Will Your Retirement Plan Survive A Stress Test? A Practical Guide.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Will Your Retirement Plan Survive a Stress Test? A Practical Guide

Retirement. The word conjures images of sun-drenched beaches, leisurely hobbies, and finally having the time to pursue those long-deferred dreams. But the reality of a comfortable retirement often hinges on a single, often overlooked factor: the resilience of your retirement plan. Is it robust enough to weather unexpected storms? This practical guide will help you stress-test your retirement plan and ensure you're prepared for whatever the future holds.

The Importance of Proactive Planning:

Many retirees underestimate the potential impact of unexpected events. A sudden illness, market downturn, or unexpected inflation can significantly derail carefully laid plans. Instead of hoping for the best, proactive planning is crucial. This involves a thorough examination of your current financial situation and a realistic assessment of potential risks.

Conducting Your Retirement Plan Stress Test:

A comprehensive stress test isn't just about crunching numbers; it's about honestly evaluating your financial vulnerability. Here's a step-by-step guide:

1. Assess Your Current Financial Situation:

- Calculate your net worth: This includes all assets (savings, investments, property) minus liabilities (debts, mortgages). Tools like personal finance software or spreadsheets can help.

- Estimate your annual expenses: Be realistic! Include healthcare costs, travel, entertainment, and potential unexpected expenses. Consider inflation's impact on future costs.

- Analyze your income streams: This includes Social Security benefits, pensions, and any other regular income sources. Understand the limitations and potential fluctuations of each source.

2. Identify Potential Risks:

- Market volatility: Stock markets fluctuate. How would your portfolio withstand a significant downturn? Consider diversification strategies. Learn more about .

- Inflation: Rising prices erode purchasing power. How will your retirement income keep pace with inflation? Consider inflation-protected securities.

- Healthcare costs: Medical expenses can be substantial in retirement. Do you have adequate health insurance coverage? Explore long-term care insurance options.

- Longevity risk: Living longer than anticipated can deplete your savings. Ensure your plan accounts for a longer lifespan than initially projected.

- Unexpected events: Job loss, family emergencies, or unexpected home repairs can all impact your retirement savings. Having an emergency fund is critical.

3. Run Various Scenarios:

Use online retirement calculators or consult a financial advisor to model different scenarios. Consider:

- A pessimistic market scenario: What happens if your investments lose a significant percentage of their value?

- A high-inflation scenario: How would your income and expenses be affected by significantly higher inflation?

- An unexpected expense scenario: What happens if you face a large, unexpected medical bill or home repair?

4. Adjust Your Plan Accordingly:

Based on the stress test results, adjust your retirement plan as needed. This might involve:

- Increasing your savings rate: If your current savings fall short, consider increasing contributions to retirement accounts.

- Delaying retirement: Working a few more years can significantly boost your retirement nest egg.

- Rebalancing your portfolio: Adjust your asset allocation to reduce risk.

- Exploring additional income streams: Consider part-time work or other sources of income to supplement your retirement income.

Seeking Professional Advice:

While this guide provides valuable insights, seeking personalized advice from a qualified financial advisor is strongly recommended. They can help you create a comprehensive retirement plan tailored to your specific needs and risk tolerance. Don't hesitate to ask questions and ensure you understand all aspects of your retirement strategy. A well-structured plan will give you the peace of mind you deserve, allowing you to fully enjoy your retirement years.

Call to Action: Schedule a consultation with a financial advisor today to begin stress-testing your retirement plan and securing your future.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Will Your Retirement Plan Survive A Stress Test? A Practical Guide.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

