Will Broadcom Hit $250? Wall Street's Pre-Earnings Expectations

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Will Broadcom Hit $250? Wall Street's Pre-Earnings Expectations are High

Broadcom (AVGO), a semiconductor giant, is on the cusp of releasing its earnings report, and Wall Street is buzzing with anticipation. The stock has seen impressive growth recently, leaving many investors wondering: can Broadcom reach the coveted $250 mark? Analyzing pre-earnings predictions reveals a complex picture, blending optimism with cautious considerations.

Strong Fundamentals Fueling the Bullish Sentiment

Several factors contribute to the bullish sentiment surrounding Broadcom's stock price. The company's consistent performance in the data center, wireless communication, and software infrastructure markets has been a key driver of growth. Strong demand for its chips, fueled by the ongoing expansion of cloud computing and 5G infrastructure, positions Broadcom favorably for continued success. Analysts point to Broadcom's robust revenue projections and healthy profit margins as compelling reasons for optimism. Many predict that the upcoming earnings report will further solidify these positive trends.

Key Factors to Watch in the Earnings Report

While the overall outlook is positive, several key areas will shape the market's reaction to Broadcom's earnings announcement. These include:

- Revenue Growth: The extent to which Broadcom surpasses or falls short of analysts' revenue expectations will significantly impact the stock price. Any major deviation could trigger substantial market volatility.

- Guidance for Q4 2023 and Beyond: Forward-looking statements about future revenue and earnings will be crucial for investors assessing long-term growth potential. Conservative guidance might dampen enthusiasm, even with strong current results.

- Impact of Macroeconomic Factors: The global economic climate, including inflation and potential recessionary pressures, will undoubtedly play a role in investor sentiment. Broadcom's ability to navigate these challenges will be closely scrutinized.

- Competition and Market Share: The competitive landscape in the semiconductor industry is fiercely competitive. Any significant shifts in market share or emerging threats from competitors could influence investor confidence.

Analyst Predictions and Price Targets

While many analysts predict continued growth for Broadcom, opinions vary on whether the $250 mark is achievable in the short term. Some prominent firms have set price targets above $250, reflecting a bullish outlook. However, others remain more cautious, citing potential headwinds such as macroeconomic uncertainty and competitive pressures. The divergence in analyst predictions highlights the inherent uncertainty surrounding any stock's future performance.

Risks and Considerations

It's crucial to remember that investing in the stock market always carries inherent risks. While Broadcom’s prospects look promising, several factors could negatively impact its stock price, including:

- Supply Chain Disruptions: Ongoing challenges in global supply chains could affect Broadcom's production and profitability.

- Geopolitical Uncertainty: Geopolitical tensions and trade disputes could create volatility in the semiconductor market.

- Increased Competition: The emergence of new competitors or technological advancements could erode Broadcom's market share.

Conclusion: A Cautiously Optimistic Outlook

The possibility of Broadcom reaching $250 is certainly within the realm of possibility, given its strong fundamentals and positive industry trends. However, investors should approach this with a degree of caution, considering the potential risks and uncertainties associated with the market. A thorough analysis of the upcoming earnings report, coupled with a careful assessment of the broader economic landscape, is crucial for informed investment decisions. Stay tuned for updates following the release of Broadcom's earnings.

Disclaimer: This article provides general information and should not be considered financial advice. Always conduct thorough research and consult with a financial professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Will Broadcom Hit $250? Wall Street's Pre-Earnings Expectations. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Patriots David Andrews Retires After Achieving His Goal

