Will Broadcom Hit $250? Wall Street Prepares For Earnings Announcement

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Will Broadcom Hit $250? Wall Street Holds Breath for Earnings Announcement

Broadcom (AVGO), a semiconductor giant, is on the cusp of its highly anticipated Q3 2023 earnings announcement, sending ripples of excitement and anxiety through Wall Street. The question on everyone's mind: Can Broadcom's stock price breach the $250 mark? Analysts are divided, with predictions ranging from cautious optimism to more conservative outlooks. This article delves into the factors influencing Broadcom's stock performance and what investors can expect from the upcoming announcement.

The $250 Hurdle: A Look at the Factors

Several key factors will determine whether Broadcom can reach the coveted $250 price point. These include:

-

Q3 Earnings Performance: The most significant factor will undoubtedly be Broadcom's actual Q3 earnings report. Analysts are keenly focused on revenue growth, profit margins, and guidance for the coming quarters. Any significant deviation from expectations could dramatically impact the stock price. Positive surprises are needed to propel AVGO towards $250.

-

Data Center Demand: Broadcom's significant exposure to the data center market makes it highly susceptible to shifts in demand. Sustained growth in this sector is crucial for maintaining Broadcom's upward trajectory. A slowdown in data center spending could negatively affect the stock's performance.

-

Global Economic Conditions: The broader macroeconomic environment continues to present uncertainties. Inflationary pressures, interest rate hikes, and geopolitical instability all cast shadows on the semiconductor industry's outlook. A positive economic forecast would undoubtedly benefit Broadcom.

-

Competition: The semiconductor industry is fiercely competitive. Broadcom faces rivals like Intel and Qualcomm, amongst others. The company's ability to maintain its competitive edge and innovate will be critical for future growth.

Analyst Predictions: A Mixed Bag

Wall Street analysts are offering a range of predictions for Broadcom's stock price following the earnings announcement. Some analysts are bullish, suggesting the potential for significant upside, even beyond $250. Others are more cautious, highlighting the risks associated with the current economic climate and the competitive landscape. This divergence in opinions underscores the uncertainty surrounding Broadcom's immediate future.

What to Watch For in the Earnings Call

Investors should pay close attention to the following during Broadcom's earnings call:

- Revenue guidance for Q4 2023 and beyond: This will offer crucial insights into the company's anticipated performance in the near future.

- Discussion of data center market trends: Understanding the company's assessment of the data center market's health is crucial for assessing future growth potential.

- Commentary on the competitive landscape: Broadcom's strategic response to competition will be a key indicator of its long-term prospects.

Conclusion: A High-Stakes Earnings Announcement

Broadcom's Q3 earnings announcement represents a pivotal moment for the company and its investors. The potential for the stock to reach $250 hinges on several interconnected factors. While the possibility exists, achieving this milestone requires a positive earnings report, sustained demand in key markets, and a favorable macroeconomic environment. Investors should carefully analyze the earnings report and the subsequent analyst commentary before making any investment decisions. Staying informed about market trends and news related to Broadcom is crucial for navigating this period of uncertainty. Remember to consult with a financial advisor before making any investment choices.

Keywords: Broadcom, AVGO, Stock Price, Earnings Announcement, Semiconductor, Q3 2023, Wall Street, $250, Data Center, Investment, Technology Stock, Market Analysis, Earnings Report, Revenue Growth, Profit Margins.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Will Broadcom Hit $250? Wall Street Prepares For Earnings Announcement. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

French Open Live Updates Musetti Vs Tiafoe Swiatek Vs Svitolina Quarter Final Results

Jun 04, 2025

French Open Live Updates Musetti Vs Tiafoe Swiatek Vs Svitolina Quarter Final Results

