Pre-Earnings Buzz: Broadcom's Stock And The Potential $250 Price Point

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Pre-Earnings Buzz: Is Broadcom's Stock Poised to Hit $250?

Broadcom (AVGO) is on the cusp of releasing its quarterly earnings report, and investor anticipation is palpable. The semiconductor giant's stock has seen significant growth recently, leaving many wondering if the upcoming announcement will propel its price towards the coveted $250 mark. This pre-earnings buzz is fueled by a combination of factors, creating a volatile but potentially lucrative environment for investors. Let's delve into the key elements driving this excitement and examine the potential for Broadcom to reach this significant price point.

Strong Recent Performance Fuels Optimism:

Broadcom's recent performance has been nothing short of stellar. The company has consistently exceeded expectations, demonstrating strong growth across various sectors, including its infrastructure software and networking solutions. This consistent outperformance has solidified its position as a leader in the semiconductor industry and instilled confidence among investors. Analysts point to several key drivers, including robust demand for its 5G infrastructure components and the ongoing expansion into the cloud computing market.

Key Factors Influencing the $250 Price Target:

Several factors contribute to the speculation surrounding the $250 price point for Broadcom's stock:

- Strong Earnings Expectations: Analysts generally predict strong earnings results for the current quarter, potentially exceeding previous forecasts. This positive outlook directly influences investor sentiment and pushes the stock price higher.

- Growth in Key Markets: Broadcom's exposure to high-growth markets like 5G, cloud computing, and artificial intelligence (AI) positions it for continued expansion. This long-term growth trajectory is a major draw for investors seeking exposure to these technologically advanced sectors.

- Strategic Acquisitions: Broadcom's history of strategic acquisitions has proven to be successful in expanding its market reach and technological capabilities. This proactive approach to growth strengthens investor confidence in the company's future performance.

- Supply Chain Resilience: While supply chain disruptions have impacted many industries, Broadcom has demonstrated a degree of resilience, further bolstering its positive outlook. This ability to navigate global challenges effectively enhances its appeal to risk-averse investors.

Risks and Considerations:

While the prospects look promising, investors should remain mindful of potential risks:

- Market Volatility: The overall market climate remains somewhat volatile, and broader economic factors could impact Broadcom's performance, regardless of its strong fundamentals.

- Competition: The semiconductor industry is highly competitive, and new entrants or aggressive strategies from existing players could impact Broadcom's market share.

- Geopolitical Factors: Global geopolitical uncertainties can create unforeseen challenges for businesses operating internationally, potentially influencing Broadcom's profitability.

Should You Invest?

The question of whether to invest in Broadcom before its earnings release is a complex one that depends on your individual risk tolerance and investment strategy. While the potential for significant gains is considerable, the inherent risks should not be overlooked. Conduct thorough research, consult with a financial advisor, and diversify your portfolio to mitigate potential losses. Remember, past performance is not indicative of future results.

Looking Ahead:

The upcoming earnings report will be crucial in determining whether Broadcom's stock will reach the $250 price point. However, the long-term outlook for the company remains positive, driven by its strong position in key growth markets and its consistent track record of exceeding expectations. Keep an eye on the post-earnings analysis and market reaction to gauge the true impact of the announcement. This pre-earnings buzz is certainly exciting, but informed decision-making is key for successful investment.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Pre-Earnings Buzz: Broadcom's Stock And The Potential $250 Price Point. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Karen Read Retrial Thursdays Witness Testimony Cancelled Explanation

