$5B+ Poured Into Bitcoin ETFs: Understanding The Bold Investment Strategy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$5 Billion+ Poured into Bitcoin ETFs: Decoding the Bold Investment Strategy

The cryptocurrency market is buzzing. Over $5 billion has flooded into Bitcoin exchange-traded funds (ETFs) in recent months, signaling a significant shift in institutional investor sentiment and a growing appetite for Bitcoin exposure within traditional financial markets. This massive influx of capital represents a bold investment strategy with both substantial potential and inherent risks. But what's driving this surge, and what does it mean for the future of Bitcoin and the broader financial landscape?

The Rise of Bitcoin ETFs: A Gateway to Institutional Investment

The approval of the first Bitcoin futures ETFs in the US marked a pivotal moment. Previously, institutional investors hesitant about directly holding Bitcoin now had a more regulated and accessible route to gain exposure. These ETFs, which track Bitcoin futures contracts rather than the underlying asset itself, offer a degree of comfort to investors accustomed to traditional market structures. This accessibility is a key factor driving the current investment spree.

Why the $5 Billion+ Investment? Understanding the Motivations

Several factors contribute to this significant investment in Bitcoin ETFs:

- Increased Regulatory Clarity: The gradual increase in regulatory clarity surrounding cryptocurrencies, particularly in major markets like the US, has boosted investor confidence. While complete regulatory frameworks are still developing, the progress made is reassuring for institutions seeking compliance.

- Inflation Hedge Potential: With persistent inflationary pressures globally, investors are seeking assets that might act as a hedge against inflation. Bitcoin, with its limited supply, is viewed by some as a potential store of value, similar to gold.

- Diversification Strategies: Many institutional investors are incorporating Bitcoin into their portfolios as a diversification strategy. Its low correlation with traditional assets can help reduce overall portfolio volatility.

- Technological Advancements: Continued innovation within the Bitcoin ecosystem, including advancements in scaling solutions and layer-2 technologies, is enhancing its efficiency and usability. This makes it a more attractive investment proposition.

Risks Associated with Bitcoin ETF Investments

While the potential rewards are significant, investing in Bitcoin ETFs also carries inherent risks:

- Volatility: Bitcoin's price is notoriously volatile, subject to sudden and dramatic swings. This volatility can lead to significant losses for investors.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies remains fluid and subject to change. New regulations could negatively impact the value of Bitcoin ETFs.

- Security Risks: While ETFs mitigate some of the risks associated with directly holding Bitcoin, security breaches affecting the underlying exchanges or custodians remain a possibility.

- Market Manipulation: The relatively small size of the Bitcoin market compared to traditional markets makes it potentially susceptible to manipulation.

The Future of Bitcoin ETFs and Institutional Adoption

The $5 billion+ investment represents a significant milestone in the mainstream adoption of Bitcoin. As regulatory clarity improves and institutional investors become more comfortable with the asset class, we can expect further growth in the Bitcoin ETF market. The availability of spot Bitcoin ETFs, which track the actual price of Bitcoin rather than futures contracts, could further accelerate this trend. However, it's crucial for investors to understand the inherent risks before investing and to conduct thorough due diligence. This massive investment underscores Bitcoin's evolving role in the global financial system and the growing acceptance of cryptocurrencies as a legitimate asset class.

Call to Action: Stay informed about the latest developments in the cryptocurrency market and consult with a financial advisor before making any investment decisions. Understanding the risks and rewards associated with Bitcoin ETFs is crucial for making informed investment choices. For more information on Bitcoin and related topics, explore resources like [link to reputable financial news source] and [link to relevant government regulatory body].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $5B+ Poured Into Bitcoin ETFs: Understanding The Bold Investment Strategy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

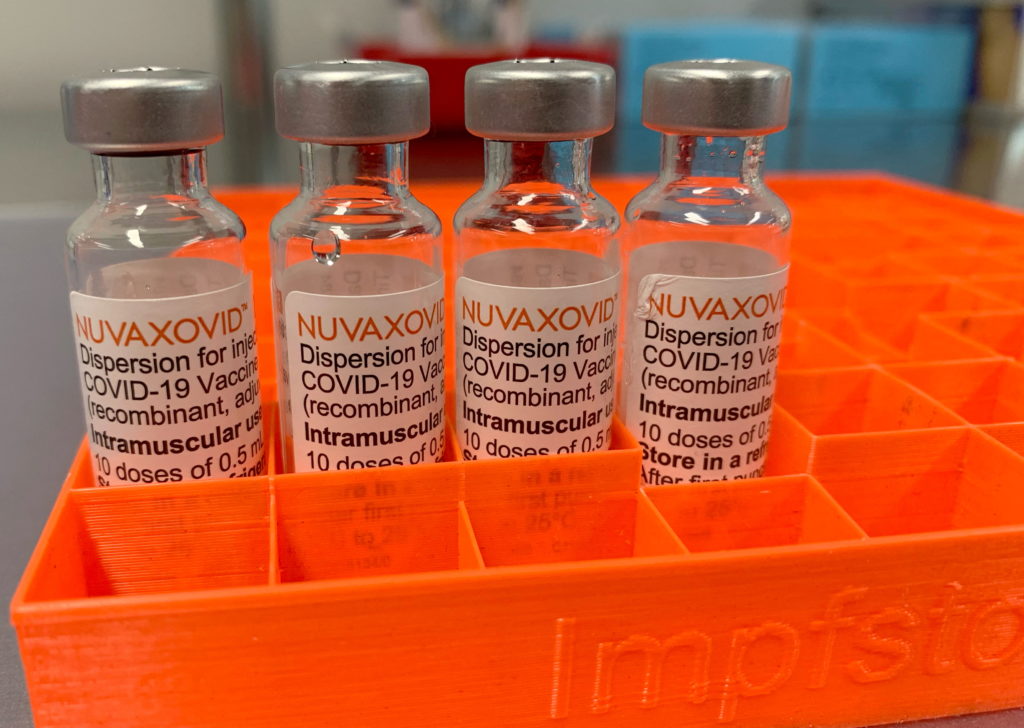

Fda Approval For Novavax Covid 19 Vaccine Understanding The Conditions

May 20, 2025

Fda Approval For Novavax Covid 19 Vaccine Understanding The Conditions

May 20, 2025 -

Thunders Dominant Win Sends Them Back To Western Conference Finals After 7 Year Absence

May 20, 2025

Thunders Dominant Win Sends Them Back To Western Conference Finals After 7 Year Absence

May 20, 2025 -

Different Days Different Results Ohtanis Bullpen Vs Kershaws Debut

May 20, 2025

Different Days Different Results Ohtanis Bullpen Vs Kershaws Debut

May 20, 2025 -

Playoff Upset Thunders Convincing Game 7 Win Over Denver

May 20, 2025

Playoff Upset Thunders Convincing Game 7 Win Over Denver

May 20, 2025 -

Get The Master Of Ceremony Warbonds In Helldivers 2 On May 15th

May 20, 2025

Get The Master Of Ceremony Warbonds In Helldivers 2 On May 15th

May 20, 2025