Super Micro Computer's Stock: An Investor's Perspective On Future Performance

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Super Micro Computer's Stock: An Investor's Perspective on Future Performance

Super Micro Computer, Inc. (SMCI) has been a compelling player in the server and data center technology space for years. But what does the future hold for this tech giant, and is now the right time to invest? This in-depth analysis explores Super Micro's current market position, recent performance, and potential future growth, providing investors with a comprehensive perspective on SMCI stock.

Super Micro's Strong Position in a Booming Market

Super Micro's success is deeply intertwined with the explosive growth of the global data center market. The increasing demand for cloud computing, artificial intelligence (AI), and high-performance computing (HPC) fuels the need for robust and efficient server solutions – a sector where Super Micro excels. Their focus on energy-efficient designs and advanced technologies positions them well to capitalize on this continued expansion. The company's innovative approach, including advancements in GPU computing and NVMe storage, further solidifies their competitive advantage.

Recent Financial Performance and Key Growth Drivers

Super Micro's recent financial reports showcase impressive revenue growth and profitability. While specific numbers are subject to change and should be verified through official financial statements, key drivers include:

- Strong demand for high-performance computing solutions: The rise of AI and machine learning significantly boosts the demand for Super Micro's servers.

- Expansion into new markets: Super Micro's strategic initiatives to broaden its market reach into emerging technologies and geographic regions contribute to sustainable growth.

- Focus on innovation: Continuous investment in research and development allows Super Micro to stay ahead of the curve and offer cutting-edge solutions.

- Strategic partnerships: Collaborations with leading technology companies provide access to wider markets and strengthens Super Micro's brand image.

Challenges and Risks to Consider

Despite the positive outlook, investors need to be aware of potential challenges:

- Increased competition: The server market is highly competitive, with established players and emerging startups vying for market share.

- Supply chain disruptions: Global supply chain issues can impact production and delivery, potentially affecting profitability.

- Economic downturns: A general economic slowdown could reduce demand for technology infrastructure investments.

- Dependence on key customers: Concentration of business with a few major clients might expose Super Micro to increased risk.

Analyzing SMCI Stock: Is it a Buy, Sell, or Hold?

Determining whether SMCI stock is a buy, sell, or hold requires a thorough due diligence process. Investors should consider:

- Fundamental analysis: Evaluate Super Micro's financial statements, including revenue growth, profitability, and debt levels. Look for consistent growth trends and strong financial health.

- Technical analysis: Analyze SMCI's stock price charts to identify trends, support levels, and resistance levels. This can provide insights into potential price movements.

- Industry analysis: Stay informed about the overall data center market and competitive landscape to assess Super Micro's future prospects.

- Risk tolerance: Assess your personal risk tolerance before making investment decisions. Investing in stocks always involves a degree of risk.

Conclusion: Navigating the Future of SMCI

Super Micro's strong position in a rapidly growing market, coupled with its focus on innovation and strategic partnerships, suggests a promising future. However, investors must carefully consider the inherent risks before making any investment decisions. Conduct thorough research, consult with financial advisors, and develop a well-defined investment strategy tailored to your individual financial goals and risk tolerance. Remember to always consult with a qualified financial advisor before making any investment decisions.

(Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in stocks involves risk, and you could lose money.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Super Micro Computer's Stock: An Investor's Perspective On Future Performance. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Karl Anthony Towns Game 3 Impact How Will The Pacers Respond In The Nba East Finals Game 4

May 28, 2025

Karl Anthony Towns Game 3 Impact How Will The Pacers Respond In The Nba East Finals Game 4

May 28, 2025 -

Nba Playoffs Karl Anthony Towns Game 3 Performance A Turning Point For The Knicks

May 28, 2025

Nba Playoffs Karl Anthony Towns Game 3 Performance A Turning Point For The Knicks

May 28, 2025 -

Invest In The Dip 2 Promising S And P 500 Stocks For Upside Potential

May 28, 2025

Invest In The Dip 2 Promising S And P 500 Stocks For Upside Potential

May 28, 2025 -

French Open Paolini Overcomes Yuan Challenge Secures Seventh Consecutive Victory

May 28, 2025

French Open Paolini Overcomes Yuan Challenge Secures Seventh Consecutive Victory

May 28, 2025 -

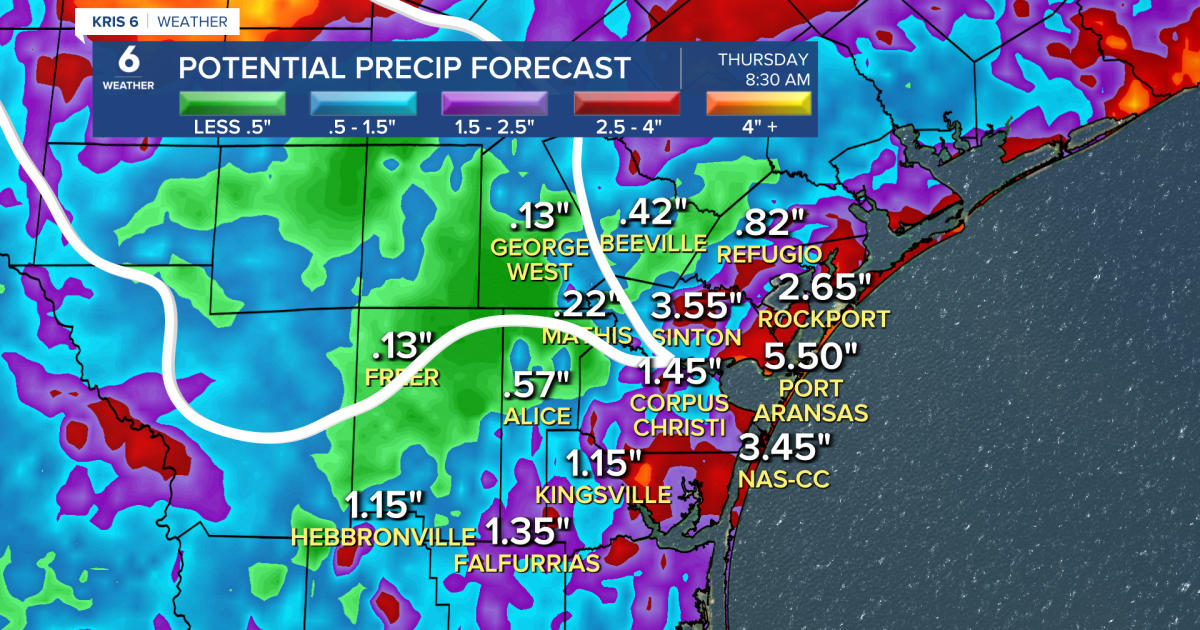

Abundant Gulf Moisture To Bring Potential For Heavy Rainfall

May 28, 2025

Abundant Gulf Moisture To Bring Potential For Heavy Rainfall

May 28, 2025