Jun 04, 2025 -

Beyond The Gridiron Exploring The Life And Legacy Of Carl Nassib

Jun 04, 2025

Beyond The Gridiron Exploring The Life And Legacy Of Carl Nassib

Jun 04, 2025 -

Royals Roster Move Top Prospect Jac Caglianone Gets The Call Espn

Jun 04, 2025

Royals Roster Move Top Prospect Jac Caglianone Gets The Call Espn

Jun 04, 2025 -

Olympic Champion Tom Daley Openness Identity And The Power Of Family

Jun 04, 2025

Olympic Champion Tom Daley Openness Identity And The Power Of Family

Jun 04, 2025 -

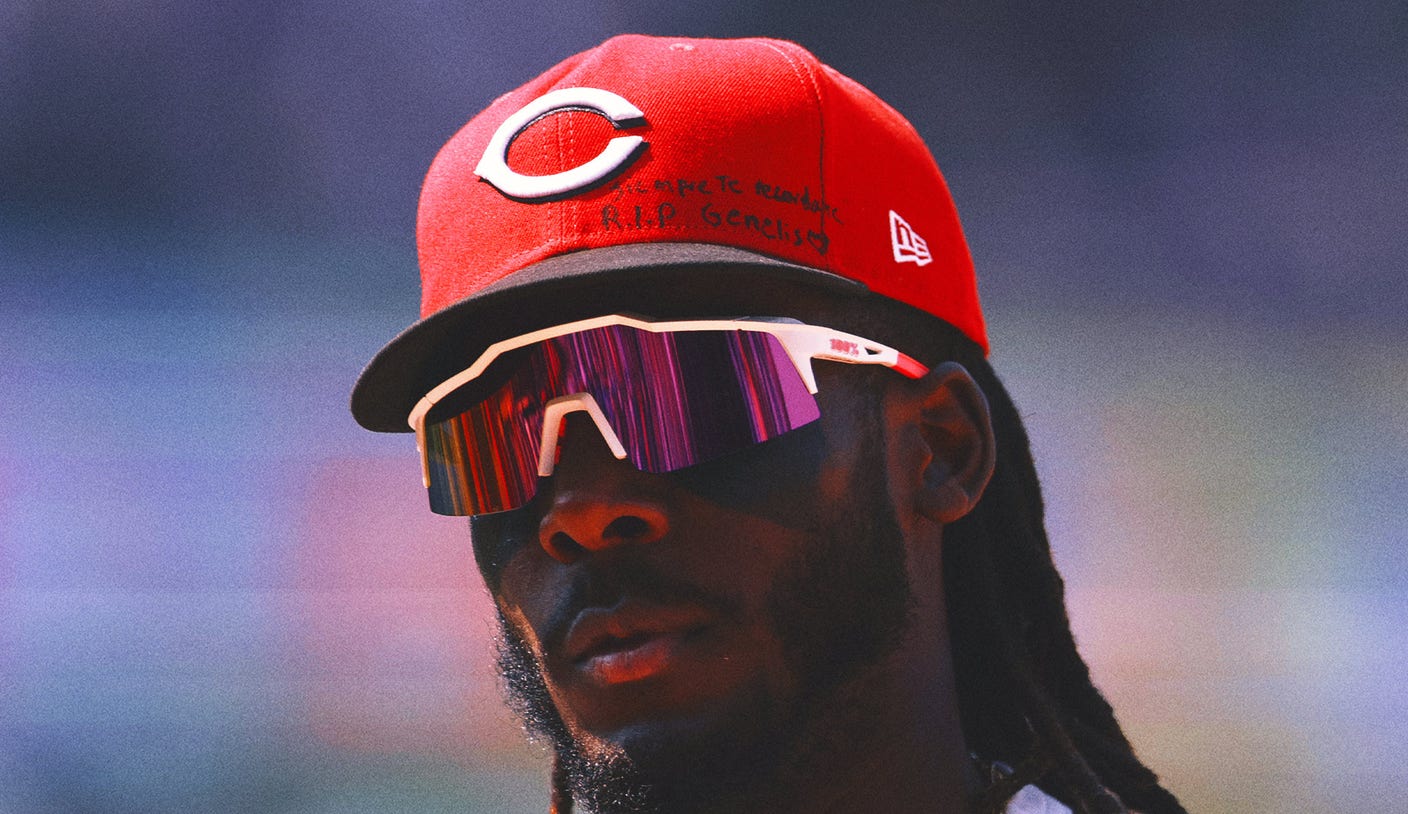

Devastating Loss Powerful Tribute Elly De La Cruzs Home Run For His Sister

Jun 04, 2025

Devastating Loss Powerful Tribute Elly De La Cruzs Home Run For His Sister

Jun 04, 2025