Jun 04, 2025

Patriots David Andrews Retires After Achieving His Goal

Jun 04, 2025 -

Australias Energy Storage Future At Risk Suppliers Warning

Jun 04, 2025

Australias Energy Storage Future At Risk Suppliers Warning

Jun 04, 2025 -

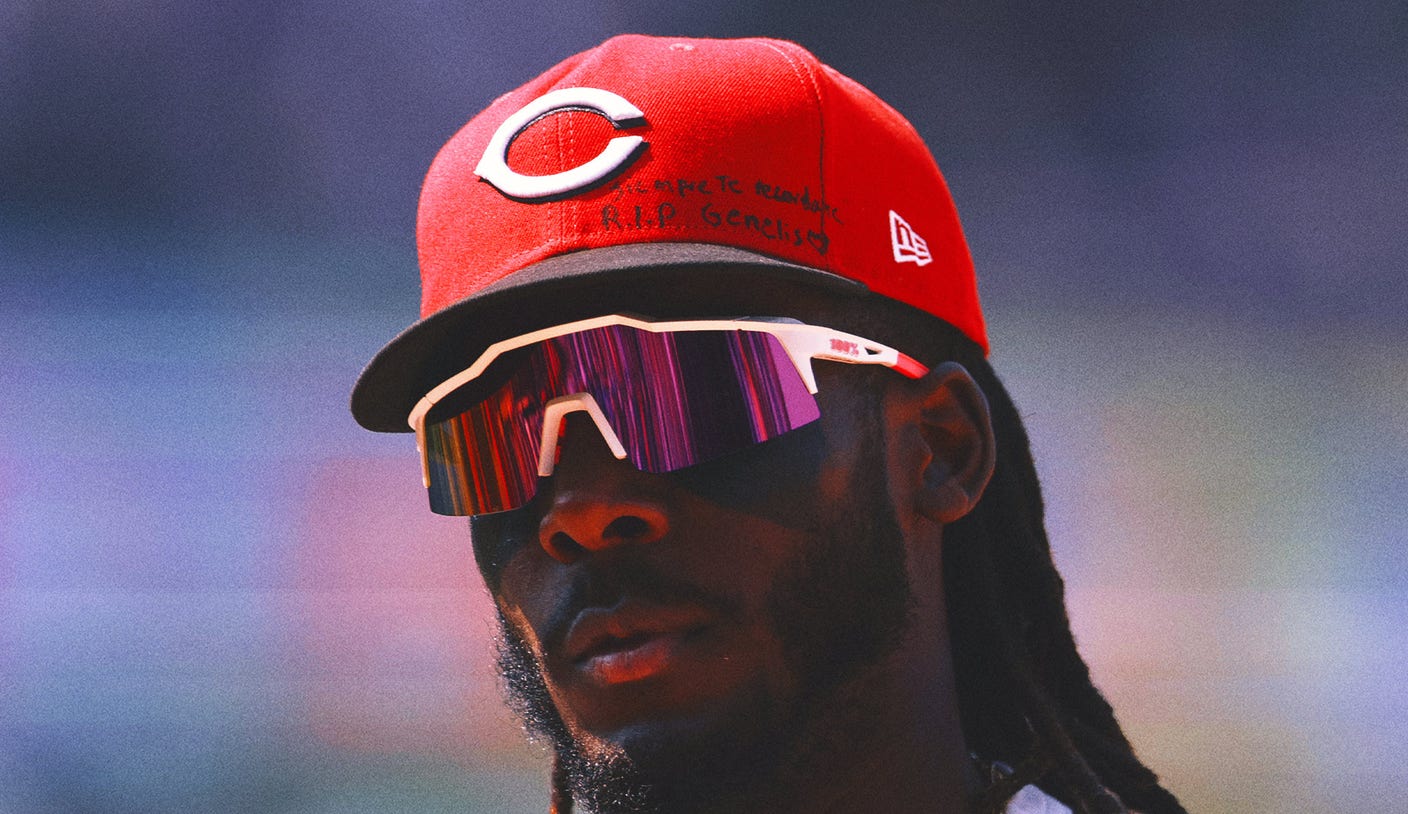

Cincinnati Reds De La Cruz Hits Home Run Amidst Family Loss

Jun 04, 2025

Cincinnati Reds De La Cruz Hits Home Run Amidst Family Loss

Jun 04, 2025 -

Max Verstappens Post Race Admission Fault In Spanish Gp Crash With Russell

Jun 04, 2025

Max Verstappens Post Race Admission Fault In Spanish Gp Crash With Russell

Jun 04, 2025 -

De La Cruzs Heartbreaking Tribute Home Run After Sisters Death

Jun 04, 2025

De La Cruzs Heartbreaking Tribute Home Run After Sisters Death

Jun 04, 2025

Latest Posts

-

Heathrow Airport On Lockdown Investigation Into Potential Hazardous Substance

Sep 09, 2025

