Will Broadcom Stock Rise Or Fall? Expert Predictions Following Earnings Report

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Will Broadcom Stock Rise or Fall? Expert Predictions Following Earnings Report

Broadcom (AVGO) recently released its latest earnings report, sending ripples through the tech investment world. The question on everyone's mind: will Broadcom stock rise or fall in the coming weeks and months? Analyzing the report and expert opinions reveals a complex picture, with both bullish and bearish arguments to consider.

Broadcom's Q3 2023 Earnings: A Mixed Bag

Broadcom's Q3 2023 earnings report presented a mixed bag of results. While the company beat analysts' expectations on earnings per share (EPS), revenue slightly missed projections. This discrepancy, combined with a cautious outlook for the next quarter, has left investors uncertain about the future direction of the stock. The company cited macroeconomic headwinds and softening demand in certain sectors as contributing factors to the slightly weaker-than-expected revenue.

Key Factors Influencing Future Stock Performance:

Several key factors will determine whether Broadcom stock rises or falls:

-

Macroeconomic Conditions: The global economic outlook remains uncertain, with persistent inflation and potential recessionary pressures impacting technology spending. This is a major wildcard influencing investor sentiment towards tech stocks, including Broadcom.

-

Demand for Semiconductors: The semiconductor industry is cyclical, and demand fluctuations can significantly affect Broadcom's performance. The company's exposure to various sectors – from wired infrastructure to wireless communication – makes its performance relatively resilient, but not immune to broader downturns.

-

Competition: Broadcom operates in a competitive landscape. The actions of its competitors, including new product launches and pricing strategies, will directly impact its market share and profitability.

-

Acquisition Strategy: Broadcom has a history of strategic acquisitions, expanding its product portfolio and market reach. Future acquisitions could significantly influence the company's growth trajectory and investor confidence.

Expert Predictions: A Divided Opinion

Analyst opinions on Broadcom's future are currently divided. Some analysts maintain a bullish outlook, citing the company's strong fundamentals, diversified product portfolio, and potential for future growth driven by technological advancements such as 5G and AI. They highlight Broadcom's robust free cash flow and consistent dividend payouts as attractive features for long-term investors. These analysts point to the recent dip as a buying opportunity.

Conversely, other analysts express more cautious views, citing the macroeconomic uncertainties and potential softening of demand in key markets. They advise investors to proceed with caution, suggesting that the stock price may remain volatile in the near term. Some suggest waiting for clearer indications of market recovery before investing.

Technical Analysis: Chart Patterns and Support Levels

Technical analysts are also scrutinizing Broadcom's chart patterns to predict future price movements. Support levels and resistance levels are crucial considerations for short-term trading strategies. Examining the stock's historical performance and current technical indicators can offer insights into potential price targets. However, it's crucial to remember that technical analysis is not foolproof.

Conclusion: A Cautiously Optimistic Outlook?

While the immediate future of Broadcom stock remains uncertain, a cautiously optimistic outlook seems warranted. The company's strong fundamentals and strategic positioning within the technology sector suggest long-term growth potential. However, investors should carefully weigh the macroeconomic risks and remain mindful of the volatility inherent in the technology market. Thorough due diligence, coupled with a long-term investment horizon, is crucial for navigating the complexities of the current market environment.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult a qualified financial advisor before making any investment decisions.

Further Reading:

- (Replace with a relevant, current news source)

Keywords: Broadcom, AVGO, stock price, earnings report, stock market, semiconductor, technology, investment, analyst predictions, macroeconomic conditions, financial news, stock forecast.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Will Broadcom Stock Rise Or Fall? Expert Predictions Following Earnings Report. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Quinn Sacco And Hennes Confirmed For Rangers Coaching Staff Under Manager Sullivan

Jun 05, 2025

Quinn Sacco And Hennes Confirmed For Rangers Coaching Staff Under Manager Sullivan

Jun 05, 2025 -

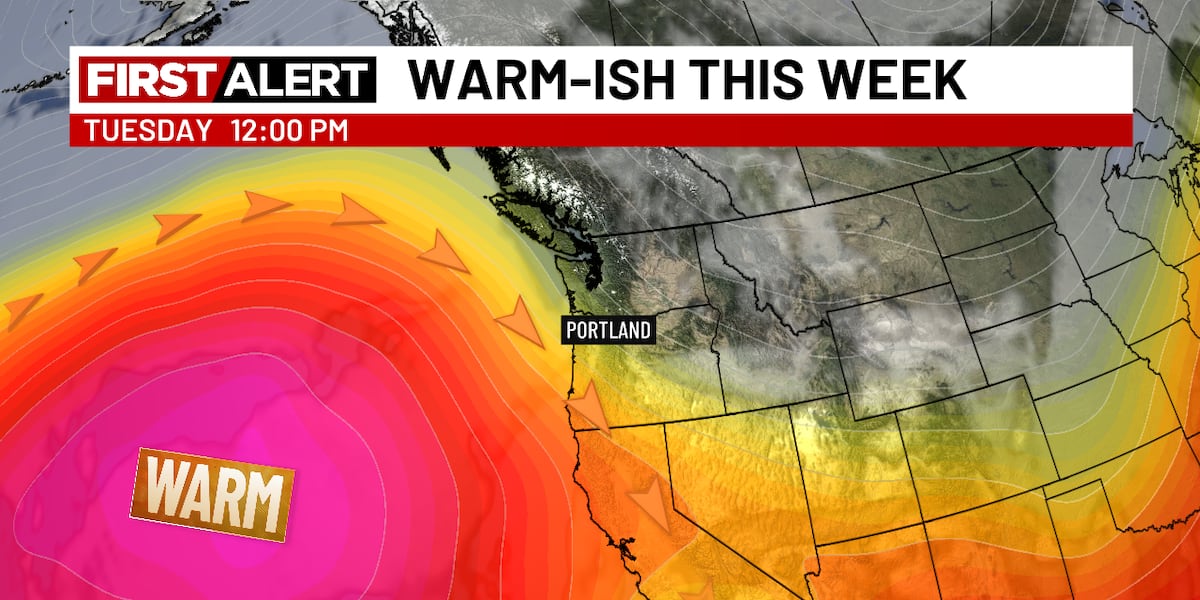

Sunshine And Warmth Dominate Early June Forecast

Jun 05, 2025

Sunshine And Warmth Dominate Early June Forecast

Jun 05, 2025 -

Lois Boissons Shock Victory Andreeva Falls To Wildcard Challenger

Jun 05, 2025

Lois Boissons Shock Victory Andreeva Falls To Wildcard Challenger

Jun 05, 2025 -

Rashod Batemans Record Breaking Nfl Contract Surpasses Eric Deckers For Gophers Wide Receivers

Jun 05, 2025

Rashod Batemans Record Breaking Nfl Contract Surpasses Eric Deckers For Gophers Wide Receivers

Jun 05, 2025 -

What Drove Applied Digital Apld Stock Higher Today Analysis And Insights

Jun 05, 2025

What Drove Applied Digital Apld Stock Higher Today Analysis And Insights

Jun 05, 2025