Will Broadcom Hit $250? Wall Street's Focus Before Q3 Earnings

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Will Broadcom Hit $250? Wall Street's Focus Before Q3 Earnings

Broadcom (AVGO), a semiconductor giant, is on the cusp of its Q3 2023 earnings report, and Wall Street is buzzing with anticipation. The stock has seen significant growth, leaving many investors wondering: can Broadcom reach the coveted $250 mark? This question is dominating pre-earnings discussions, fueled by a complex interplay of factors impacting the tech sector and Broadcom's own performance.

The Road to $250: A Look at the Current Landscape

Broadcom's current price sits just shy of the $250 target, making this a crucial moment for investors. Several key factors are shaping analysts' predictions:

-

Strong Q2 Results: Broadcom's Q2 earnings significantly exceeded expectations, boosting investor confidence. This positive momentum is a major contributing factor to the optimism surrounding the $250 target. The company's diverse portfolio, spanning infrastructure software and semiconductor solutions, proved resilient even amidst broader economic uncertainties.

-

Data Center Demand: The explosive growth of the data center market continues to fuel demand for Broadcom's networking and infrastructure solutions. This segment is expected to remain a significant driver of revenue growth in the coming quarters. [Link to article about data center growth]

-

AI Boom: The burgeoning artificial intelligence (AI) sector is a significant tailwind for Broadcom. Its chips and technologies are vital components in AI infrastructure, positioning the company for substantial growth as AI adoption accelerates. [Link to article about AI chip demand]

-

Global Economic Uncertainty: Despite the positive momentum, global economic headwinds present a challenge. Concerns about inflation and potential recession could impact spending on technology, potentially affecting Broadcom's future performance. [Link to article about global economic outlook]

Analyst Predictions and Investor Sentiment

Analyst sentiment is largely bullish, with many predicting that Broadcom will not only meet but exceed Q3 expectations. However, the $250 price point remains a point of contention. While some analysts believe the stock is poised to break this barrier, others remain cautious, citing potential macroeconomic risks. Investor sentiment is currently positive, but a negative surprise in the Q3 earnings report could quickly shift the market's perception.

What to Watch for in the Q3 Earnings Report

Investors will be closely scrutinizing several key metrics in the upcoming earnings report:

- Revenue Growth: Sustained, strong revenue growth across all segments will be crucial for confirming the bullish outlook.

- Guidance for Q4: The company's outlook for the next quarter will provide valuable insights into its future trajectory and will heavily influence the stock price.

- Margin Performance: Maintaining healthy profit margins in a challenging economic environment will reassure investors.

- Capital Expenditure Plans: Broadcom's investment strategy will signal its confidence in future growth and market opportunities.

Conclusion: A High-Stakes Earnings Report

The question of whether Broadcom will hit $250 is far from settled. The company's Q3 earnings report will be a pivotal moment, shaping investor sentiment and potentially pushing the stock price towards or away from the coveted $250 mark. While the outlook is largely positive, investors should remain vigilant, acknowledging the potential impact of macroeconomic factors. The next few weeks will be crucial for anyone holding or considering investing in AVGO. Stay tuned for updates following the earnings release!

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you should always conduct your own research before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Will Broadcom Hit $250? Wall Street's Focus Before Q3 Earnings. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

