Is The Bitcoin Bull Run Over? Analyst Warns Of Potential 50% Correction

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is the Bitcoin Bull Run Over? Analyst Warns of Potential 50% Correction

Bitcoin's price has experienced a rollercoaster ride in recent months, leaving investors wondering: is the bull run finally over? A prominent cryptocurrency analyst, [Analyst Name - replace with actual analyst's name and link to their reputable source, e.g., "Michael van de Poppe of Eight Global"], is raising concerns, predicting a potential 50% correction could be on the horizon. This warning comes amidst a period of market volatility and growing uncertainty surrounding the future of Bitcoin and the broader cryptocurrency market.

The recent price action has indeed been less than stellar for Bitcoin (BTC). After reaching an all-time high of [Insert recent ATH price and date], the price has consolidated, showing signs of a potential bear market. This has led many investors to question whether the current market conditions signal the end of the recent bull run.

Why the Pessimism? Factors Contributing to the Analyst's Prediction

Several factors are contributing to the analyst's bearish outlook. These include:

-

Macroeconomic Factors: Global inflation, rising interest rates, and geopolitical instability are all negatively impacting risk assets, including cryptocurrencies. The tightening monetary policy adopted by central banks worldwide is reducing the availability of cheap capital, historically a fuel for the crypto bull market.

-

Regulatory Uncertainty: Ongoing regulatory scrutiny of the cryptocurrency industry adds another layer of uncertainty. Changes in regulatory frameworks, particularly in major markets like the US, can significantly impact Bitcoin's price. Uncertainty breeds volatility, and this volatility can easily trigger a sharp correction.

-

Technical Analysis: The analyst, [Analyst Name], points to specific technical indicators on Bitcoin's price chart – such as [mention specific indicators like RSI, MACD, moving averages, etc. and briefly explain their significance] – as justification for their prediction. They suggest these indicators point towards a significant price drop being highly probable. (Link to the analyst's chart analysis, if available).

-

On-Chain Metrics: Beyond price charts, on-chain data, such as [mention specific on-chain metrics like the MVRV ratio, realized cap, etc., and briefly explain their implications], are also adding to the bearish sentiment. These metrics often provide insights into investor behavior and potential market reversals.

What Does a 50% Correction Mean for Bitcoin Investors?

A 50% correction would represent a substantial drop in Bitcoin's price. For long-term investors, this might be a buying opportunity, provided they have a robust risk management strategy in place. However, for those with less risk tolerance, it could signal a need for caution and potentially even partial divestment from their Bitcoin holdings.

Important Note: It's crucial to remember that market predictions are inherently uncertain. No one can definitively say whether a 50% correction will occur. This article presents the views of a specific analyst, and it's essential to conduct your own thorough research before making any investment decisions.

Navigating the Crypto Market Volatility

The cryptocurrency market is known for its volatility. To navigate this volatility effectively, consider the following:

- Diversification: Don't put all your eggs in one basket. Diversify your portfolio across different cryptocurrencies and asset classes.

- Risk Management: Only invest what you can afford to lose. Have a clear exit strategy and stick to it.

- Due Diligence: Thoroughly research any cryptocurrency before investing. Understand the underlying technology, the project's team, and the potential risks involved.

The cryptocurrency market remains a dynamic and evolving space. While this analyst's prediction of a potential 50% Bitcoin correction is a significant warning, investors should remain informed, adapt their strategies accordingly, and always prioritize responsible risk management. The future of Bitcoin, and the broader crypto market, remains to be seen. Stay tuned for further updates.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies involves significant risk, and you could lose all of your investment.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is The Bitcoin Bull Run Over? Analyst Warns Of Potential 50% Correction. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Btc Price Alert 116 750 Support Crucial Potential Drop To 107k 110k Fire Charts Analysis

Aug 01, 2025

Btc Price Alert 116 750 Support Crucial Potential Drop To 107k 110k Fire Charts Analysis

Aug 01, 2025 -

Report Stanford University Names John Donahoe New Athletic Director

Aug 01, 2025

Report Stanford University Names John Donahoe New Athletic Director

Aug 01, 2025 -

Steamy Amber Mark Scene In Countdown Counters Leaves Viewers On The Edge

Aug 01, 2025

Steamy Amber Mark Scene In Countdown Counters Leaves Viewers On The Edge

Aug 01, 2025 -

Gilbert Arenas Charged In Connection With Illegal Poker Games Espn Update

Aug 01, 2025

Gilbert Arenas Charged In Connection With Illegal Poker Games Espn Update

Aug 01, 2025 -

La Casa De Los Famosos Mexico 2025 30 De Julio Primeras Nominaciones De Aldo De Nigris

Aug 01, 2025

La Casa De Los Famosos Mexico 2025 30 De Julio Primeras Nominaciones De Aldo De Nigris

