Billionaire Buffett's Investment Shift: From Banking To A 7,700% Growth Story

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Billionaire Buffett's Investment Shift: From Banking to a 7,700% Growth Story

Warren Buffett's legendary investment prowess is once again making headlines. While the Oracle of Omaha is famously associated with his long-term bets on established banking giants, a recent revelation highlights a remarkable shift in his investment strategy, yielding an astounding 7,700% return. This isn't just another successful investment; it’s a masterclass in identifying disruptive potential and capitalizing on long-term growth.

From Traditional Finance to Tech Triumph:

Buffett's Berkshire Hathaway portfolio, traditionally heavily weighted in financial institutions like Bank of America and American Express, has seen a significant diversification in recent years. This strategic move reflects a growing interest in technology and the immense potential of innovative companies. While details remain scarce about the specific timing of the investment, the sheer magnitude of the return points to an exceptionally astute decision. The 7,700% growth surpasses even Buffett's most celebrated investments, sparking intense curiosity within the financial world.

Identifying the Winning Formula:

While the specific company benefiting from Buffett's investment remains undisclosed (likely due to ongoing market sensitivity), several analysts speculate that it might be a firm operating within the rapidly expanding technology sector. Buffett's focus has increasingly shifted towards companies showcasing strong fundamentals, consistent revenue growth, and a durable competitive advantage. This approach underscores his preference for long-term value creation over short-term market fluctuations. The staggering 7,700% return highlights the immense power of this strategy when applied to a disruptive technology sector.

Lessons from the Master Investor:

Buffett's latest success offers invaluable lessons for both seasoned investors and newcomers. These include:

- Adaptability: The shift from traditional banking to technology demonstrates the importance of adapting to evolving market dynamics. Holding onto outdated investment strategies can hinder long-term success.

- Long-Term Vision: Buffett's investment philosophy emphasizes patience and a long-term perspective. The 7,700% return underscores the rewards of holding onto successful investments for extended periods.

- Due Diligence: Meticulous research and a deep understanding of a company's fundamentals remain crucial elements of Buffett's success.

- Identifying Disruptive Potential: The extraordinary returns achieved likely stem from identifying a company poised for significant growth within a high-growth sector.

The Future of Buffett's Investments:

This unexpected surge in returns raises questions about the future direction of Buffett's investment strategy. Will we see more significant allocations to the technology sector? Or will this remain a strategic, albeit highly successful, outlier in his portfolio? Only time will tell. However, one thing remains certain: Warren Buffett's ability to identify and capitalize on market opportunities continues to inspire and challenge even the most seasoned investors.

Conclusion:

Warren Buffett's recent investment triumph serves as a powerful reminder of the potential for exceptional returns in the ever-evolving world of finance. His ability to adapt, remain patient, and identify disruptive potential underscores the importance of a well-defined investment strategy and continuous learning. This 7,700% growth story will undoubtedly be analyzed and debated for years to come, providing valuable insights for investors of all levels. Are you ready to learn from the master and refine your own investment strategy? [Link to relevant resource, e.g., investment education platform].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Billionaire Buffett's Investment Shift: From Banking To A 7,700% Growth Story. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Latest Wnba Power Rankings Who Challenges The Lynx And Liberty

Jun 05, 2025

Latest Wnba Power Rankings Who Challenges The Lynx And Liberty

Jun 05, 2025 -

Top 10 Sports Storylines That Defined May 2024

Jun 05, 2025

Top 10 Sports Storylines That Defined May 2024

Jun 05, 2025 -

Pre Earnings Buzz Broadcoms Stock And The Potential 250 Price Point

Jun 05, 2025

Pre Earnings Buzz Broadcoms Stock And The Potential 250 Price Point

Jun 05, 2025 -

Amanda Seyfrieds Premiere Outfit A Rabanne Fringe Dress For I Dont Understand You

Jun 05, 2025

Amanda Seyfrieds Premiere Outfit A Rabanne Fringe Dress For I Dont Understand You

Jun 05, 2025 -

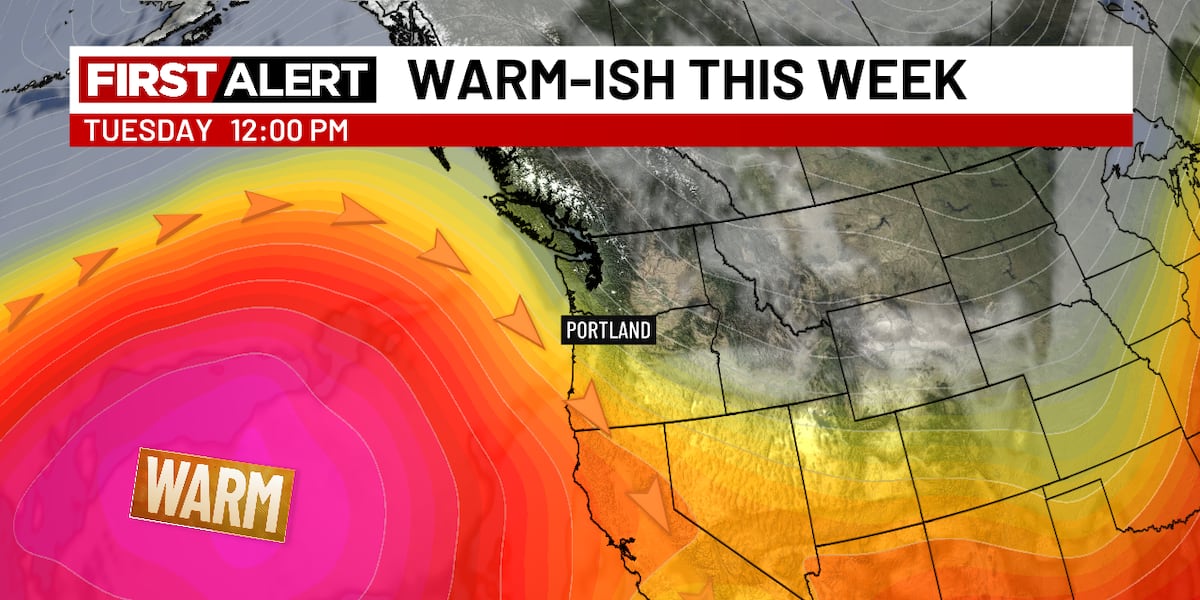

Warm And Sunny Start To June Weather Forecast

Jun 05, 2025

Warm And Sunny Start To June Weather Forecast

Jun 05, 2025