Crypto Price Forecast: Bitcoin, Ethereum, And Ripple Bear Market Targets

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Crypto Price Forecast: Bitcoin, Ethereum, and Ripple Bear Market Targets

The cryptocurrency market has entered a volatile period, with Bitcoin, Ethereum, and Ripple experiencing significant price drops. This bear market has left many investors wondering: where are the bottom prices for these major cryptocurrencies? While predicting the future of any market is inherently risky, analyzing current market trends, on-chain data, and historical patterns can offer potential insights into potential bear market targets for Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP).

Bitcoin (BTC): Navigating the Bear

Bitcoin, the original cryptocurrency, has seen its price fluctuate wildly in recent months. Many analysts are looking at key support levels to gauge potential bear market lows. Some technical analysts point to the $20,000-$25,000 range as a possible floor, citing historical price action and psychological support levels. However, unforeseen macroeconomic factors could push prices lower. Analyzing on-chain metrics, such as miner capitulation and accumulation trends, can offer additional insights into potential price bottoms. [Link to relevant on-chain analysis website]

- Key Factors to Watch: Macroeconomic conditions (inflation, interest rates), regulatory announcements, and Bitcoin mining difficulty adjustments.

- Potential Bear Market Target: $20,000 - $25,000 (with potential for further downside in extreme scenarios).

Ethereum (ETH): The Merge Aftermath and Beyond

The Ethereum Merge, a significant upgrade transitioning Ethereum from a proof-of-work to a proof-of-stake consensus mechanism, was initially expected to boost ETH’s price. However, the subsequent market downturn has dampened this optimism. Analysts are now examining potential support levels for ETH, with some suggesting a range between $1,000 and $1,500 as a possible bear market bottom. The development activity on the Ethereum network and the growth of the DeFi ecosystem remain important factors to consider. [Link to Ethereum development activity tracker]

- Key Factors to Watch: Development progress on Ethereum scaling solutions (like sharding), DeFi adoption, and overall market sentiment.

- Potential Bear Market Target: $1,000 - $1,500 (subject to broader market conditions).

Ripple (XRP): Legal Uncertainty and Price Action

Ripple Labs’ ongoing legal battle with the Securities and Exchange Commission (SEC) continues to cast a shadow over XRP's price. The uncertainty surrounding the outcome of this case significantly impacts investor confidence. While technical analysis suggests potential support levels, the legal developments will likely play a more significant role in determining XRP's price floor. Should a positive outcome materialize, a significant price rebound is possible. However, a negative ruling could further depress prices. [Link to reputable news source covering the Ripple lawsuit]

- Key Factors to Watch: The progress and outcome of the SEC lawsuit, overall regulatory clarity in the cryptocurrency space, and adoption by payment processors.

- Potential Bear Market Target: Difficult to pinpoint with certainty due to the legal uncertainty; potential support levels could be found in the $0.30 - $0.40 range, but this is highly speculative.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies carries significant risk, and you could lose all of your invested capital. Always conduct thorough research and consider your own risk tolerance before making any investment decisions.

Conclusion:

Predicting bear market targets is inherently speculative. While the above analysis suggests potential support levels for Bitcoin, Ethereum, and Ripple, the actual bottom could be higher or lower depending on a confluence of factors. Staying informed about market trends, regulatory changes, and technological developments is crucial for navigating the cryptocurrency market successfully. Remember to always diversify your portfolio and only invest what you can afford to lose.

Call to Action: Stay updated on the latest crypto news by subscribing to our newsletter [Link to Newsletter Signup].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Crypto Price Forecast: Bitcoin, Ethereum, And Ripple Bear Market Targets. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