Aug 01, 2025

Latest Posts

-

Nc Motorcycle Crash Your Guide To Finding Effective Legal Representation

Aug 02, 2025

Nc Motorcycle Crash Your Guide To Finding Effective Legal Representation

Aug 02, 2025 -

Braves Reds Slugfest 16 Runs Explode In Record Setting 8th Inning

Aug 02, 2025

Braves Reds Slugfest 16 Runs Explode In Record Setting 8th Inning

Aug 02, 2025 -

Espns Top College Football Games Of 2025 A Schedule Superlative Preview

Aug 02, 2025

Espns Top College Football Games Of 2025 A Schedule Superlative Preview

Aug 02, 2025 -

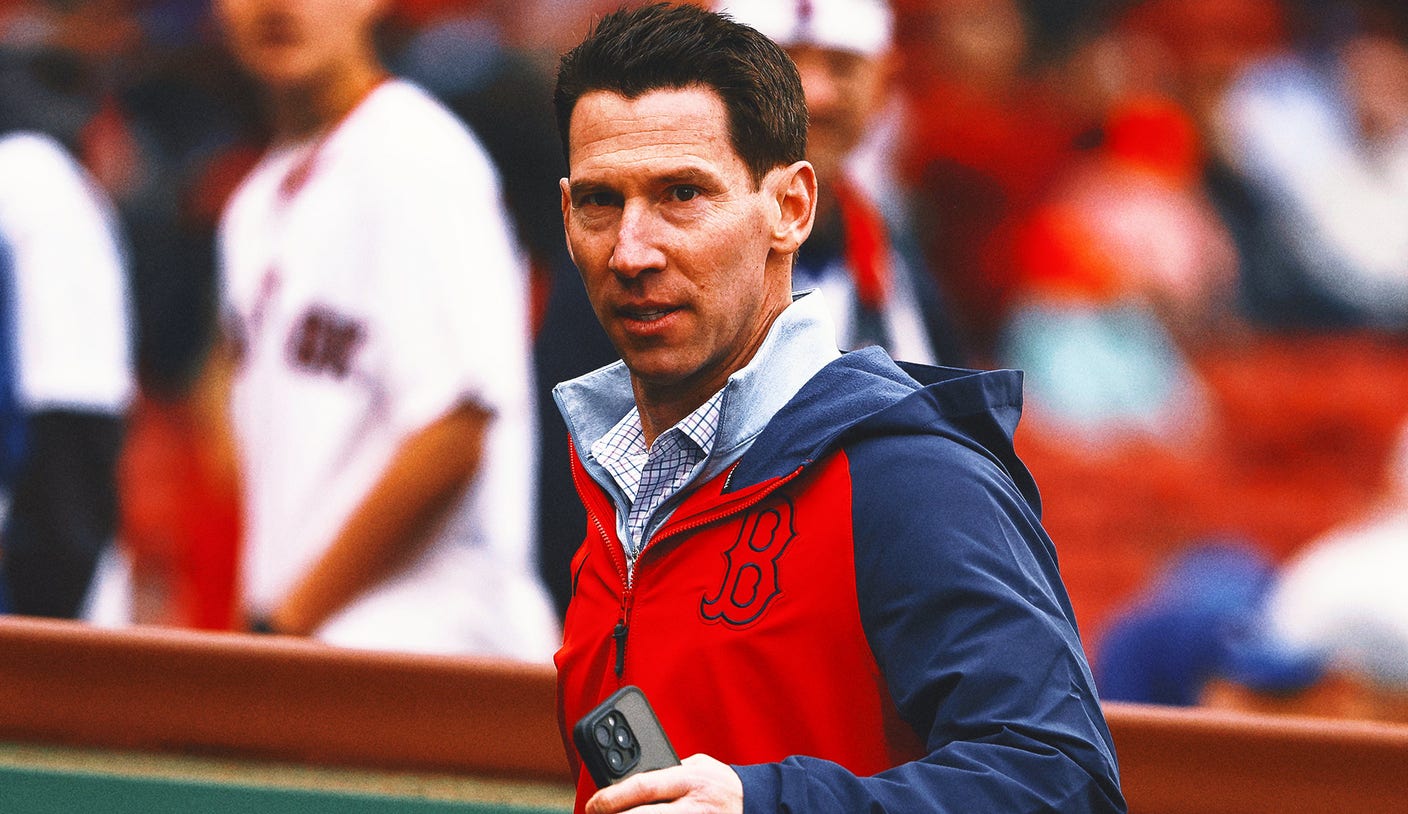

Red Sox Silent At Trade Deadline Explaining The Lack Of Deals

Aug 02, 2025

Red Sox Silent At Trade Deadline Explaining The Lack Of Deals

Aug 02, 2025 -

New York Yankees Vs Miami Marlins Fridays Lineup Revealed

Aug 02, 2025

New York Yankees Vs Miami Marlins Fridays Lineup Revealed

Aug 02, 2025