Comprehensive LMB Investment Report: Key Trends And Predictions

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Comprehensive LMB Investment Report: Key Trends and Predictions for 2024 and Beyond

The Lumber and Building Materials (LMB) sector is a cornerstone of economic growth, and understanding its investment landscape is crucial for savvy investors. This comprehensive report delves into the key trends shaping the LMB market and offers insightful predictions for the future. From soaring inflation to evolving construction techniques, the industry faces significant challenges and opportunities. Let's explore the key findings.

H2: Navigating the Shifting Sands: Key Trends in LMB Investment

The LMB sector is experiencing a period of dynamic change, driven by several interconnected factors:

-

Inflationary Pressures: Soaring material costs and labor shortages continue to impact profitability and project timelines. Investors need to carefully assess pricing strategies and risk mitigation plans. [Link to article on inflation's impact on construction]

-

Supply Chain Disruptions: Global supply chain vulnerabilities remain a persistent concern, impacting the availability and cost of key materials. Diversification of sourcing and strategic partnerships are becoming increasingly important.

-

Sustainable Building Practices: The growing emphasis on sustainability is driving demand for eco-friendly building materials, presenting both challenges and opportunities for investors. Demand for products like engineered wood, recycled content materials, and sustainably harvested lumber is on the rise. [Link to article on sustainable building materials]

-

Technological Advancements: Innovation in construction technology, such as prefabrication and 3D printing, is transforming the industry. Investors need to identify companies embracing these advancements to gain a competitive edge.

-

Shifting Demographics and Housing Demand: Population growth and changing housing preferences are influencing construction patterns. Understanding regional variations in demand is critical for targeted investments.

H2: LMB Investment Predictions: A Look Ahead

Based on our analysis of current trends and market dynamics, we offer the following predictions for the LMB investment landscape:

-

Increased Consolidation: We anticipate further consolidation within the industry, with larger players acquiring smaller companies to gain market share and improve efficiency.

-

Focus on Technology: Investment in companies leveraging technology to improve efficiency, reduce costs, and enhance sustainability will likely yield strong returns.

-

Resilience in Demand: Despite economic uncertainty, the underlying demand for housing and infrastructure projects is expected to remain relatively strong, supporting continued investment in the sector.

-

Premium on Sustainability: Companies prioritizing sustainable practices and offering eco-friendly products are poised for significant growth.

-

Regional Variations: Investment opportunities will vary significantly by region, requiring a nuanced understanding of local market conditions.

H3: Mitigating Risks and Maximizing Returns

Successful LMB investment requires a thorough understanding of the market's inherent risks and opportunities. Investors should:

- Conduct thorough due diligence: Carefully assess the financial health, management team, and competitive landscape of any potential investment.

- Diversify your portfolio: Spread your investments across different segments of the LMB market and geographical regions to mitigate risk.

- Stay informed: Keep abreast of industry trends, technological advancements, and regulatory changes.

- Consider ESG factors: Environmental, social, and governance (ESG) factors are increasingly important to investors and will play a significant role in shaping the future of the LMB sector.

H2: Conclusion: A Promising but Challenging Landscape

The LMB investment landscape presents both significant challenges and rewarding opportunities. By understanding the key trends, mitigating potential risks, and embracing innovative approaches, investors can navigate this dynamic sector and achieve strong returns. This report provides a framework for informed decision-making, but further independent research is always recommended before making any investment choices.

Call to Action: Download our full report for a deeper dive into the data and analysis behind these predictions. [Link to hypothetical report download]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Comprehensive LMB Investment Report: Key Trends And Predictions. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

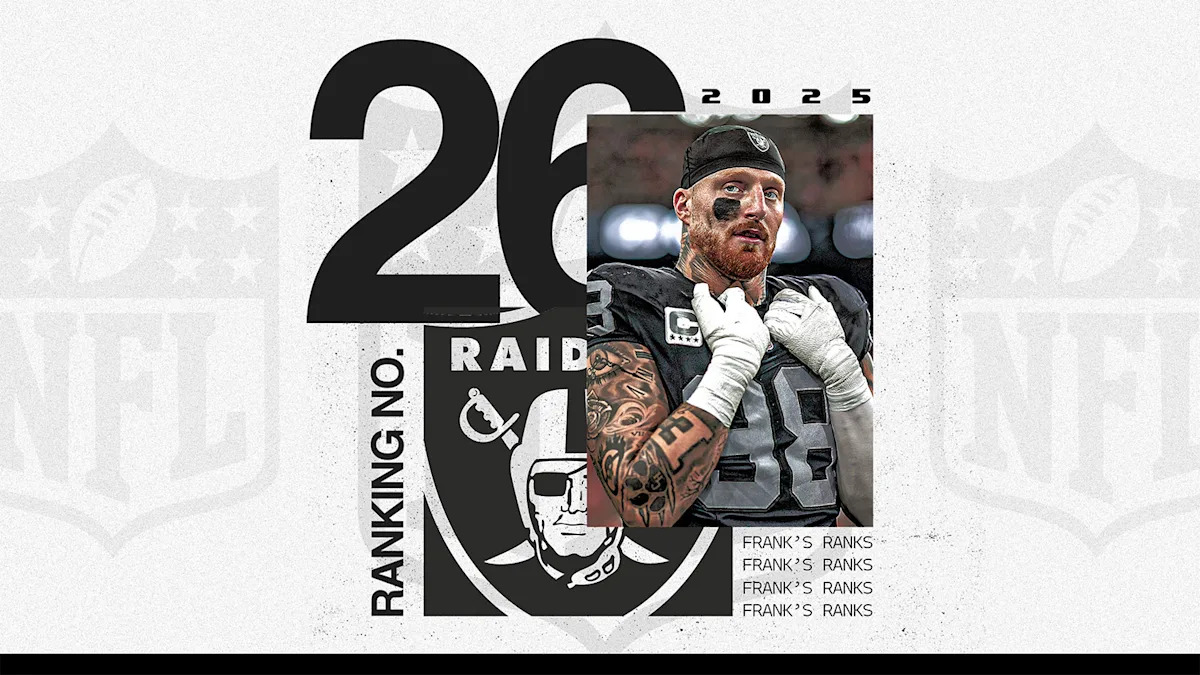

Las Vegas Raiders 26th In Offseason Power Rankings A Realistic Assessment

Jun 27, 2025

Las Vegas Raiders 26th In Offseason Power Rankings A Realistic Assessment

Jun 27, 2025 -

Francie Fak In The Bear Season 4 Why Natalie Doesnt Like Her

Jun 27, 2025

Francie Fak In The Bear Season 4 Why Natalie Doesnt Like Her

Jun 27, 2025 -

Empower Field Concert The Weeknds Record Breaking Performance In Pictures

Jun 27, 2025

Empower Field Concert The Weeknds Record Breaking Performance In Pictures

Jun 27, 2025 -

Neymars Future Secured Contract Extension With Santos Until December

Jun 27, 2025

Neymars Future Secured Contract Extension With Santos Until December

Jun 27, 2025 -

Gold Cup 2024 Canada Advances Marschs Coaching Role Crucial

Jun 27, 2025

Gold Cup 2024 Canada Advances Marschs Coaching Role Crucial

Jun 27, 2025