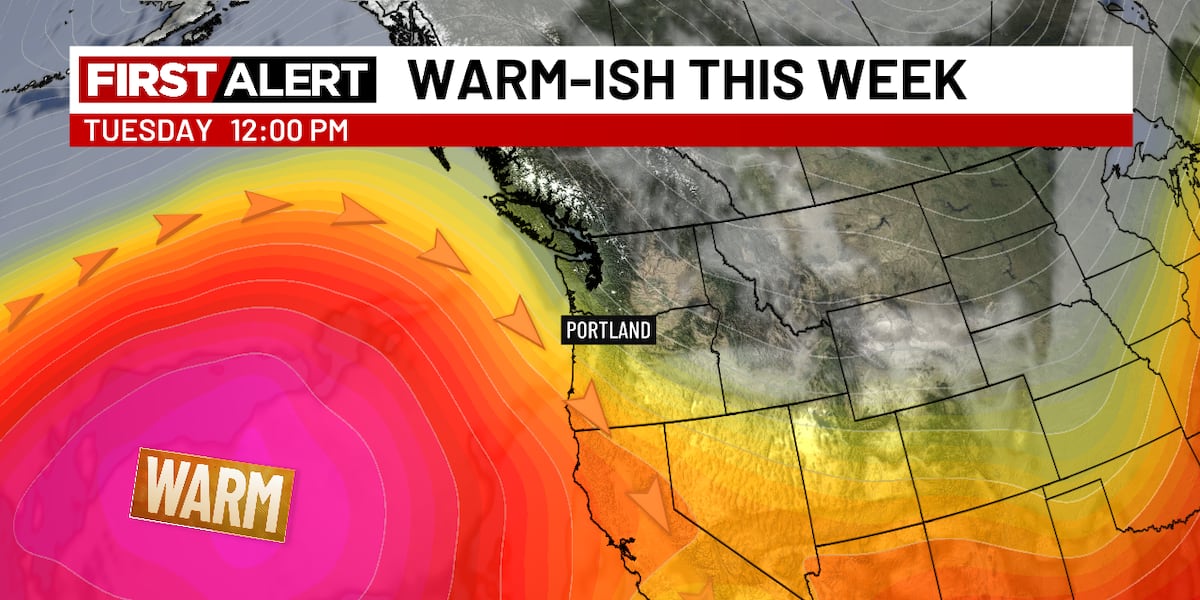

Early June Weather Warm Sunny And Dry Conditions Predicted

Jun 05, 2025

Early June Weather Warm Sunny And Dry Conditions Predicted

Jun 05, 2025 -

From The Archives Grace Potter Shares Unreleased Material And Memorable Moments

Jun 05, 2025

From The Archives Grace Potter Shares Unreleased Material And Memorable Moments

Jun 05, 2025 -

Relive The Thrill Top 10 Sports Storylines From May 2024

Jun 05, 2025

Relive The Thrill Top 10 Sports Storylines From May 2024

Jun 05, 2025 -

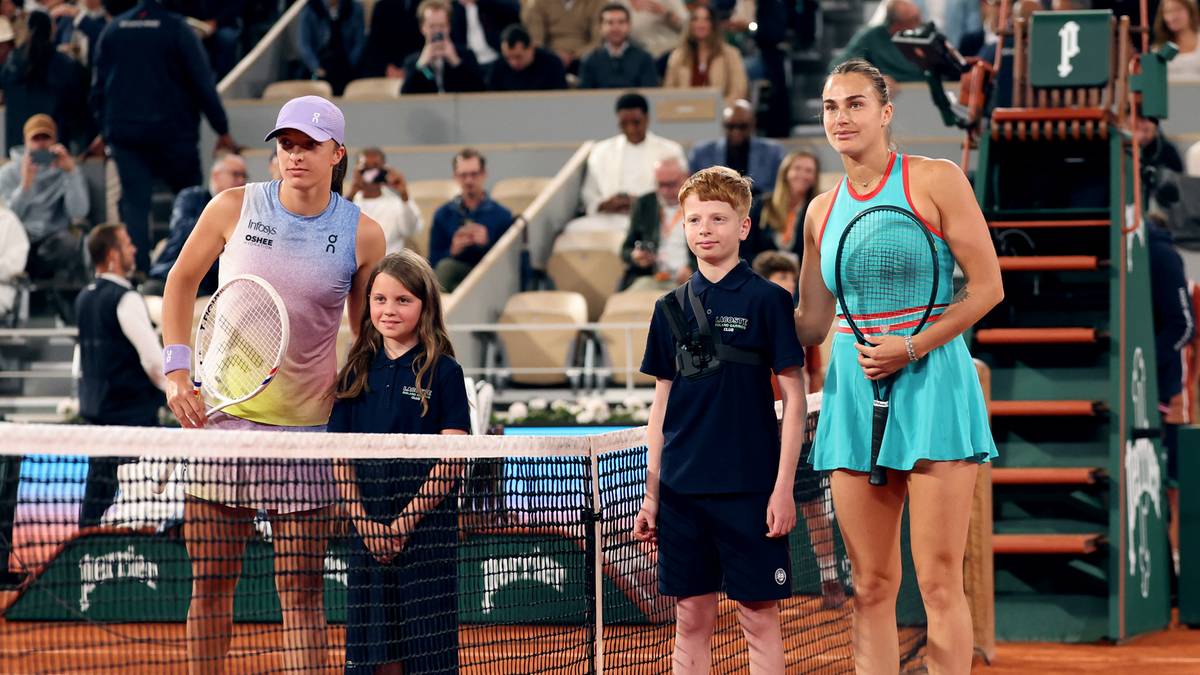

Wynik Na Zywo Swiatek Sabalenka Roland Garros Pelna Relacja

Jun 05, 2025

Wynik Na Zywo Swiatek Sabalenka Roland Garros Pelna Relacja

Jun 05, 2025 -

Post Injury Power Mike Trouts First Home Run For The Angels

Jun 05, 2025

Post Injury Power Mike Trouts First Home Run For The Angels

Jun 05, 2025