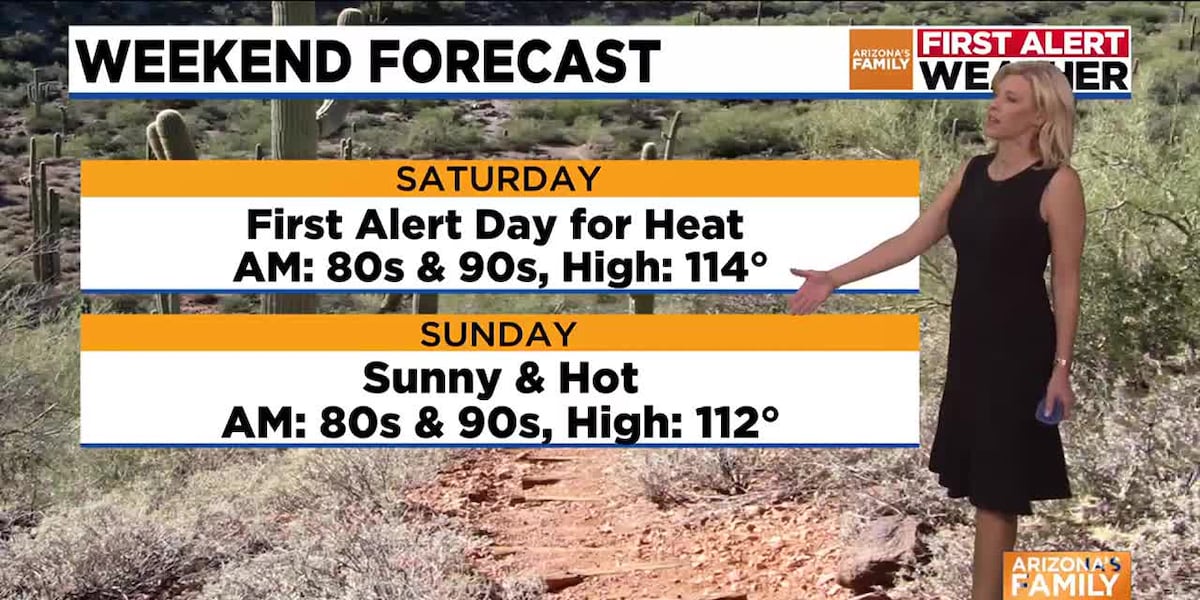

Arizona Heat Wave First Alert Weather Days Issued

Aug 01, 2025

Arizona Heat Wave First Alert Weather Days Issued

Aug 01, 2025 -

Hard Summer 2025 Complete Guide To Dates Tickets And Performances

Aug 01, 2025

Hard Summer 2025 Complete Guide To Dates Tickets And Performances

Aug 01, 2025 -

Indiana Fever Vs Dallas Wings Game Time Tv Channel And Caitlin Clarks Status

Aug 01, 2025

Indiana Fever Vs Dallas Wings Game Time Tv Channel And Caitlin Clarks Status

Aug 01, 2025 -

Is The Bitcoin Bull Run Over Analyst Warns Of Potential 50 Correction

Aug 01, 2025

Is The Bitcoin Bull Run Over Analyst Warns Of Potential 50 Correction

Aug 01, 2025 -

Leagues Cup 2023 A Streamlined Tournament Takes Center Stage

Aug 01, 2025

Leagues Cup 2023 A Streamlined Tournament Takes Center Stage

Aug 01, 2025

Latest Posts

-

Seattle Mariners Trade Deadline Acquisitions Assessing The Impact

Aug 02, 2025

Seattle Mariners Trade Deadline Acquisitions Assessing The Impact

Aug 02, 2025 -

Blades New Abilities Unveiled Comparisons To Vergils Powers

Aug 02, 2025

Blades New Abilities Unveiled Comparisons To Vergils Powers

Aug 02, 2025 -

Serious I 80 Accident Near Northgate Blvd Leaves Multiple Injured

Aug 02, 2025

Serious I 80 Accident Near Northgate Blvd Leaves Multiple Injured

Aug 02, 2025 -

Chinas Yu Zidi Secures Relay Bronze At World Swimming Championships

Aug 02, 2025

Chinas Yu Zidi Secures Relay Bronze At World Swimming Championships

Aug 02, 2025 -

Can The Yankees Keep Momentum After Volpes Impressive Game

Aug 02, 2025

Can The Yankees Keep Momentum After Volpes Impressive Game

Aug 02, 2025