$200M Inflows Into Ethereum Funds: Investors Bet Big On Post-Pectra Growth

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$200M Inflows into Ethereum Funds: Investors Bet Big on Post-Merge Growth

Ethereum has seen a significant surge in investor confidence, with a massive $200 million pouring into Ethereum-focused investment funds in recent weeks. This substantial influx of capital signals a bullish outlook on the future of the second-largest cryptocurrency, particularly in the wake of the successful Ethereum Merge. The Merge, a highly anticipated network upgrade transitioning Ethereum from a proof-of-work to a proof-of-stake consensus mechanism, is widely considered a pivotal moment in the cryptocurrency's history. This renewed interest raises questions about the future trajectory of ETH prices and the overall health of the crypto market.

Why the Sudden Surge in Ethereum Investment?

Several factors contribute to this wave of investment in Ethereum funds. The successful completion of the Merge, without major technical hiccups, significantly boosted investor confidence. The Merge was a complex undertaking, and its successful execution demonstrated the resilience and development prowess of the Ethereum ecosystem. This achievement effectively mitigated some of the long-standing criticisms surrounding Ethereum's scalability and energy consumption.

Beyond the Merge, other factors are playing a role:

-

Improved Scalability: The transition to proof-of-stake has significantly reduced Ethereum's energy consumption and improved transaction speeds, addressing key limitations previously hindering its widespread adoption. This enhanced efficiency is attracting both institutional and individual investors.

-

Deflationary Potential: The shift to proof-of-stake has introduced a deflationary mechanism, potentially making ETH a more attractive store of value. As transaction fees are burned, the circulating supply of ETH could decrease over time, potentially driving up its price.

-

Growing DeFi Ecosystem: Ethereum remains the dominant platform for decentralized finance (DeFi), hosting a vast array of applications and protocols. The continued growth and innovation within the DeFi ecosystem further bolster Ethereum's appeal to investors. This robust ecosystem provides a wide array of opportunities for yield farming, lending, and borrowing, attracting a diverse range of participants.

-

Institutional Adoption: Increasingly, institutional investors are showing interest in Ethereum, viewing it as a potentially valuable addition to their portfolios. This growing institutional adoption lends further credibility and stability to the cryptocurrency.

What Does This Mean for the Future of Ethereum?

The significant inflow of capital into Ethereum funds paints a positive picture for the cryptocurrency's future. While market volatility remains inherent in the cryptocurrency space, this substantial investment suggests a strong belief in Ethereum's long-term potential. However, it's crucial to remember that cryptocurrency investments are inherently risky and should be made with caution and thorough research.

Looking Ahead: While the $200 million influx is encouraging, it's important to monitor broader market trends and regulatory developments. Geopolitical factors and macroeconomic conditions can significantly impact the cryptocurrency market. This latest investment signifies a vote of confidence in Ethereum's post-Merge evolution, but sustained growth will depend on continued innovation and broader market sentiment. Investors should remain informed about the latest developments in the Ethereum ecosystem and approach investments with a well-defined risk management strategy.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies involves significant risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $200M Inflows Into Ethereum Funds: Investors Bet Big On Post-Pectra Growth. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

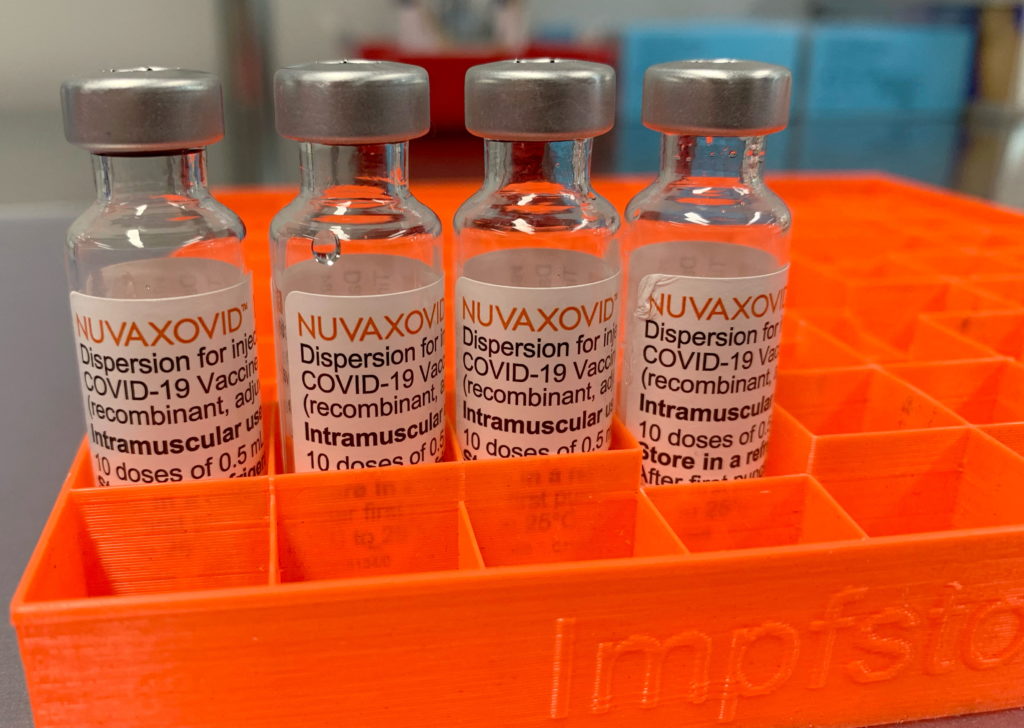

Conditional Fda Approval For Novavax Covid 19 Vaccine Understanding The Restrictions

May 20, 2025

Conditional Fda Approval For Novavax Covid 19 Vaccine Understanding The Restrictions

May 20, 2025 -

Always Kept It Real Jamie Lee Curtis Honest Take On Lindsay Lohans Career

May 20, 2025

Always Kept It Real Jamie Lee Curtis Honest Take On Lindsay Lohans Career

May 20, 2025 -

Strip The Duck Jon Jones Aspinall Comments Ignite Mma Fan Debate

May 20, 2025

Strip The Duck Jon Jones Aspinall Comments Ignite Mma Fan Debate

May 20, 2025 -

New Rules For Tourists In Bali Addressing Misconduct And Protecting The Island

May 20, 2025

New Rules For Tourists In Bali Addressing Misconduct And Protecting The Island

May 20, 2025 -

Journalisms Road To Victory Overcoming Challenges At The Preakness

May 20, 2025

Journalisms Road To Victory Overcoming Challenges At The Preakness

May 20, 2025