Heathrow Airport On Lockdown Investigation Into Potential Hazardous Substance

Sep 09, 2025 -

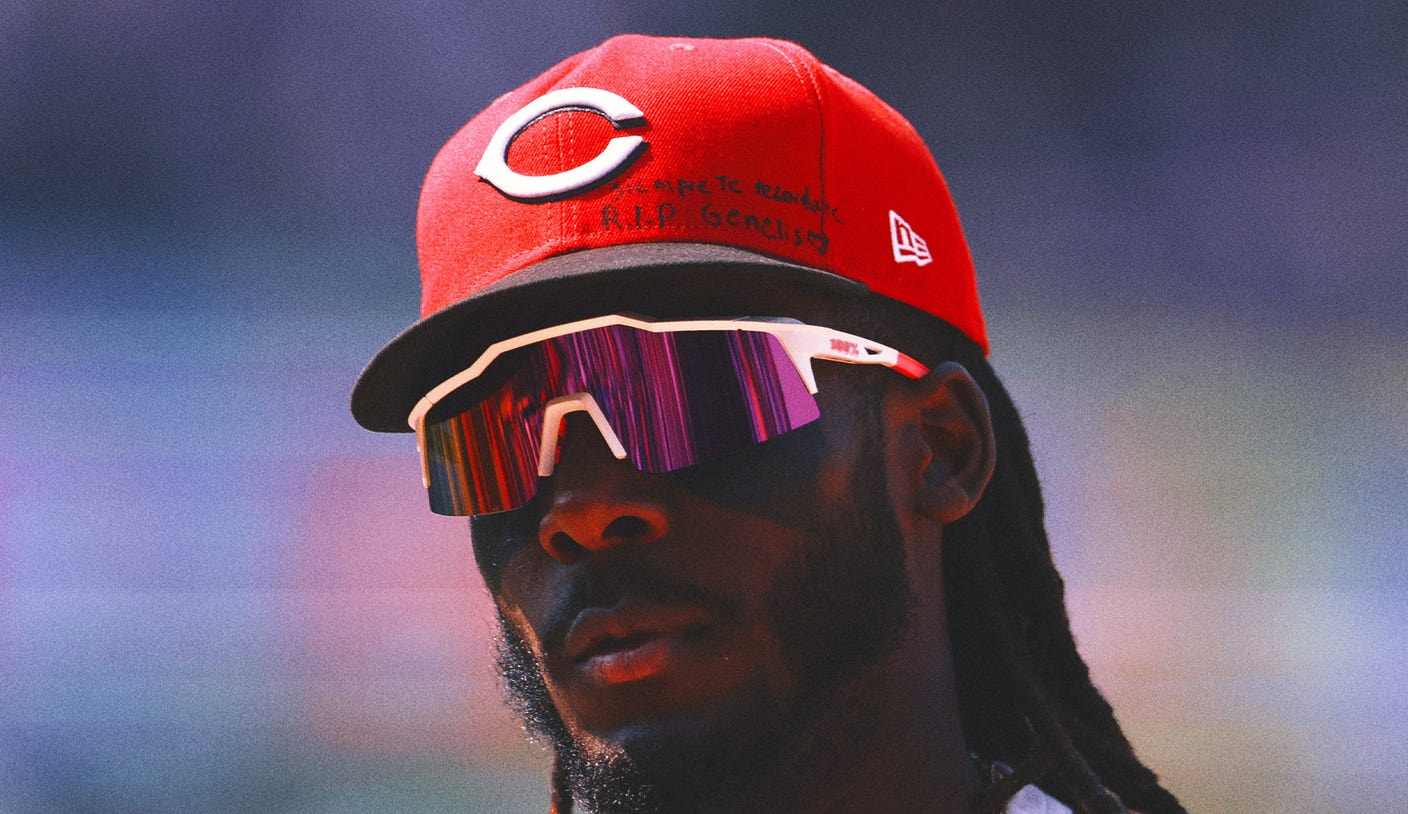

Hall Of Fame Class Of 2023 Carmelo Anthony Dwight Howard And Maya Moore Honored

Sep 09, 2025

Hall Of Fame Class Of 2023 Carmelo Anthony Dwight Howard And Maya Moore Honored

Sep 09, 2025 -

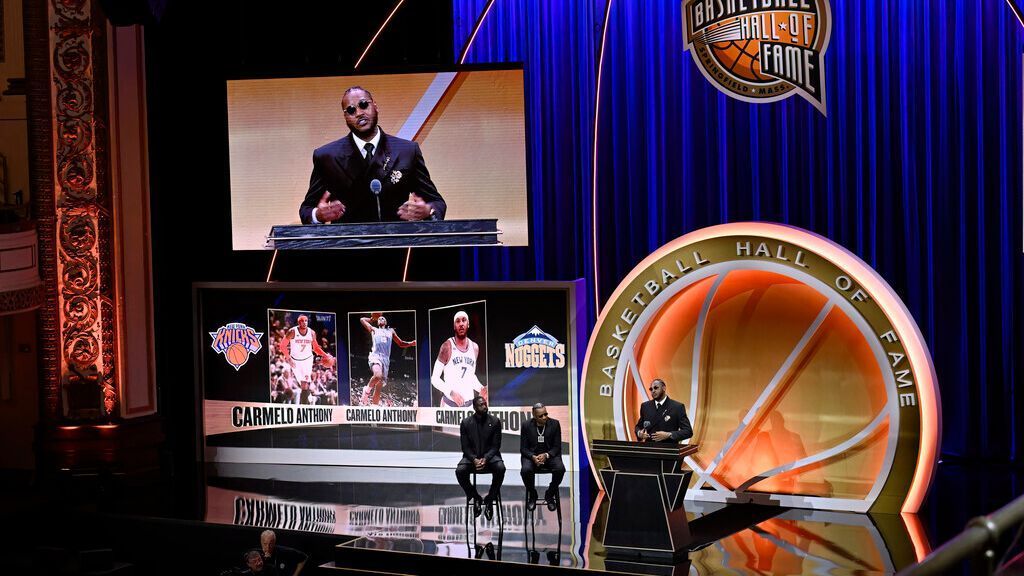

Charles Woodson Packers Nfc North Dominance Solidified By Micah Parsons

Sep 09, 2025

Charles Woodson Packers Nfc North Dominance Solidified By Micah Parsons

Sep 09, 2025 -

Delta Flight 161 Makes Emergency Landing In Amsterdam Airbus A350 Incident Update

Sep 09, 2025

Delta Flight 161 Makes Emergency Landing In Amsterdam Airbus A350 Incident Update

Sep 09, 2025 -

Investigation Underway After Nba Players Sister Shot And Killed

Sep 09, 2025

Investigation Underway After Nba Players Sister Shot And Killed

Sep 09, 2025