CRDO Vs. AVGO: Which Offers Superior Returns In The AI Chip Market?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

CRDO vs. CRUS: Which Offers Superior Returns in the AI Chip Market? (Corrected Title for Accuracy)

The artificial intelligence (AI) chip market is exploding, attracting significant investment and sparking intense competition. Two companies frequently mentioned in this burgeoning sector are CRUS (Cirrus Logic) and AVGO (Broadcom). But which offers superior returns for investors navigating this rapidly evolving landscape? This in-depth analysis compares CRUS and AVGO, examining their strengths, weaknesses, and potential for future growth in the AI chip market.

Understanding the AI Chip Market Landscape

Before diving into a CRUS vs. AVGO comparison, it's crucial to understand the context. The AI chip market is driven by the increasing demand for high-performance computing power needed to train and run sophisticated AI algorithms. This demand fuels the growth of specialized chips like GPUs (Graphics Processing Units), ASICs (Application-Specific Integrated Circuits), and FPGAs (Field-Programmable Gate Arrays). Both CRUS and AVGO play different, yet significant, roles within this ecosystem.

Cirrus Logic (CRUS): A Focus on Audio and Analog Chips

While not solely focused on AI chips, Cirrus Logic is a key player in the audio and analog semiconductor market. Their technology finds applications in various AI-powered devices, including smartphones, smart speakers, and augmented reality (AR) headsets. Their strong position in these markets provides indirect exposure to the AI boom.

- Strengths: Established market presence, strong relationships with major tech companies like Apple.

- Weaknesses: Less direct exposure to the core AI chip market compared to AVGO. Dependence on a few key customers.

- AI Relevance: Provides essential components for devices utilizing AI functionalities.

Broadcom (AVGO): A Diversified Giant with AI Ambitions

Broadcom is a much larger and more diversified company than CRUS, operating across various semiconductor segments. Their recent acquisitions and strategic investments demonstrate a significant push into the AI chip market, particularly with their high-speed networking and infrastructure solutions crucial for data centers powering AI applications.

- Strengths: Massive scale, strong financial position, diversified portfolio, direct involvement in AI infrastructure.

- Weaknesses: High valuation, potential for regulatory scrutiny due to its size and acquisitions.

- AI Relevance: Directly supplies crucial components for data centers and networking infrastructure supporting AI development and deployment.

CRUS vs. AVGO: A Comparative Analysis

| Feature | CRUS | AVGO |

|---|---|---|

| Market Cap | Smaller | Significantly Larger |

| Revenue | Lower | Much Higher |

| Direct AI Focus | Indirect, via components in AI devices | Direct, via infrastructure components |

| Risk Profile | Higher (dependence on key clients) | Lower (diversified portfolio) |

| Growth Potential | Moderate | High (driven by AI infrastructure growth) |

Which Offers Superior Returns?

Predicting superior returns is challenging, as both companies have different risk profiles and growth trajectories. AVGO's larger scale, diversified portfolio, and direct involvement in the core AI infrastructure suggest potentially higher long-term growth, particularly as the AI market continues its exponential expansion. However, this comes with a higher valuation and potential regulatory risks.

CRUS, while offering less direct exposure to AI, presents a lower-risk investment with potentially solid returns driven by its strong position in the audio and analog chip market. Its growth is intertwined with the overall growth of AI-powered consumer electronics.

Conclusion:

The choice between CRUS and AVGO depends on individual risk tolerance and investment goals. For investors seeking potentially higher long-term growth in the AI infrastructure sector, AVGO might be a more attractive option. However, investors seeking a lower-risk investment with a less volatile profile might prefer CRUS. Thorough due diligence and consideration of individual investment strategies are crucial before making any investment decisions. Remember to consult with a financial advisor before investing in any stock.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on CRDO Vs. AVGO: Which Offers Superior Returns In The AI Chip Market?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Contenders Or Pretenders Evaluating Backup Qbs For A 2024 Nfl Playoff Bid

