$200 Million Ethereum Investment Surge: Analyzing The Post-Pectra Upgrade Market

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$200 Million Ethereum Investment Surge: Analyzing the Post-Pectra Upgrade Market

The cryptocurrency market is buzzing after a significant influx of capital into Ethereum, totaling a staggering $200 million. This investment surge follows the highly anticipated Shanghai upgrade, also known as the "Pectra" upgrade, which unlocked staked ETH. This injection of capital suggests a renewed confidence in Ethereum's future and its potential for growth, but what exactly is driving this surge and what does it mean for the future of the market? Let's dive in.

The Pectra Upgrade: A Catalyst for Investment

The Shanghai upgrade, a pivotal moment in Ethereum's history, allowed validators to withdraw their staked ETH for the first time. This unstaking mechanism was crucial in addressing concerns around liquidity and accessibility within the Ethereum ecosystem. Before the upgrade, staked ETH was essentially locked, limiting its usability. The ability to now access these funds has significantly impacted market sentiment, unlocking a substantial amount of capital previously tied up in staking. This is a key factor driving the current investment surge.

Analyzing the Investment Surge:

-

Increased Liquidity: The unlocking of staked ETH has injected a significant amount of liquidity into the market, making it more attractive for investors. This increased liquidity reduces volatility and encourages further investment.

-

Reduced Risk Perception: The successful implementation of the Shanghai upgrade demonstrated Ethereum's capacity for significant upgrades and improvements, reducing the perceived risk associated with the network. This positive perception boosts investor confidence.

-

Deflationary Pressure: The Ethereum network continues to burn ETH with each transaction, leading to deflationary pressure and a potential increase in value over time. This attractive characteristic fuels long-term investment strategies.

-

Growing DeFi Ecosystem: Ethereum's thriving decentralized finance (DeFi) ecosystem continues to attract significant capital. The availability of unstaked ETH further enhances the capabilities and growth potential within this sector. (External Link).

What Does This Mean for the Future?

While this $200 million surge is encouraging, it's crucial to maintain a balanced perspective. The cryptocurrency market remains volatile, and several factors could influence future price movements. However, the positive indicators following the Shanghai upgrade suggest a strong underlying trend of increased adoption and confidence in Ethereum's long-term viability.

Looking Ahead:

The increased investment in Ethereum signifies a positive outlook for the future of the network. Continued development, advancements in scalability solutions like sharding, and the ongoing growth of the DeFi ecosystem are all factors that will likely contribute to sustained growth.

Key Takeaways:

- The $200 million investment surge reflects growing confidence in Ethereum post-Shanghai upgrade.

- The ability to unstake ETH has significantly impacted market liquidity and investor sentiment.

- The deflationary nature of Ethereum, coupled with its robust DeFi ecosystem, continues to attract investment.

- While volatility remains a factor, the long-term outlook for Ethereum appears positive.

This recent investment surge highlights Ethereum's resilience and adaptability within the ever-evolving cryptocurrency landscape. While predicting the future is impossible, this significant investment is a strong indicator of continued growth and potential within the Ethereum ecosystem. Keep an eye on future developments and consider your own investment strategies accordingly.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $200 Million Ethereum Investment Surge: Analyzing The Post-Pectra Upgrade Market. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Japan Concedes On Us Tariffs Signaling Potential Trade Agreement

May 20, 2025

Japan Concedes On Us Tariffs Signaling Potential Trade Agreement

May 20, 2025 -

Ncaa Baseball Liberty Defeats Top Ranked Texas A And M

May 20, 2025

Ncaa Baseball Liberty Defeats Top Ranked Texas A And M

May 20, 2025 -

May 15th Brings Masters Of Ceremony Warbonds To Helldivers 2

May 20, 2025

May 15th Brings Masters Of Ceremony Warbonds To Helldivers 2

May 20, 2025 -

Rafael Devers Red Soxs Designated Hitter Finds Success

May 20, 2025

Rafael Devers Red Soxs Designated Hitter Finds Success

May 20, 2025 -

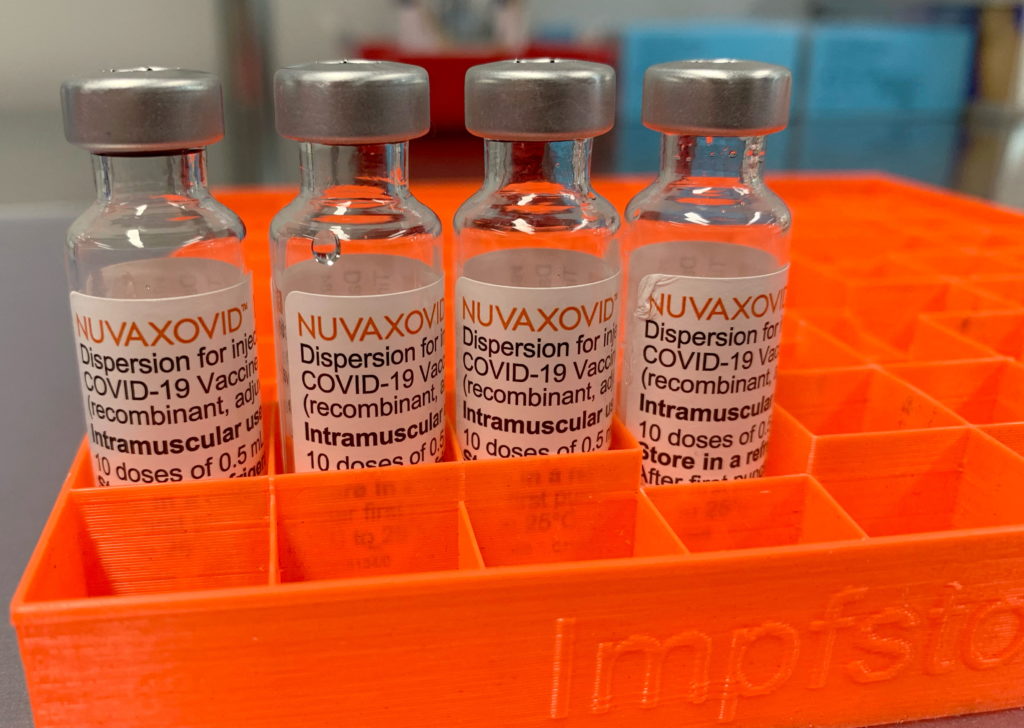

Fda Approves Novavax Covid 19 Vaccine Use Restrictions Explained

May 20, 2025

Fda Approves Novavax Covid 19 Vaccine Use Restrictions Explained

May 20, 2025