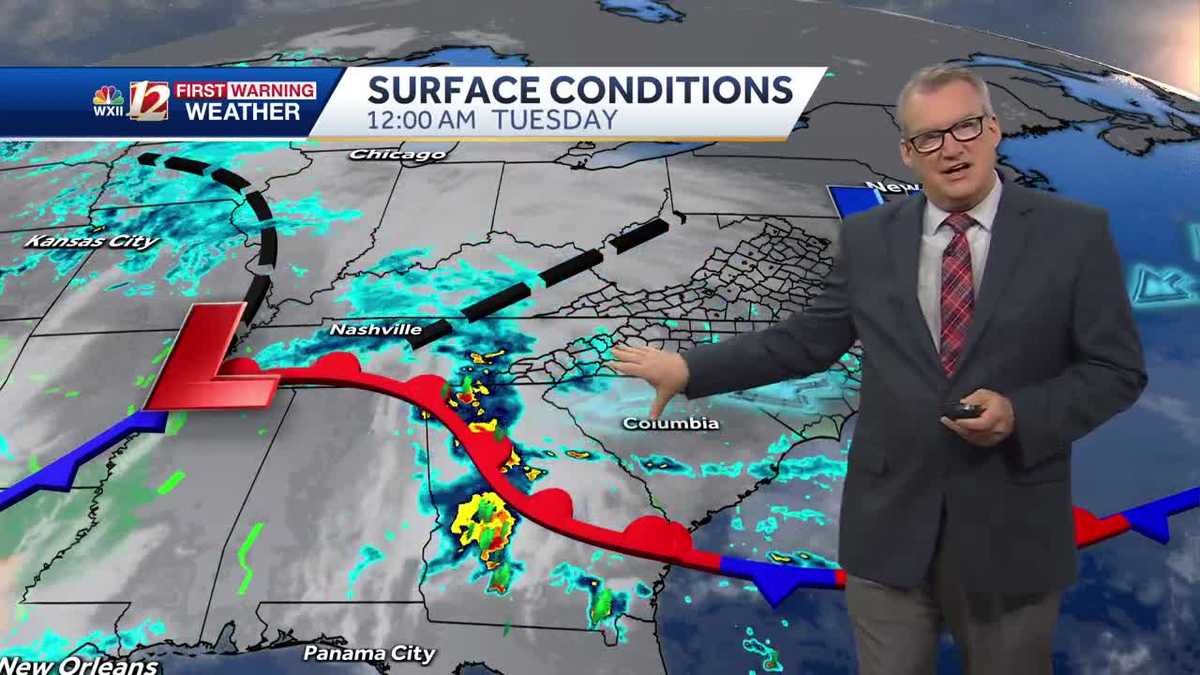

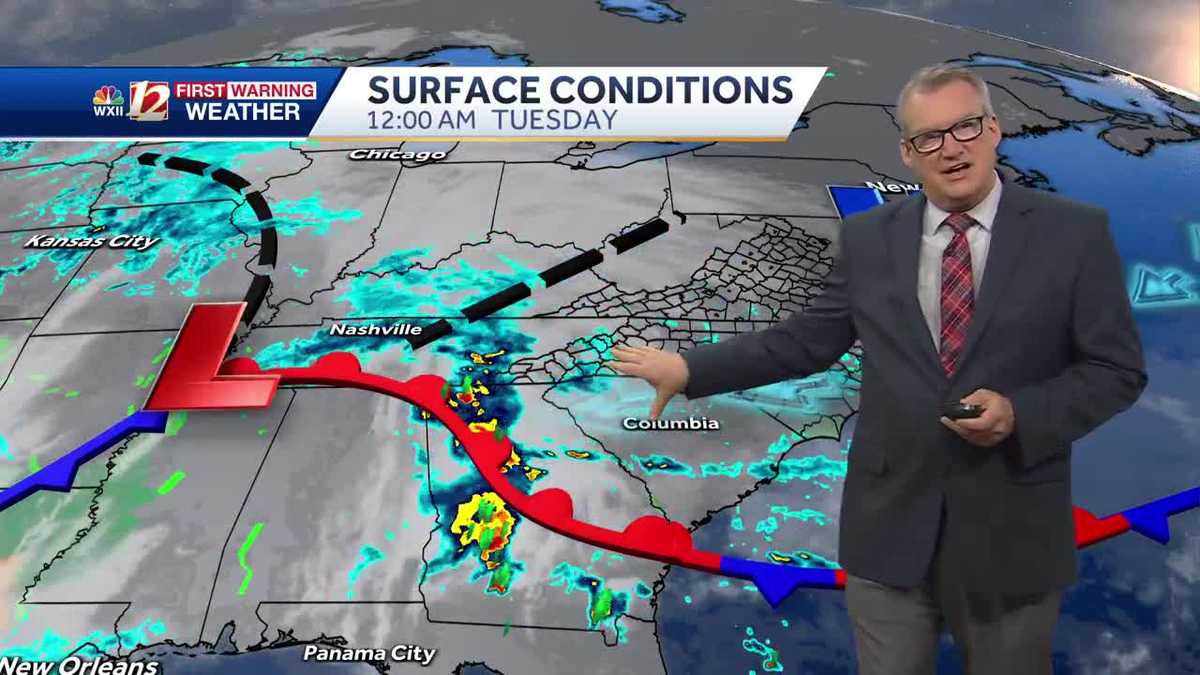

Prepare For A Cool And Wet Tuesday Weather Forecast

May 28, 2025

Prepare For A Cool And Wet Tuesday Weather Forecast

May 28, 2025 -

Pirates Oneil Cruz Sets New Standard 122 9 Mph Home Run In Statcast History

May 28, 2025

Pirates Oneil Cruz Sets New Standard 122 9 Mph Home Run In Statcast History

May 28, 2025 -

Cool And Wet Tuesday Expecting Heavy Rainfall

May 28, 2025

Cool And Wet Tuesday Expecting Heavy Rainfall

May 28, 2025 -

Hurricanes Game 4 Triumph Ending The Eastern Conference Finals Skid

May 28, 2025

Hurricanes Game 4 Triumph Ending The Eastern Conference Finals Skid

May 28, 2025