Air Canada's $500M Issuer Bid: Preliminary Findings Unveiled

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Air Canada's $500M Issuer Bid: Preliminary Findings Unveiled – A Closer Look

Air Canada's recent announcement of a $500 million issuer bid to repurchase its own shares has sent ripples through the Canadian financial market. This significant move, aimed at bolstering shareholder value, has already sparked considerable discussion and analysis. This article delves into the preliminary findings and implications of this substantial corporate action.

What is an Issuer Bid?

Before diving into the specifics of Air Canada's bid, let's clarify what an issuer bid entails. Essentially, it's a formal offer by a publicly traded company to buy back its own outstanding shares from existing shareholders at a predetermined price. This differs from open market repurchases, offering a structured and often more efficient method for reducing the number of outstanding shares. Issuer bids can signal a variety of corporate strategies, including a belief that the company's stock is undervalued or a desire to increase earnings per share.

Air Canada's $500 Million Initiative: Key Details

Air Canada's $500 million issuer bid represents a substantial commitment to its shareholders. While the exact details are still emerging, preliminary findings suggest a focus on returning capital to investors and potentially enhancing its financial position. The offer price and other key parameters will be crucial in determining the overall success and impact of the bid. Further details are expected to be released in the coming weeks, offering a clearer picture of the strategy's specifics.

Potential Implications and Market Reaction:

The market reaction to Air Canada's announcement has been largely positive, reflecting a generally optimistic outlook on the airline's recovery and future prospects. However, several factors will influence the long-term impact:

- Share Price Performance: The success of the bid will depend heavily on the offered price relative to the current market price. A competitive offer is likely to attract significant participation from shareholders.

- Debt Reduction: The repurchase of shares could also be viewed as a strategic move towards reducing the company's overall debt burden, improving its financial health and strengthening its credit rating. This is particularly relevant given the challenges faced by the airline industry in recent years.

- Investor Confidence: The bid could be interpreted as a vote of confidence from Air Canada's management in the company's future prospects, potentially boosting investor confidence and attracting further investment.

Analyzing the Strategic Rationale:

Several factors likely contributed to Air Canada's decision to launch this significant issuer bid:

- Strong Financial Position: Air Canada's improved financial performance post-pandemic may have provided the financial flexibility to undertake such a large-scale share repurchase.

- Undervalued Stock: Management might believe the current market price undervalues the company's intrinsic worth, making a buyback an attractive proposition.

- Shareholder Returns: The bid directly contributes to returning capital to shareholders, a key priority for many publicly traded companies.

Looking Ahead:

Air Canada's $500 million issuer bid marks a significant development in the company's ongoing efforts to maximize shareholder value and navigate the evolving landscape of the airline industry. As more details emerge, analysts and investors will closely scrutinize the offer's terms and conditions to assess its impact on the company's long-term strategy and financial performance. Further updates are anticipated in the coming days and weeks, providing a clearer picture of this important corporate decision. Stay tuned for further developments.

Keywords: Air Canada, issuer bid, share repurchase, stock buyback, shareholder value, Canadian market, airline industry, financial news, corporate strategy, investment, market reaction, debt reduction, financial performance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Air Canada's $500M Issuer Bid: Preliminary Findings Unveiled. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

After A Decade Hytales Development Halts Hypixel Studios Closes

Jun 27, 2025

After A Decade Hytales Development Halts Hypixel Studios Closes

Jun 27, 2025 -

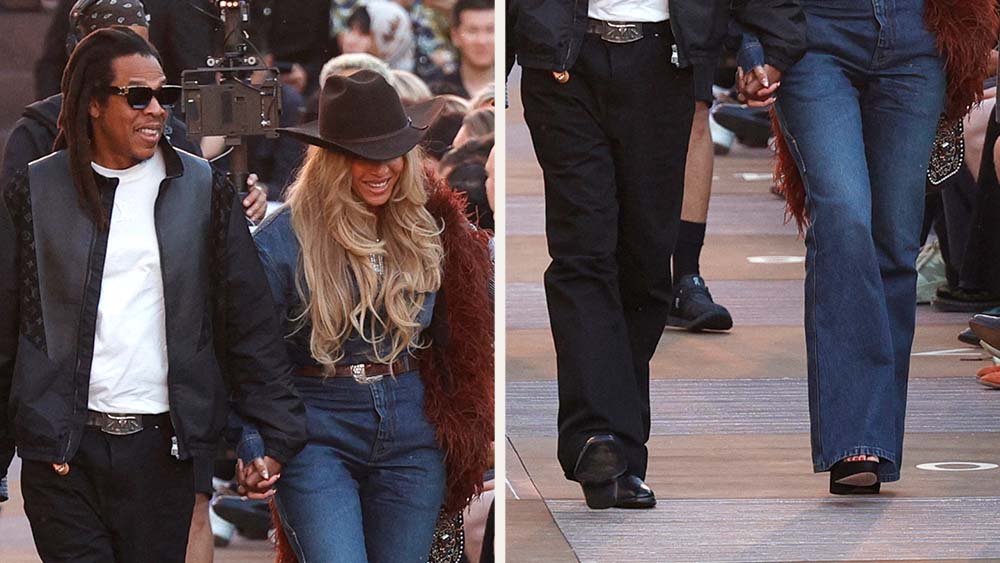

Power Couple Beyonce And Jay Z In Western Style At Louis Vuitton Paris Show

Jun 27, 2025

Power Couple Beyonce And Jay Z In Western Style At Louis Vuitton Paris Show

Jun 27, 2025 -

Comprehensive Lmb Investment Report Key Trends And Predictions

Jun 27, 2025

Comprehensive Lmb Investment Report Key Trends And Predictions

Jun 27, 2025 -

The Weeknd Conquers So Fi Stadium A Photo Recap Of His Performance

Jun 27, 2025

The Weeknd Conquers So Fi Stadium A Photo Recap Of His Performance

Jun 27, 2025 -

Endividamento Americano Impacto No Mercado De Titulos E A Saida Em Massa

Jun 27, 2025

Endividamento Americano Impacto No Mercado De Titulos E A Saida Em Massa

Jun 27, 2025