Bitcoin ETF Investments Exceed $5 Billion: Analyzing The Bold Strategies

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin ETF Investments Exceed $5 Billion: Analyzing the Bold Strategies Fueling Market Growth

The cryptocurrency market is buzzing with excitement as Bitcoin exchange-traded fund (ETF) investments recently surpassed the monumental $5 billion mark. This surge signifies a significant shift in investor sentiment and highlights the growing acceptance of Bitcoin as a mainstream asset class. But what bold strategies are driving this unprecedented influx of capital? Let's delve into the key factors fueling this remarkable growth and analyze the implications for the future of Bitcoin and the broader financial landscape.

The Rise of Bitcoin ETFs: A Game Changer for Institutional Investors

The approval of the first Bitcoin futures ETF in the US marked a pivotal moment. This paved the way for increased institutional investment, previously hesitant due to regulatory uncertainty and the perceived volatility of the cryptocurrency market. The availability of regulated, easily accessible investment vehicles like ETFs has dramatically lowered the barrier to entry for large financial institutions, pension funds, and hedge funds. This accessibility is a key driver behind the $5 billion milestone.

Strategies Driving Investment Growth:

Several key strategies are contributing to the remarkable growth in Bitcoin ETF investments:

-

Diversification: Many investors view Bitcoin as a hedge against inflation and a potential diversifier within their existing portfolios. The relatively low correlation between Bitcoin and traditional asset classes makes it an attractive option for reducing overall portfolio risk.

-

Institutional Adoption: As mentioned, the approval of Bitcoin ETFs has significantly boosted institutional confidence. Large investors now have a more regulated and transparent way to gain exposure to Bitcoin, leading to substantial capital inflows.

-

Regulatory Clarity (to a degree): While regulatory clarity remains a work in progress globally, the approval of Bitcoin futures ETFs in the US represents a significant step forward. This increased regulatory certainty encourages further investment. However, the regulatory landscape continues to evolve, and investors should remain aware of potential future changes. [Link to relevant regulatory news source]

-

Long-Term Growth Potential: Many investors believe Bitcoin holds significant long-term growth potential. Its limited supply, increasing adoption as a payment method, and growing acceptance as a store of value are key factors driving this belief.

Challenges and Risks:

Despite the remarkable growth, several challenges and risks remain:

-

Volatility: Bitcoin remains a volatile asset, subject to significant price swings. Investors should be prepared for potential losses.

-

Regulatory Uncertainty: While progress has been made, regulatory uncertainty persists in many jurisdictions. Changes in regulations could significantly impact the price of Bitcoin and the performance of Bitcoin ETFs.

-

Security Concerns: The security of cryptocurrency exchanges and wallets remains a concern. Investors should choose reputable platforms and employ robust security measures.

The Future of Bitcoin ETF Investments:

The $5 billion milestone is a significant achievement, but it's likely just the beginning. As regulatory clarity improves and institutional adoption continues, we can expect further growth in Bitcoin ETF investments. The ongoing development of spot Bitcoin ETFs, which track the actual price of Bitcoin rather than futures contracts, could further accelerate this trend. However, investors should approach Bitcoin investments with caution, understanding the inherent risks involved.

Call to Action: Stay informed about the evolving regulatory landscape and market trends to make informed investment decisions. Consider consulting with a qualified financial advisor before investing in Bitcoin or any other cryptocurrency.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin ETF Investments Exceed $5 Billion: Analyzing The Bold Strategies. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Game 7 Clincher Panthers Sweep Aside Maple Leafs

May 20, 2025

Game 7 Clincher Panthers Sweep Aside Maple Leafs

May 20, 2025 -

Lost For 21 Days California Womans Account Of Mountain Rescue

May 20, 2025

Lost For 21 Days California Womans Account Of Mountain Rescue

May 20, 2025 -

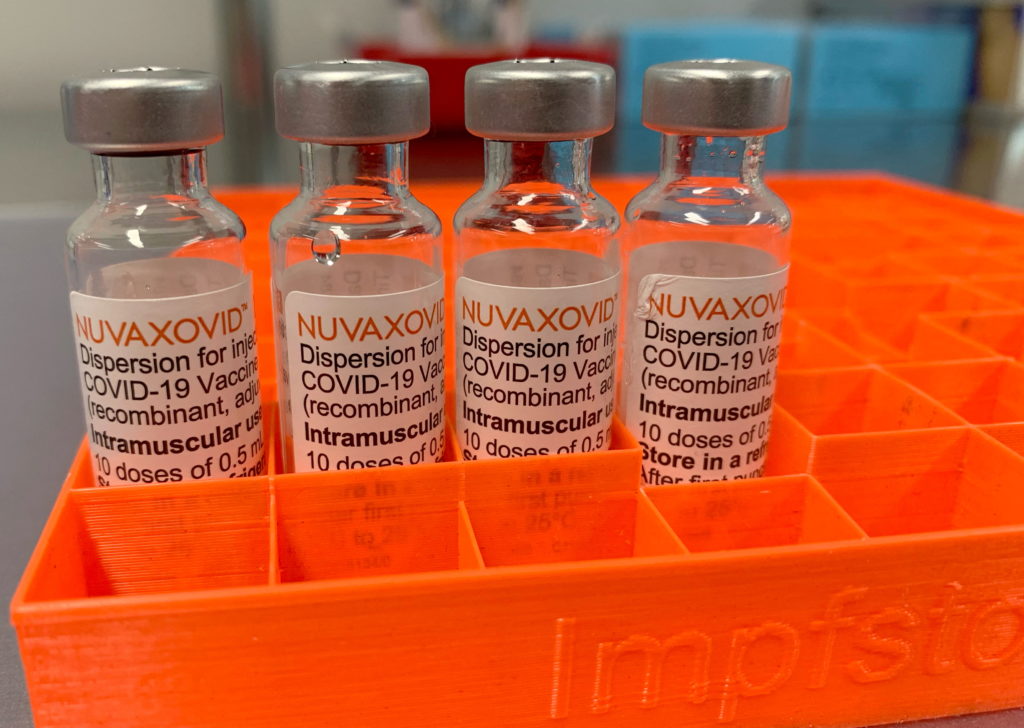

Fda Approval For Novavax Covid 19 Vaccine Comes With Unusual Restrictions

May 20, 2025

Fda Approval For Novavax Covid 19 Vaccine Comes With Unusual Restrictions

May 20, 2025 -

Jon Jones And Tom Aspinall The Strip The Duck Controversy Explained

May 20, 2025

Jon Jones And Tom Aspinall The Strip The Duck Controversy Explained

May 20, 2025 -

Lower Us Tariffs A Compromise Reached In Japan Us Trade Negotiations

May 20, 2025

Lower Us Tariffs A Compromise Reached In Japan Us Trade Negotiations

May 20, 2025