What Teams Could Trade For Cooper Flagg 2025 Nba Draft Projections

Jun 05, 2025

What Teams Could Trade For Cooper Flagg 2025 Nba Draft Projections

Jun 05, 2025 -

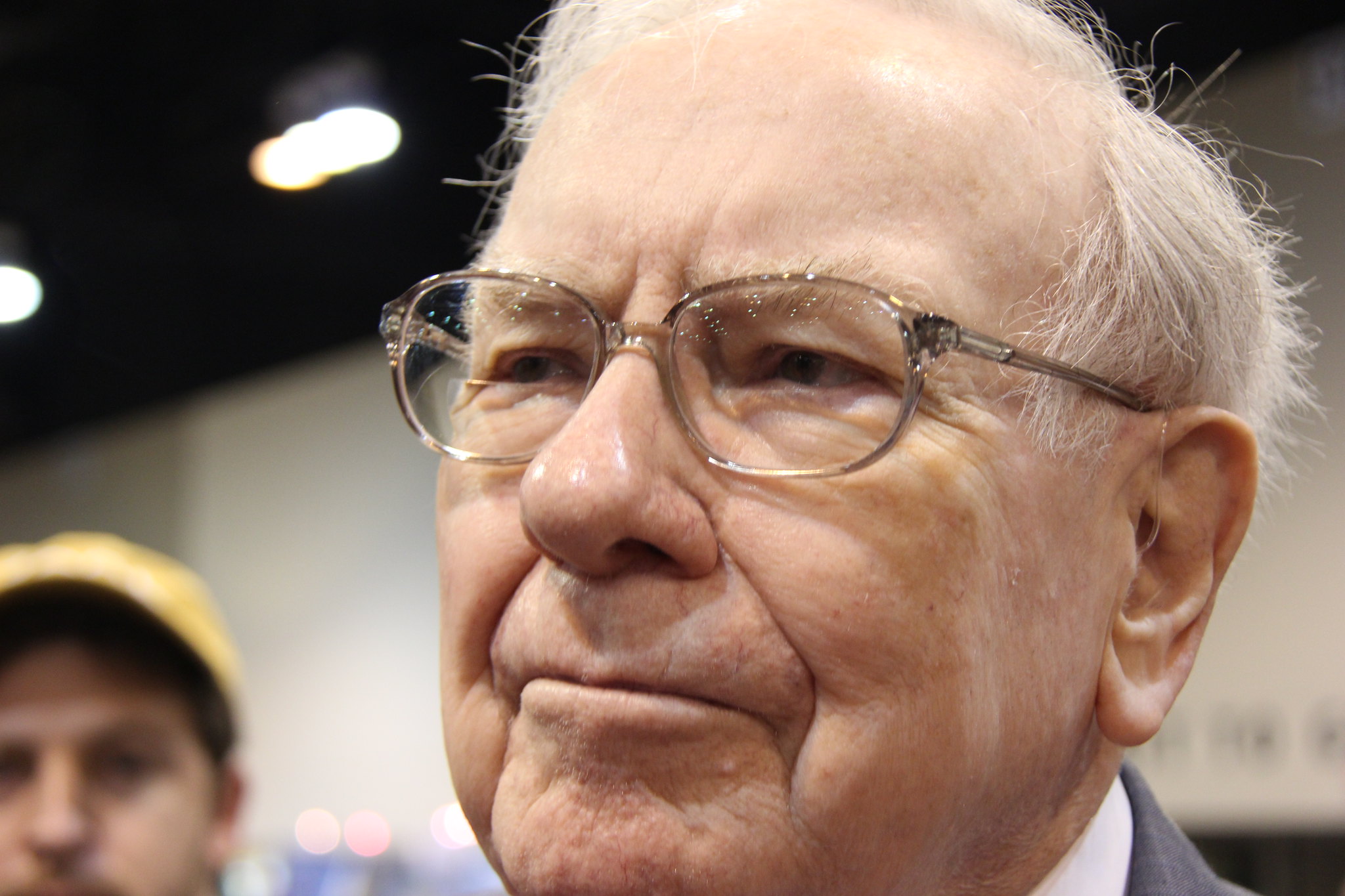

Buffetts Big Move Exit From Bank Of America Entry Into Explosive Consumer Brand

Jun 05, 2025

Buffetts Big Move Exit From Bank Of America Entry Into Explosive Consumer Brand

Jun 05, 2025 -

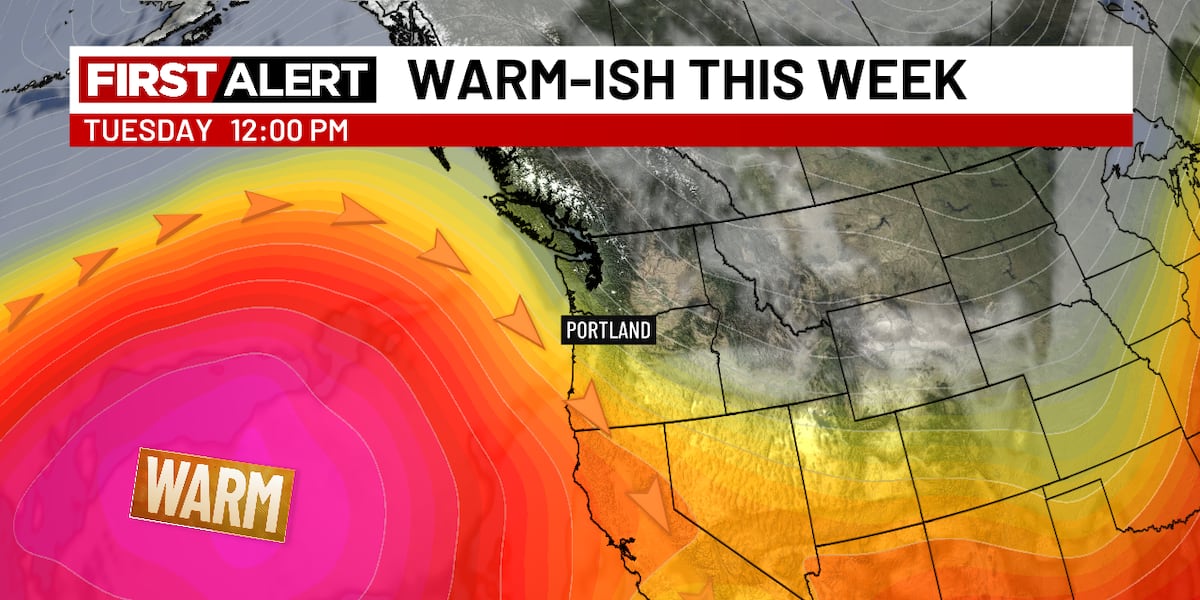

Early June Brings Warmth Sunshine And Dry Conditions

Jun 05, 2025

Early June Brings Warmth Sunshine And Dry Conditions

Jun 05, 2025 -

Australias Big Battery Project At Risk As Key Supplier Struggles

Jun 05, 2025

Australias Big Battery Project At Risk As Key Supplier Struggles

Jun 05, 2025 -

Karl Anthony Towns Injury Details Revealed Knee And Finger Issues

Jun 05, 2025

Karl Anthony Towns Injury Details Revealed Knee And Finger Issues

Jun 05, 2025