£950 Or Less: The Disappointing Outcome For Car Finance Mis-selling Victims

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

£950 or Less: The Disappointing Outcome for Car Finance Mis-selling Victims

The Financial Conduct Authority (FCA) has announced a redress scheme for victims of car finance mis-selling, but many are expressing deep disappointment at the paltry compensation offered. Instead of the thousands of pounds many expected, the average payout is reportedly hovering around a measly £950. This leaves many feeling cheated a second time, highlighting a significant flaw in the system designed to right past wrongs.

The scheme, intended to compensate individuals who were mis-sold car finance products between 2014 and 2021, aimed to address widespread concerns about unfair practices. These included:

- Unaffordable loans: Consumers were frequently approved for loans they couldn't realistically afford, leading to spiralling debt.

- Excessive interest rates: Many borrowers were trapped in high-interest loans with little hope of escaping.

- Lack of transparency: The complexity of finance agreements made it difficult for consumers to fully understand the terms and conditions.

- Aggressive selling tactics: Pressure selling and misrepresentation of product features were common complaints.

Why the Low Payouts?

The low average compensation of £950 is sparking outrage among affected consumers and consumer rights groups. Several factors contribute to this disappointing outcome:

- Limited scope of the scheme: The redress scheme may not cover all forms of mis-selling, leaving many victims without recourse. For example, those who experienced difficulties due to unfair contract terms, but without direct evidence of mis-selling, may be excluded.

- Administrative costs: A significant portion of the funds allocated to the scheme is likely being consumed by administrative costs, reducing the amount available for individual compensation.

- Complexity of claims: Navigating the claims process can be complex and time-consuming, often requiring significant paperwork and proof of financial hardship. Many individuals may not possess the resources or the knowledge to effectively pursue their claims.

- FCA's methodology: The method used by the FCA to calculate compensation might undervalue the actual losses suffered by consumers.

What Can Victims Do Now?

While the £950 average payout is far from ideal, those who received a redress offer should carefully consider their options. They should:

- Review the offer letter thoroughly: Understand exactly what the compensation covers and any remaining outstanding debts.

- Seek independent financial advice: A financial advisor can help assess the offer and determine if it's in their best interests to accept it.

- Consider further action: If the offer is deemed insufficient, individuals might explore alternative avenues, such as engaging a solicitor specializing in consumer rights. However, this will likely involve additional costs and time.

Looking Ahead: The Need for Stronger Consumer Protections

The disappointing outcome of the car finance mis-selling redress scheme underscores the critical need for stronger consumer protections within the financial services industry. It highlights the limitations of current regulatory frameworks and the urgent need for increased transparency and accountability from lenders. The FCA needs to review its processes and ensure that future redress schemes provide fair and adequate compensation to victims of financial mis-selling. Consumer rights organizations are advocating for significant improvements to ensure that future victims are not subjected to such inadequate redress. This case should serve as a stark warning to both consumers and financial institutions alike. Consumers should be empowered to make informed decisions, and financial institutions should operate with integrity and transparency.

Related Articles:

- [Link to an article about consumer rights in the UK]

- [Link to an article about the FCA's role in protecting consumers]

Call to Action: Have you been affected by car finance mis-selling? Share your experience in the comments below. Your story could help others.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on £950 Or Less: The Disappointing Outcome For Car Finance Mis-selling Victims. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

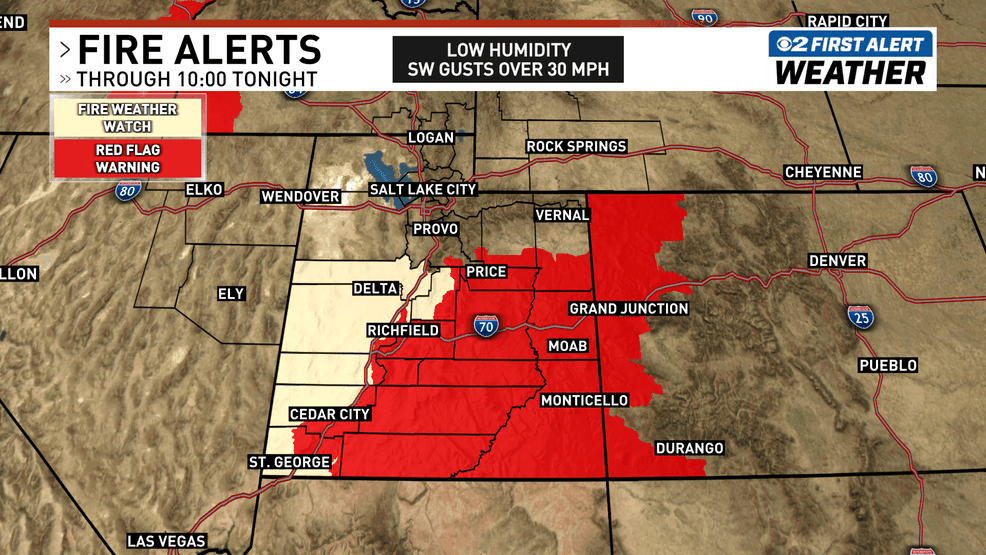

Statewide Emergency Utah Governors Response To Spreading Wildfires

Aug 04, 2025

Statewide Emergency Utah Governors Response To Spreading Wildfires

Aug 04, 2025 -

Utah Weather Alert Thunderstorm Potential And Elevated Fire Risk

Aug 04, 2025

Utah Weather Alert Thunderstorm Potential And Elevated Fire Risk

Aug 04, 2025 -

College Footballs Swiss Army Knife Travis Hunters Dual Role

Aug 04, 2025

College Footballs Swiss Army Knife Travis Hunters Dual Role

Aug 04, 2025 -

A Rod Jeter And Big Papi Weigh In Mlb Trade Deadline Winners

Aug 04, 2025

A Rod Jeter And Big Papi Weigh In Mlb Trade Deadline Winners

Aug 04, 2025 -

Son Heung Min Announces Tottenham Exit Whats Next For The South Korean Star

Aug 04, 2025

Son Heung Min Announces Tottenham Exit Whats Next For The South Korean Star

Aug 04, 2025

Latest Posts

-

Leg Injury Forces Messi Out Of Inter Miamis League Cup Competition

Aug 04, 2025

Leg Injury Forces Messi Out Of Inter Miamis League Cup Competition

Aug 04, 2025 -

Bristol Motor Speedways Mlb Speedway Classic Suspended To Continue Sunday

Aug 04, 2025

Bristol Motor Speedways Mlb Speedway Classic Suspended To Continue Sunday

Aug 04, 2025 -

North Highlands Crash Woman Cyclist Injured Need For Bicycle Accident Attorney

Aug 04, 2025

North Highlands Crash Woman Cyclist Injured Need For Bicycle Accident Attorney

Aug 04, 2025 -

From Big Screen To Small Ridley Scotts Alien Gets A Tv Adaptation

Aug 04, 2025

From Big Screen To Small Ridley Scotts Alien Gets A Tv Adaptation

Aug 04, 2025 -

Jerry Jones Downplays Micah Parsons Trade Request Dont Lose Sleep

Aug 04, 2025

Jerry Jones Downplays Micah Parsons Trade Request Dont Lose Sleep

Aug 04, 2025