May 27, 2025

Contenders Or Pretenders Evaluating Backup Qbs For A 2024 Nfl Playoff Bid

May 27, 2025 -

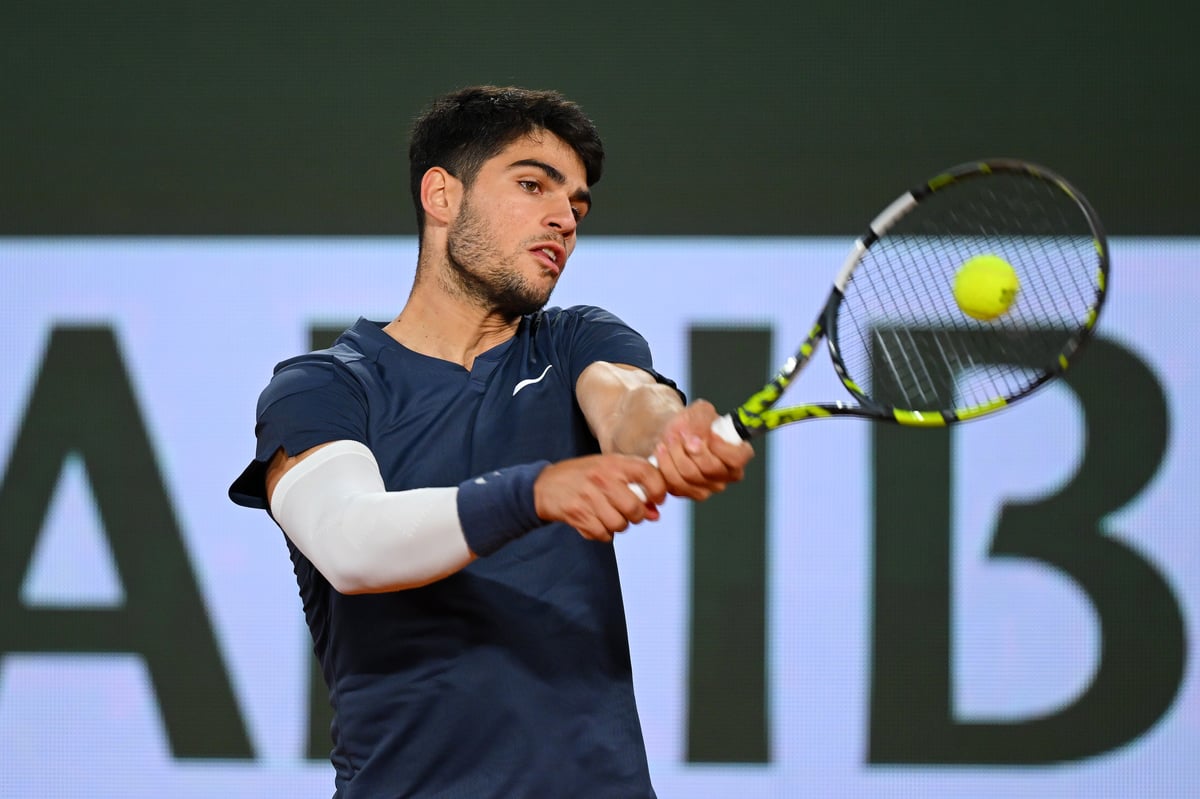

Two Former Cavaliers Headline Roland Garros 2024 Entry List

May 27, 2025

Two Former Cavaliers Headline Roland Garros 2024 Entry List

May 27, 2025 -

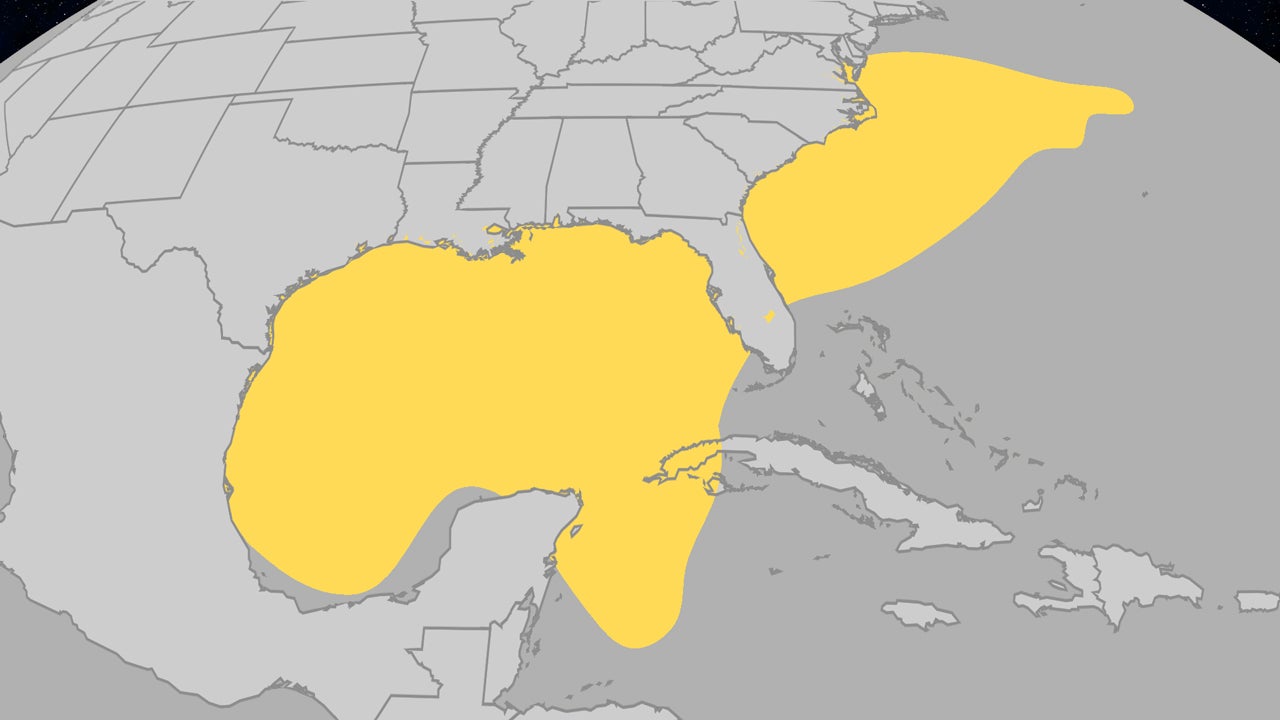

Atlantic Hurricane Season Outlook June Storm Trends And Predictions

May 27, 2025

Atlantic Hurricane Season Outlook June Storm Trends And Predictions

May 27, 2025 -

Best Ways To Watch Roland Garros 2025 In The Uk Live Stream And Tv

May 27, 2025

Best Ways To Watch Roland Garros 2025 In The Uk Live Stream And Tv

May 27, 2025 -

Down 20 Knicks Rally To Stun Pacers In Thrilling Game 3

May 27, 2025

Down 20 Knicks Rally To Stun Pacers In Thrilling Game 3

May 27, 2025