Super Micro Computer's Stock Price: Assessing The Risk Of Correction

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Super Micro Computer's Stock Price: Assessing the Risk of Correction

Super Micro Computer, Inc. (SMCI) has experienced a remarkable surge in its stock price recently, leaving many investors wondering: is a correction on the horizon? This article delves into the current market position of SMCI, examining the factors contributing to its growth and evaluating the potential risks of a price downturn. Understanding these dynamics is crucial for investors considering adding SMCI to their portfolios or managing existing holdings.

The Rise of Super Micro Computer:

Super Micro Computer's recent success is largely attributed to its strong position in the burgeoning data center and cloud computing markets. The company's focus on high-performance computing (HPC) solutions, particularly its advanced server technology and green computing initiatives, has resonated strongly with clients seeking efficient and scalable infrastructure. This increased demand, fueled by the global digital transformation, has driven significant revenue growth for SMCI. Furthermore, the company's robust supply chain management, a critical factor in the current global chip shortage, has provided a competitive edge.

Factors Contributing to Potential Correction:

While the outlook for Super Micro Computer appears positive, several factors could trigger a stock price correction:

-

Overvaluation: Rapid stock price increases often lead to overvaluation concerns. Investors should carefully analyze SMCI's price-to-earnings (P/E) ratio and other key valuation metrics to determine if the current price reflects its intrinsic value. A high P/E ratio, relative to its competitors and industry benchmarks, could signal a vulnerability to a correction.

-

Global Economic Uncertainty: Macroeconomic factors, such as inflation, interest rate hikes, and potential recessions, can significantly impact investor sentiment and market performance. These external pressures could negatively affect demand for data center infrastructure, impacting SMCI's growth trajectory.

-

Competition: The data center and cloud computing market is highly competitive. Established players and emerging startups constantly challenge SMCI's market share. Any significant loss of market share or technological disruption could put downward pressure on the stock price.

-

Supply Chain Disruptions: While SMCI has demonstrated resilience, persistent supply chain challenges could still hinder production and affect revenue forecasts. Any unexpected disruptions could negatively impact investor confidence.

Analyzing the Risk:

Assessing the risk of a correction requires a thorough analysis of SMCI's financial statements, competitive landscape, and macroeconomic conditions. Investors should consider:

-

Fundamental Analysis: A detailed examination of SMCI's financial health, including revenue growth, profitability, and debt levels, is critical. Understanding the company's long-term growth prospects is key to evaluating its intrinsic value.

-

Technical Analysis: Studying SMCI's chart patterns, trading volume, and other technical indicators can provide insights into potential price movements. Identifying support and resistance levels can help determine potential price targets in a correction scenario.

-

News and Sentiment Analysis: Staying updated on industry news, analyst ratings, and investor sentiment can help gauge market expectations for SMCI's future performance.

Conclusion:

Super Micro Computer's recent success is undeniable, but the possibility of a stock price correction remains a valid concern. Investors should adopt a cautious yet informed approach, conducting thorough due diligence before making investment decisions. Diversification within a broader portfolio is also recommended to mitigate risk. Remember to consult with a qualified financial advisor before making any investment decisions. Staying informed about market trends and conducting your own research are crucial for navigating the complexities of the stock market. While the future of SMCI is promising, understanding and managing potential risks is paramount for successful long-term investment.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Super Micro Computer's Stock Price: Assessing The Risk Of Correction. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

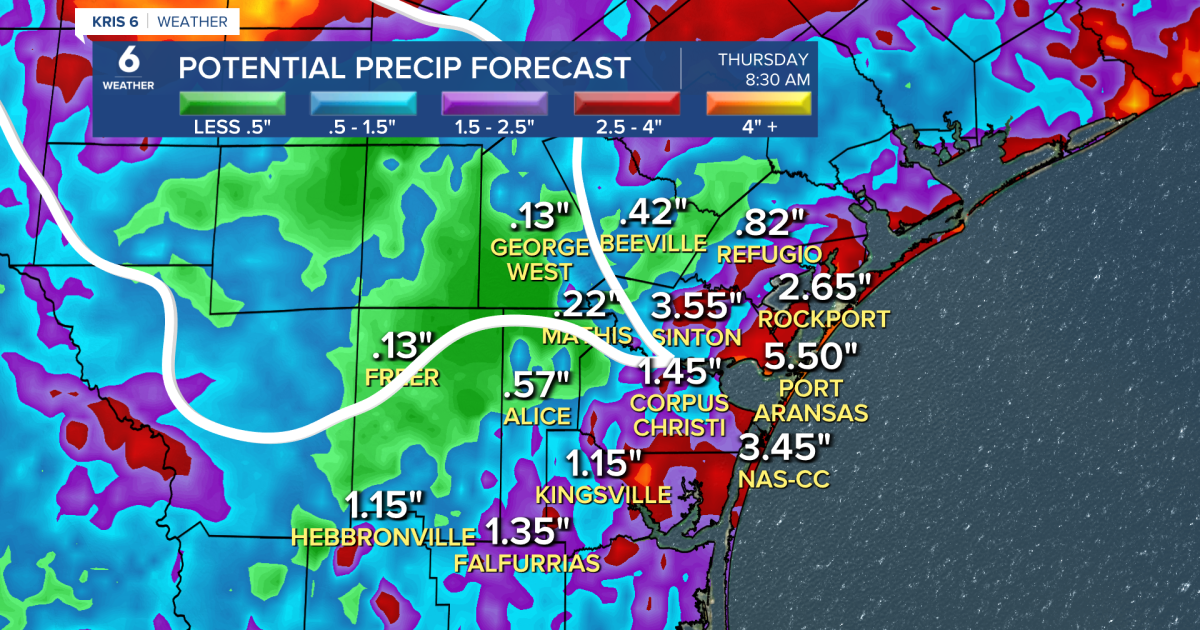

Expect Heavy Rainfall Multiple Weather Systems Fueled By Abundant Gulf Moisture

May 28, 2025

Expect Heavy Rainfall Multiple Weather Systems Fueled By Abundant Gulf Moisture

May 28, 2025 -

Indy 500 Penalty Three Drivers Moved To Back For Tech Violations

May 28, 2025

Indy 500 Penalty Three Drivers Moved To Back For Tech Violations

May 28, 2025 -

Record High Indianapolis 500 Winnings Continue Impressive Streak

May 28, 2025

Record High Indianapolis 500 Winnings Continue Impressive Streak

May 28, 2025 -

Espn Ranks All College Football Head Coaches By Their Playing Careers

May 28, 2025

Espn Ranks All College Football Head Coaches By Their Playing Careers

May 28, 2025 -

Amc Entertainment Stock Receives Boost Deutsche Banks Recent Acquisition

May 28, 2025

Amc Entertainment Stock Receives Boost Deutsche Banks Recent Acquisition

May 28, 2025