Jun 05, 2025

Karen Read Retrial Thursdays Witness Testimony Cancelled Explanation

Jun 05, 2025 -

Will They Or Wont They Evaluating Nfl Playoff Hopefuls For 2023

Jun 05, 2025

Will They Or Wont They Evaluating Nfl Playoff Hopefuls For 2023

Jun 05, 2025 -

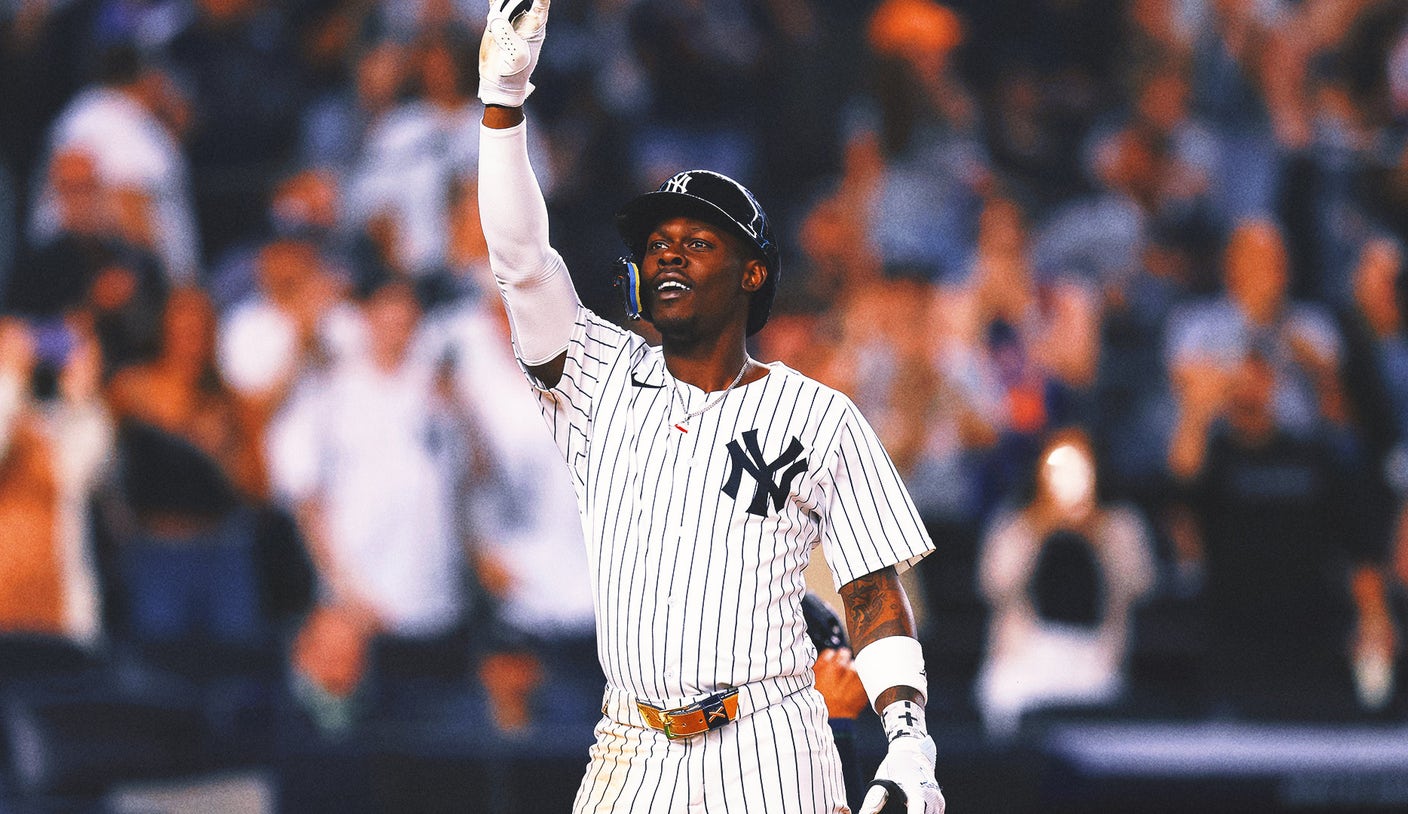

Jazz Is Back Chisholm Jr Leads Yankees To Victory

Jun 05, 2025

Jazz Is Back Chisholm Jr Leads Yankees To Victory

Jun 05, 2025 -

Halle Berry And Van Hunt Their Relationship Explored

Jun 05, 2025

Halle Berry And Van Hunt Their Relationship Explored

Jun 05, 2025 -

Recent Developments Dan Muse And The Rangers Assistant Coaching Changes

Jun 05, 2025

Recent Developments Dan Muse And The Rangers Assistant Coaching Changes

Jun 05, 2025