AMC Stock Performance Following Deutsche Bank Investment

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

AMC Stock Soars: Deutsche Bank's Investment Fuels Meme Stock Rally

AMC Entertainment Holdings Inc. (AMC) stock experienced a significant surge following a surprising investment announcement from Deutsche Bank. The move sent ripples through the market, reigniting the debate surrounding meme stocks and their volatile nature. This article delves into the details of Deutsche Bank's involvement, the subsequent impact on AMC's stock performance, and what it means for investors.

Deutsche Bank's Unexpected Stake:

The news broke on [Insert Date], sending shockwaves through the financial world. Deutsche Bank, a major global investment bank, revealed it had acquired a substantial stake in AMC. While the exact size of the holding wasn't immediately disclosed, the mere presence of such a prominent player in the meme stock arena sparked intense speculation and fueled a rapid increase in trading volume. This unexpected investment signaled a potential shift in the perception of AMC, a company that has been a focal point of the meme stock phenomenon since its surge in popularity during the pandemic.

AMC Stock's Dramatic Reaction:

The immediate reaction was dramatic. AMC stock prices jumped [Insert Percentage] within [ timeframe] of the announcement. This rapid increase underscores the power of institutional investor involvement in influencing the price of meme stocks, often driven by social media sentiment and retail investor enthusiasm. The surge highlighted the unpredictable nature of these assets, offering both significant opportunities and substantial risks.

Analyzing the Investment:

Several factors could explain Deutsche Bank's strategic move. It's possible the bank saw an undervalued opportunity in AMC, recognizing its potential for growth despite its historical volatility. Another theory suggests the investment is a calculated bet on the continued strength of the meme stock market, capitalizing on the fervent online communities that drive trading activity. Regardless of the underlying rationale, the investment represents a significant validation for those who hold bullish sentiment towards AMC.

The Future of AMC and Meme Stocks:

The Deutsche Bank investment raises crucial questions about the long-term viability of meme stocks and the role of institutional investors in their price fluctuations. While the short-term gains are undeniable, long-term investors need to consider the inherent risks associated with meme stocks. These assets are highly susceptible to market sentiment swings and social media trends, making them less predictable than traditional investments. This unpredictability makes thorough due diligence crucial before investing.

What This Means for Investors:

This event highlights the importance of staying informed about market trends and analyzing investment decisions carefully. While the recent price surge is exciting, investors should approach AMC and similar meme stocks with caution, considering factors beyond short-term price fluctuations. Diversification is key in any investment portfolio, and relying heavily on meme stocks carries significant risk.

Further Research:

- For a deeper understanding of meme stock investing, explore resources like [link to reputable financial news site].

- Learn more about AMC's financial performance through their official investor relations page: [link to AMC investor relations].

- Stay updated on market trends by following reputable financial news sources.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and past performance is not indicative of future results. Consult a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on AMC Stock Performance Following Deutsche Bank Investment. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

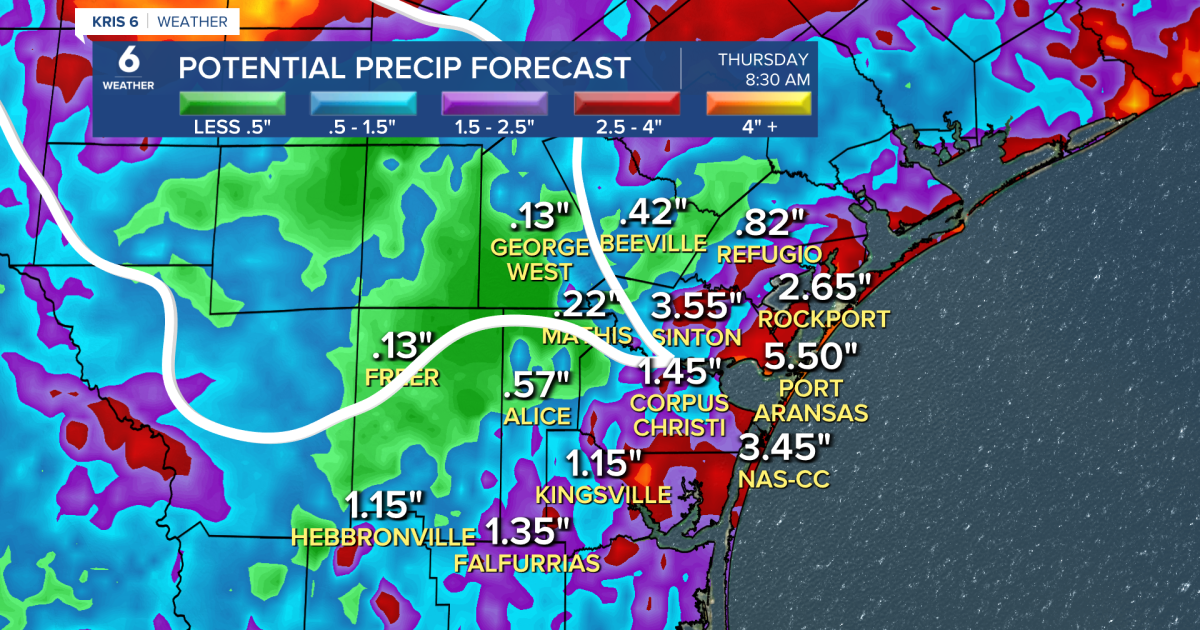

Expect Heavy Rain Series Of Weather Disturbances And Abundant Gulf Moisture

May 28, 2025

Expect Heavy Rain Series Of Weather Disturbances And Abundant Gulf Moisture

May 28, 2025 -

Investing In Ai Semiconductors Crdo And Avgo Stock Analysis

May 28, 2025

Investing In Ai Semiconductors Crdo And Avgo Stock Analysis

May 28, 2025 -

Super Micro Computers Stock An Investors Perspective On Future Performance

May 28, 2025

Super Micro Computers Stock An Investors Perspective On Future Performance

May 28, 2025 -

Tesla Investors Rejoice Musk Hints At Massive Stock Growth Potential

May 28, 2025

Tesla Investors Rejoice Musk Hints At Massive Stock Growth Potential

May 28, 2025 -

Liverpool Receives Outpouring Of Support After Car Crash At Celebration

May 28, 2025

Liverpool Receives Outpouring Of Support After Car Crash At Celebration

May 28, 2025